Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

Every major technological leap—from whale oil to kerosene, horse‑drawn wagons to combustion engines—hit escape velocity only when the numbers turned against the incumbent. Climate policy now stands at that same inflection. If fossil fuels remain profitable, they will remain dominant; if clean energy remains costly, it will remain marginal. The policy frontier, therefore, has a single organizing principle: crush the profit differential in both directions at once—force hydrocarbons up a cost cliff even as we bulldoze clean technology down its learning curve.

The Cost‑Revenue Equation That Politics Ignores

Campaigners still frame decarbonization as a moral imperative, but investors benchmark capital on return and risk. The 2022 gas shock exposed the consequences of neglecting that arithmetic: Russian flows fell 70 %, European Title Transfer Facility (TTF) jumped to an all‑time intraday high of €345 MWh, and Moscow booked record revenue despite lower volumes. Cutting supply without flooding the market with cheaper substitutes simply hands pricing power to the producer.

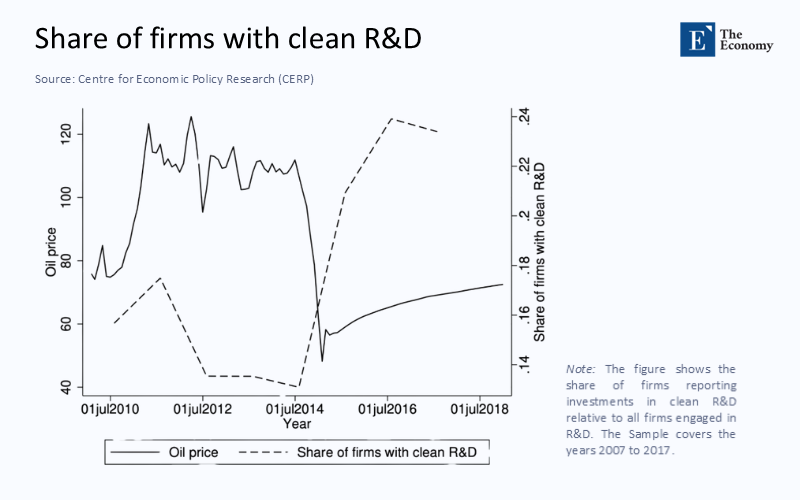

The same logic flipped in Norway after Brent crude collapsed from $110 to $50 in 2014. Severely exposed contractors pivoted into wind and carbon‑capture engineering, doubling clean‑tech patenting relative to peers less exposed to the shock. Prices, not placards, triggered that pivot.

Carbon Pricing: Where “Unprofitable” Becomes the Business Model

Sweden’s carbon tax, introduced at €22 t¹ in 1991, now stands above €130 t¹—the highest in the world. Over that period, real GDP per capita nearly doubled while territorial emissions fell by more than a quarter. This success story of Sweden's carbon tax should instill optimism in the audience about the potential of carbon pricing. At €130 t¹, a combined‑cycle gas turbine emitting 0.35 t CO₂ MWh¹ pays €45 MWh in carbon, obliterating its spark spread on most grids.

A parallel can be seen in British Columbia’s revenue‑neutral levy, which recycles proceeds to households. Evaluations show emissions 5–15 % below the counterfactual path. At the same time, growth outpaced the rest of Canada. The lesson is to design the tax so voters see cash back, not merely cost.

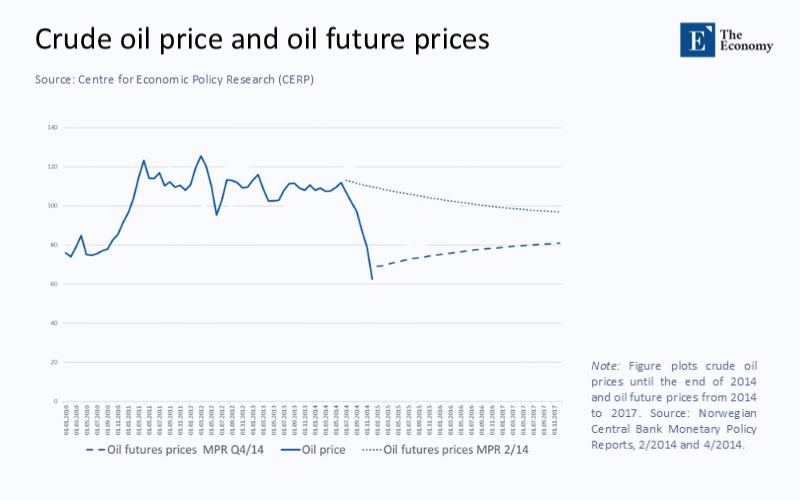

The oil price collapse in 2014 rewired the economics of energy investment, especially in Norway. As shown in Figure 1, Brent crude plummeted from over $110 to nearly $50 within months, a shock that triggered profound shifts in capital allocation. Norwegian service providers pivoted to clean technology, doubling clean‑tech patenting relative to peers less exposed to the price drop. This radical price movement was not just a financial blip but an industrial accelerant.

Clean Energy’s Cost Freefall Is Real—But Regionally Uneven

The June 2024 Lazard LCOE survey shows global median solar PV at $0.05 kWh¹ and onshore wind at $0.04—below the fuel‑only cost of operating an amortized coal unit on a continent, except parts of Southeast Asia. Yet “global median” masks dispersion: Indonesia’s solar auctions still cleared above $0.08, while Brazil’s hit $0.033. Bridging that gap means killing residual balance‑of‑system premiums: grid delays, inverter tariffs, and country‑risk spread in project finance.

