Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

Stability is the New Status Symbol

In the after‑shocks of the pandemic, a quiet revolution is rewriting the bargain between employer and employee. Flashy bonuses, stock‑option windfalls, and even four‑day weeks are losing shine. The perk that now turns heads at the office water cooler is the simplest of promises: next month’s wage packet will look similar to this month’s. Call it dull, but stability has become the twenty‑first‑century status symbol.

The Evidence: Earnings on Shuffle Play

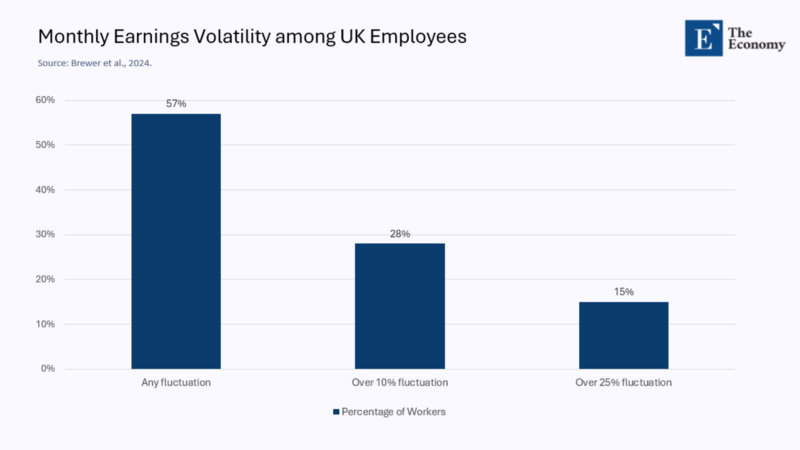

Brewer et al.'s new “video‑analytics” study for VoxEU tracked the payslips of 250,000 British workers month‑by‑month rather than relying on annual snapshots. The moving picture is unnerving:

- 57 % of employees experience some change in pay from one month to the next.

- 28 % see swings greater than 10 %.

- A hardy 15 % endure roller‑coaster shifts of ±25 % or more every month.

Beneath those averages lurks a sharper truth: the bottom decile—cleaners, carers, warehouse pickers—ride the wildest swings. For them, payday feels less like a steady drumbeat and more like a Spotify playlist that keeps hitting shuffle.

A Very Human Reaction

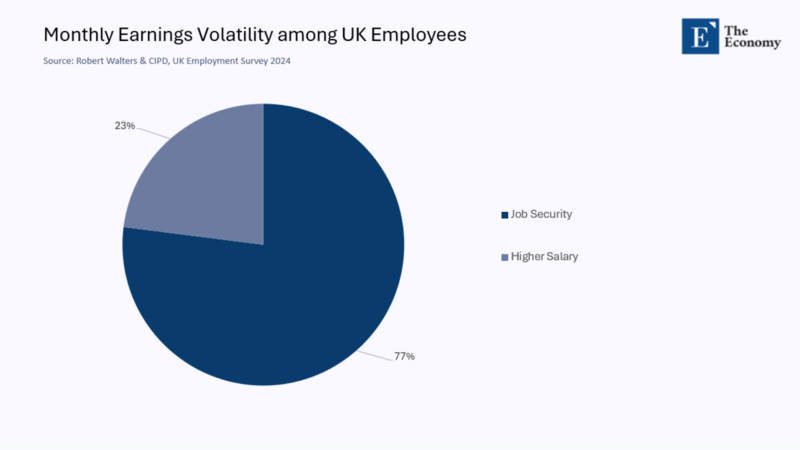

Economists often treat income volatility as a spreadsheet annoyance fixable with a cheap line of credit. That view ignores human psychology. Behavioral research shows a €100 loss hurts roughly twice as much as a €100 gain delights. Volatility, in other words, is a tax on nerves: it corrodes sleep, delays family formation, and nudges households toward high‑cost debt.

Therefore, it is rational—not hysterical—for workers to trade upward in security and downward in headline salary. A Robert Walters/CIPD survey finds that 77 % of UK professionals now rank job security above pay rises.

