Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

The Necessity of Policy Reforms in the Face of Remote Work's Profound Impact Remote work has significantly altered the traditional geography of housing demand. The once-dominant factor of proximity to the central business district (CBD) has been supplanted by a new premium on lifestyle, one that higher‑income, remote‑capable workers are willing to pay for. This shift is not only widening the ownership gap but also re-pricing long-affordable suburbs and pushing lower-income households further out. In the face of these profound changes, policy reforms are not just necessary but crucial.

From Location to Livability: A New Valuation Metric

For most of the 20th century, the rule of thumb in urban economics was simple: the closer a dwelling sat to the CBD, the higher its price. Today, broadband has trumped rail timetables. The European Central Bank's January 2025 blog chronicles how London's commuter belts are now appreciating faster than the once-premium postcodes of Zone 1, as remote work reshuffles demand toward space, gardens, and home-office potential. LandTech's borough-level data underscore the speed of that pivot: between 2012 and 2022, outer-London prices climbed 83%, ten points faster than inner London, at 73%.

The market is speaking clearly. Size, light, and outdoor access have become the new hedonic variables. Once commuting time and transport costs have been shaved to near‑zero for remote‑capable employees, a pure preference for domestic amenities remains.

The Winners: Remote‑Capable, High‑Income Households

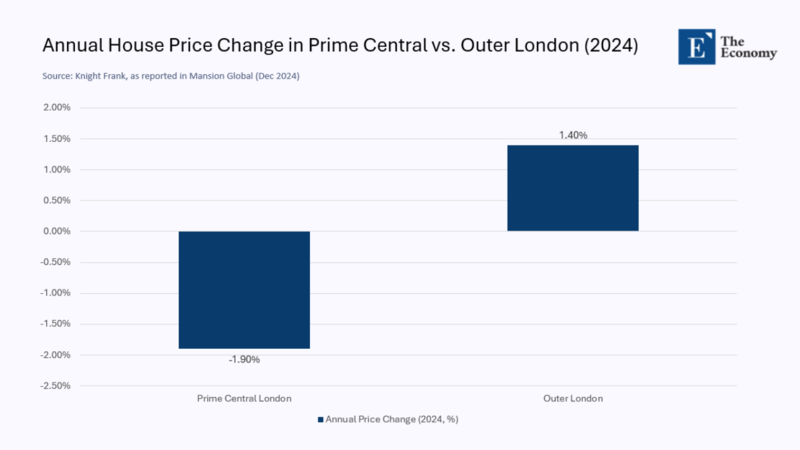

McKinsey Global Institute estimates that roughly 60 % of jobs paying above the median wage in advanced economies can be performed remotely at least part of the week. These workers are disproportionately homeowners, enjoy easier credit access, and often possess the capital gains needed to upsize. Therefore, their exodus toward suburban markets arrives with higher purchasing power than incumbent residents. Knight Frank records a +1.4 % gain in 2024 house prices in London's prime outer boroughs, even as prime‑central London slipped ‑1.9%.

Because these households also have discretion over when ‑ or whether ‑ to appear in an office, they can arbitrage housing markets across entire regions or even countries, shopping for the optimal package of space, schools, and tax. Their mobility has become a multiplier on price increases in suburban nodes from Reading to Richmond.

The Losers: Location‑Bound Workers and Renters

Those tethered to physical workplaces ‑ carers, transport staff, retail and hospitality employees ‑ are caught in a double bind. First, the influx of high‑income remote buyers bids up suburban prices. Second, rental investors follow the capital gains, raising rents on the stock once it becomes accessible to key workers. CEPR's conceptual framework warns that housing costs consume 45% of income for the bottom quartile of earners in major European metropolitan areas, up from 36% pre-pandemic, with ownership becoming increasingly out of reach, and renting risks becoming a lifelong condition that yields no asset appreciation.

The U.S. data tell a parallel story. A San Francisco Fed study attributes over half of 2020‑2021 house‑price inflation across U.S. metros to remote-work-fueled demand, while an NBER digest reaches a similar conclusion, finding that telework explains at least 50 % of pandemic‑era price growth. Crucially, the benefits of those capital gains accrue almost entirely to existing homeowners.