The oil price crash of 2014 did more than destabilize markets; it fundamentally altered corporate investment strategies. As the Figure illustrates, the share of firms investing in clean R&D jumped sharply in the aftermath of the price collapse. Heavily exposed oil service companies redeployed talent into renewables and carbon capture, aided by targeted Norwegian grants. The data shows that capital flows to cleaner alternatives when hydrocarbons hit a price wall.

The correlation is clear: as fossil fuel profitability plummets, clean innovation accelerates. Policy that actively drives hydrocarbons up the cost curve can therefore catalyze the next wave of sustainable technologies.

Price Signals Plus Innovation: The Norway Template

Norway’s oil service ecosystem offered a crash course in forced adaptation. When day rates halved, Aker Solutions and Kongsberg transplanted subsea and control‑system expertise into the floating wind and CCS. The government matched the pivot with Innovation Norway grants that rose from 1 % to 6 % of total R&D spending over four years. Patent data confirm a 40 % jump in clean‑tech filings among the most exposed firms. What mattered was capability overlap plus liquidity—engineers could redeploy skills and make payroll.

Replicating that elsewhere means ring‑fencing part of carbon revenue for targeted R&D that hits obvious pain points: storage beyond four hours, ultra‑deep geothermal, and cheap green‑hydrogen catalysts. Scatter‑gun subsidies like broad production tax credits stretch budgets thin without denting venture‑stage risk.

How to Avoid Repeating Europe’s 2022 Price Spike

The Russo‑Ukraine squeeze should not be read as a cautionary tale against carbon pricing but rather as a case study of sequencing failure. Brussels lets imported methane reach 40 % of electricity without baseload renewables or storage redundancy. Once Gazprom throttled flows, gas set the marginal price for every megawatt.

Contrast California. Between 2020 and 2024, the state added 15 GW of utility solar and 5 GW of batteries; the California ISO reports peak‑day wholesale prices stayed below $60 MWh even as carbon allowances traded near $30 t¹. Front‑load clean capacity, then ramp the levy—not the reverse.

Storage, Geothermal, and the Myth of the Last Hydrocarbon

Critics warn that grids starved of dispatchable fuel will stutter. Two data points disarm that claim:

- BloombergNEF’s 2023 survey pegs lithium‑ion battery packs at $139 kWh¹, a 14 % drop in one year and 40 % since 2020.

Next‑gen geothermal: Utah’s FORGE reservoir tests deliver 24/7 output with levelised cost forecasts near $0.07 kWh¹, competitive with peaking gas even before carbon costs. This promising technology should give the audience hope about the future of clean energy. Financed at scale, these technologies erase the “fossil or blackout” dichotomy still haunting political discourse.

A Three‑Phase Blueprint for Economic Transformation

Phase I (2025‑28) – Establish the Cost Floor

Introduce a carbon floor at $60 t¹, rising $15 per tonne annually. This 'carbon floor' sets a minimum price for carbon emissions, ensuring that the cost of emitting carbon is not lower than this threshold. Hypothecate the first $50 billion annually to a competitive “Cost‑Less‑Than‑Coal” program funding university-industry consortia tackling storage, electrified heat, and green‑hydrogen catalysts.

Phase II (2029‑35) – Flood the Market with Cheap Electrons

Mandate annual capacity auctions for 150 GW renewables and 30 GW storage until wholesale prices cap below $40 MWh in every region. Pair this with a dynamic tariff that claws back windfall profits if fossil generators exploit scarcity, stabilizing consumer bills while preserving investor certainty.

Phase III (2035 onward) – Exit Fossils and Monetise Negatives

Lift the levy to $200 t⁻¹ over five years, bankrupting unabated coal and most gas peakers. Introduce a negative‑emissions premium at $150 t⁻¹ for verified direct‑air or BECCS removal to neutralize residual sectors.

This sequencing eliminates the price‑spike pathology by ensuring alternative capacity stands ready before the incumbent’s margin disappears.

Addressing Equity and Geopolitics

Revenue recycling answers regressivity: British Columbia’s model leaves the bottom income quintile net positive after dividends. If they see the cheque, the public will tolerate high carbon prices.

Geopolitically, the risk is not Chinese coal but Chinese photovoltaic hegemony: the IEA counts 277 GW of new solar in China in 2024 alone, 2.3× times the United States’ entire addition since 2000. A rising domestic carbon floor provides the demand anchor that justifies local gigafactories and dilutes Beijing’s leverage.

Grid Infrastructure: The Hidden Trillion‑Dollar Variable

The Energy Transitions Commission forecasts $800 billion annually for global grid upgrades in the 2030s and 2040s—roughly the same as all renewable CAPEX today. Without that spending, renewables curtailment will climb, and carbon prices will flow to consumers instead of crashing fossil utilization rates. The policy must, therefore, link carbon‑revenue recycling to regulated-asset-based financing of transmission and distribution, lowering the weighted average cost of capital via a guaranteed rate of return.

Engineering the End of Fossil Profit

Look at the math: a $200 t⁻¹ levy adds $70 MWh to gas; Lazard projects utility‑scale solar will brush $25 MWh by 2035, batteries another $12. The incumbent cannot compete. When investors believe that trajectory, they divest ahead of regulation. Consumers vote to keep the levy climbing when they see their rebate cheque and a stable electricity bill.

Technologies do not die because we hate them; they die because we out‑compete them. The twin pressure of a rising carbon price and a plunging clean‑tech cost curve is the only policy combination with enough force to erode the fossil profit margin into oblivion. Anything less is moral theatre—loud, righteous, and tragically slow.

The original article was authored by Esther Ann Bøler, an Assistant Professor at Imperial College London, Business School, along with two co-authors. The English version of the article, titled "How an oil price crash sparked clean innovation: Insights from Norway” was published by CEPR on VoxEU.