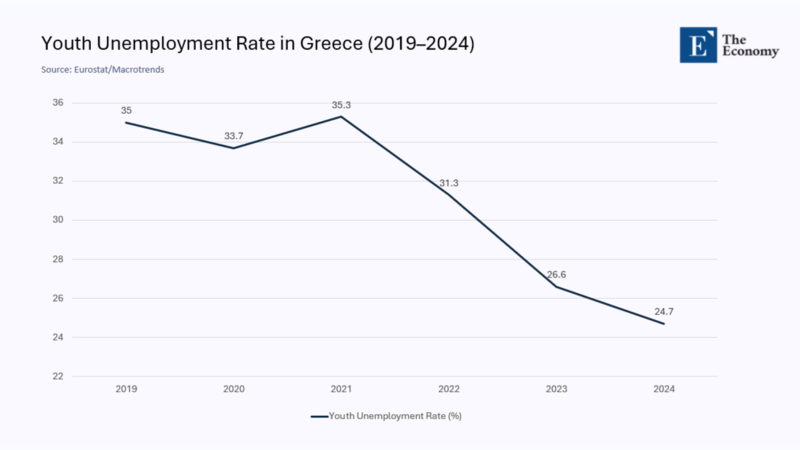

Greece: The Canary in the Coal Mine

Britain’s angst is dramatic, but Greece provides the clearest case study. Youth unemployment may have fallen from 35 % in 2019 to about 24 % in 2024, yet it remains the second‑highest in the EU. The response? A stampede toward public‑sector careers. The latest ASEP exam drew applications in the six digits for a few thousand-lifetime appointments.

Stroll through an Athenian café, and you will see the phenomenon in miniature: tables of twenty‑somethings hunched over civil‑service guides thicker than telephone books. They know the starting pay lags the private sector. They crave the guarantee that rent money will land on schedule, recession or not.

The Same Story, Different Languages

Greece is hardly unique. In South Korea, more than 200 000 candidates still sit the infamous gosi exams each year for under 5 000 civil service posts. The Ministry of Internal Affairs reports a renewed uptick in clerkship applications despite record‑low unemployment in Japan—the security instinct rhymes across cultures and business cycles from Mexico City to Milan.

Why Volatility Hurts the Poor Most

Volatility might be bearable if everyone had a rainy‑day fund. Reality is harsher. A 2023 ECFIN survey shows four in ten low‑income European households cannot cover an unexpected €400 expense without borrowing. For them, a 15 % pay dip triggers cascading sacrifices—first the electricity bill, then groceries, then rent—turning a payslip fluctuation into a mental health flashpoint.

What Policy Can Do—And Must Do

Policymakers typically oscillate between sermons on financial literacy and paeans to flexibility. Both miss the mark. The Brewer study points to four sharper tools:

- Minimum Notice of Hours – Mandate a two‑week scheduling horizon; the cost to firms is low, and the benefit to households is immense.

- Dynamic Benefit Offsets – Calculate tax‑credit top‑ups on rolling quarterly averages, cushioning abrupt dips.

- Portable Security Accounts – Like auto-enroll pensions but for emergency cash: small levies from workers and employers feed a volatility buffer.

- Volatility Disclosure – Require firms to publish a “volatility ratio”: share of staff whose pay moves >10 % month‑to‑month.

The Business Case for Boring

If appeals to fairness fall flat in boardrooms, consider the ledger: replacing a frontline worker can cost 20 % of the annual salary. Stability breeds retention, which means less turnover and the associated costs, retention breeds institutional memory, and memory boosts customer satisfaction. Predictable pay is not charity; it is efficient capital allocation.

Tech’s Double‑Edged Sword

Digital platforms are often cast as volatility villains, yet technology also holds part of the solution. Real‑time payroll services let staff tap earned wages daily, converting jagged income into manageable cash flow. Algorithmic schedulers can spread shifts evenly—if regulators set the right incentives.

A Culture Shift, Not a Gadget

Gadgets matter less than posture. Western business schools still worship “disruptors” who recast labor as pure variable cost. That gospel looks dated. Workers have tasted disruption in its rawest form and found it overpriced. Once derided as complacency, stability is now the scarce asset employees will queue—and accept pay cuts—to secure.

Looking Ahead: A Forecast You Can Bank On

Within five years, job ads that fail to tout security guarantees—predictable shifts, minimum contract lengths, volatility buffers—will be ignored by the talent they covet. Graduates will not be seduced by stock‑option fantasies but by the prosaic promise that mortgage payments will clear without midnight panic. Governments that grasp this pivot will design welfare systems that smooth volatility; firms that adapt will recruit faster and lose fewer people to burnout.

The Promise of a More Stable And Productive Future

The lesson from Brewer’s video study is simple: workers are not volatility‑seeking robots. They are planners who anchor futures on steady cash flow. Treat that insight as basic infrastructure—akin to clean water or reliable roads—and much that is dysfunctional in labor markets will start to mend.

If payslips resemble slot machines, society tilts toward anxiety, precautionary saving, and stagnation. If, instead, the direct‑deposit ping lands with metronomic regularity, people plan, invest, and innovate. Stability is not the enemy of dynamism; it is its under‑appreciated prerequisite.

The original article was authored by Mike Brewer, a Deputy Chief Executive and Chief Economist at Resolution Foundation, along with three co-authors. The English version of the article, titled "Tracking pay: Lessons from the ‘video’ revolution,” was published by CEPR on VoxEU.