Remote Work Adoption Is Peaking—and Polarising

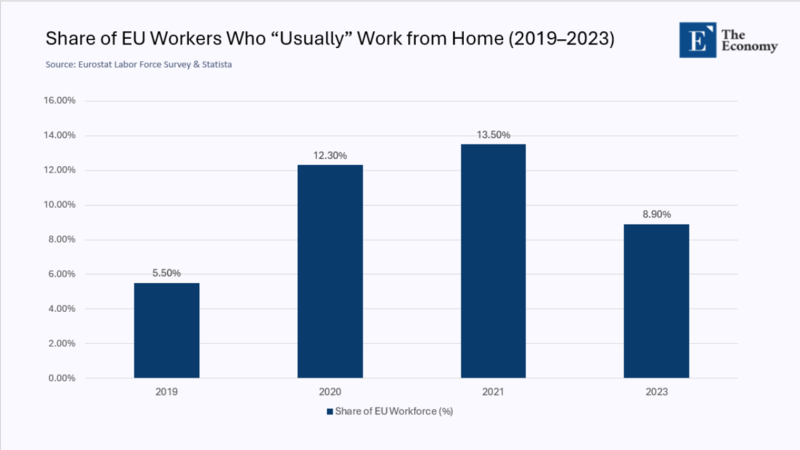

Eurostat's Labour‑Force Survey shows that the share of EU workers who "usually" work from home jumped from 5.5 % in 2019 to 13.5 % in 2021 before moderating to 8.9 % in 2023. The retreat reflects a hybrid equilibrium rather than a wholesale return to the office. However, the key distributional fact remains: the option to work remotely skews toward higher‑skilled, higher‑paid occupations.

This asymmetry establishes a new channel of inequality: the remote-work dividend. Households that are able to capture it enjoy a higher adequate income (saved commuting costs, potential wage premia) and an appreciating asset in the form of suburban housing. Location‑bound households face the mirror image: stagnant wages, longer commutes, and shrinking housing options.

A Policy Vacuum

Despite the clear data signals, land‑use regulation impedes supply where demand is most intense. Detached housing zoning, minimum lot rules, and height caps in outer boroughs hinder densification precisely when it is most needed. The OECD estimates that metropolitan housing supply undershoots demand by ≈ 20 % annually across advanced economies. In London, planning approvals for multi‑unit developments in the commuter ring remain well below pre‑2019 levels, even as transaction prices accelerate.

The consequence is a remote-work gradient of prices that conventional affordability metrics often overlook. This gradient refers to the differential impact of remote work on housing prices, creating a disparity between households with remote work capabilities and those without. Consider two otherwise similar households: a software engineer logging in from a four‑bed semi in Guildford and a hospital porter commuting daily from a rented flat in Croydon. Every additional £10,000 the engineer bids pushes the equilibrium price beyond Porter's borrowing capacity, and—significantly—does so in the sub-markets once promoted as "affordable family housing".

Quantifying the Shift: A Remote‑Work Housing Disparity Index (RHDI)

To track this new fault line, we propose the Remote-Work Housing Disparity Index, defined as the ratio of inflation-adjusted price growth in high-remote-work suburban districts to the increase in their adjacent urban cores. A back‑of‑the‑envelope calculation using ONS price indices and Eurostat telework penetration yields:

- London RHDI ≈ 1.12 (2019‑24)

- Paris RHDI ≈ 1.09

- San Francisco Bay Area RHDI ≈ 1.15

An RHDI above 1 indicates that remote-favored suburbs appreciate faster than the core. The index thus operationalizes what housing economists have observed anecdotally: remote work tilts the price‑growth map outward.

Policy Recommendations

- Targeted Zoning Reform Permit duplexes, accessory‑dwelling units, and low‑rise apartments across suburban parcels within 800 m of rail hubs.

- Transit‑Equity Bonds, a proposed policy recommendation, involve issuing municipal bonds earmarked for extending affordable transit links to exurban zones where lower‑income renters are displaced. These bonds aim to address the displacement of lower-income renters due to the remote work-driven housing market shifts. Portable Housing Vouchers are given to local RHDI scores, so subsidies rise automatically where remote‑work pressure is most acute.

- Remote-work impact Assessments Mandate that major employers publish the geographic distribution of their remote workforce and fund proportional housing impact fees.

These measures go beyond the standard "build more houses" mantra by aligning supply, mobility, and fiscal transfers with the geography of remote demand.

Conclusion

Remote work is neither a fad nor a neutral technological advance; it is a spatial sorting mechanism that reallocates purchasing power across the urban map. Without policy updates that are attuned to this mechanism, the promise of flexible work for some will translate into housing precarity for many. The data are unambiguous: suburban price inflation is outpacing the core, while the share of households positioned to take advantage of remote work remains under 10% of total employment. Bridging that gap is now central to any serious agenda on inequality.

The original article was authored by Yannis Ioannides and Liwa Rachel Ngai. The English version of the article, titled "Housing and inequality: A critical link in economic disparities,” was published by CEPR on VoxEU.