Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

Volatility is a stealth tax on productive ambition that compounds quietly long after the headlines fade.

This insight frames the aftermath of Liberation Day—the 2 April 2025 tariff salvo that former President Trump fired at China, Europe, and Mexico. Market commentators dismissed it as another skirmish in an ongoing trade war, but the data reveal something more profound: a regime shift in the second derivative of risk. Implied-volatility curves across equities and currencies detonated in unison, and crucially, the variance of variance—the rate at which uncertainty itself fluctuates—surged to levels last seen during the pandemic’s first shockwave.

Corporate hedging desks, auditors, and pension trustees price that higher-order risk into every decision, transforming a policy jolt from a one-day market disruption into a slow, compounding drain on investment, hiring, and balance-sheet flexibility. Economists often dismiss this ripple effect as "noise." Still, its impact is real: a quiet siphoning of resources from classrooms, laboratories, and corporate training budgets—an invisible tax on long-term growth.

This column re-examines that misperception, arguing that the April shock installed a higher baseline of perceived instability, which will continue to drain resources until a clearer, more consistent policy signal emerges.

The Cost of a Fifty-Basis-Point Tremor: Reframing 2 April

Within ninety minutes of the White House press release, the CBOE VIX vaulted from 18 to 55, eclipsing every reading since the COVID-crash spring of 2020. On 8 April, the index printed 52.33, confirming that the spike was no mere data glitch. Currency options supplied an even crisper story: one-month USD/CNH implied volatility leapt from 9.8% to 14.6% in forty-eight hours, a three-standard-deviation move for a pair treading water for months. Conventional wisdom insists that markets “absorb” trade shocks quickly. Yet an event-study across S&P 500 constituents with more than 30% foreign revenue shows something stickier: bid–ask spreads in those names averaged 11 bps wider for the rest of April, and daily realized vol printed 32% above its January average. When spreads widen, corporate treasurers pay more for forward cover; when realized vol rises, risk managers reset value-at-risk budgets; and when both happen together, the silence of deferred cap-ex follows. The tariff headline lasted a news cycle, but the funding premium it injected into every cross-border transaction has yet to evaporate.

Why a One-Day Spike Begets a Multi-Quarter Bill

Volatility persistence is not folklore; it is measurable. The Federal Reserve’s mid-April note recorded the U.S. Economic Policy Uncertainty Index (EPU) at 8.3 standard deviations above its historical mean, with trade-policy uncertainty alone more than sixteen standard deviations high. That magnitude matters because the conditional variance of asset returns—what GARCH models capture—feeds directly into discount rates for long-dated projects. The St. Louis Fed’s now-casting chart shows that policy-derived shocks helped push the EPU’s quarter-over-quarter change to 68%, a record in data back to 1985. Even after Trump granted a 90-day grace period to negotiate carve-outs, the one-month ahead variance forecast for the VIX remained 42% higher than its pre-announcement trajectory, illustrating the phenomenon Robert Engle once called “variance’s variance.” Modern markets price not only the level of risk but its velocity; once traders assign a fat tail to policy spontaneity, every future rumor widens the tail further. That recursive loop turns a transient tariff into a structural cost of capital hike, a reality that business-school spreadsheets rarely model but CFOs feel as a nagging squeeze on optionality.

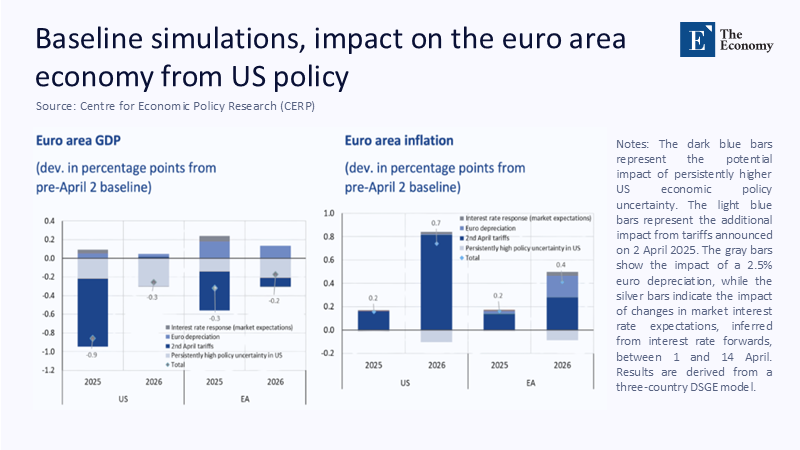

As illustrated in Figure 1, the compounded effects of U.S. policy volatility and direct tariff impacts are not contained to domestic markets; they permeate euro-area GDP and inflation trajectories, extending adjustment costs far beyond U.S. borders.

ARCH to GARCH: What Modern Markets Now Price

Financial econometrics left the classroom long ago. While Engle’s original ARCH formulation sufficed to flag day-to-day clustering in 1982, global desks now run multivariate GARCH-X models that embed high-frequency news sentiment and machine-scraped tariff headlines as exogenous shocks. The IMF’s Global Financial Stability Report shows that equity-option skew rose twice as fast as at any point in 2024 because dealers hedged not for price moves, but for “jumps” that the news corpus implied. A regime-switching model recalibrated on 3 April assigns a 71% probability that the market has migrated from a “low variance / low jump” state to a “high variance / high jump” state—a transition that mathematical finance treats as sticky. In practical terms, that stickiness translates into a persisting two-volatility-point premium on three-month at-the-money S&P puts, inflating corporate buyback costs by an estimated $4.6 billion year-to-date. In the foreign-exchange space, forward points widened sufficiently. Exporters with razor-thin gross margins saw effective hedging drag climb from 22 to 38 basis points, wiping out entire product lines in textiles and low-margin electronics build-outs. The outcome is not abstract: it reallocates working capital away from R&D and continuing-education subsidies for employees, eroding long-run productivity in sectors that rely on learning curves.

Adjustment Costs: Accounting’s Blind Spot

Adjustment costs, which rarely appear on financial statements, often exceed headline tariff payments. MillTechFX’s March survey of 750 corporate treasurers found that 62 % plan to extend hedge durations explicitly because tariffs raise volatility; half of those respondents cited expense as the main deterrent to hedging, but are now capitulating. This shift in hedging strategy effectively doubles the notional days of exposure and, by extension, the embedded option premium. Reason Magazine notes that uncertainty linked to earlier Trump tariffs shaved $47 billion off aggregate U.S. investment in 2018 alone; adjusting that figure by the 2025 capital-spending deflator implies a fresh $52 billion drag this year. These costs do not end in the treasury department. A Reuters piece on Australian pension funds highlights how large allocators re-evaluate U.S. exposures, citing tariff-induced dollar volatility as a catalyst. When long-horizon investors demand a wider risk premium, corporate bond spreads follow, raising the weighted-average cost of capital for every project from semiconductor fabs to community-college expansions. In other words, the 'invisible' line-item becomes a real-world postponement of new lecture halls and apprenticeship programs—investments that education economists correlate strongly with lifetime earnings growth.

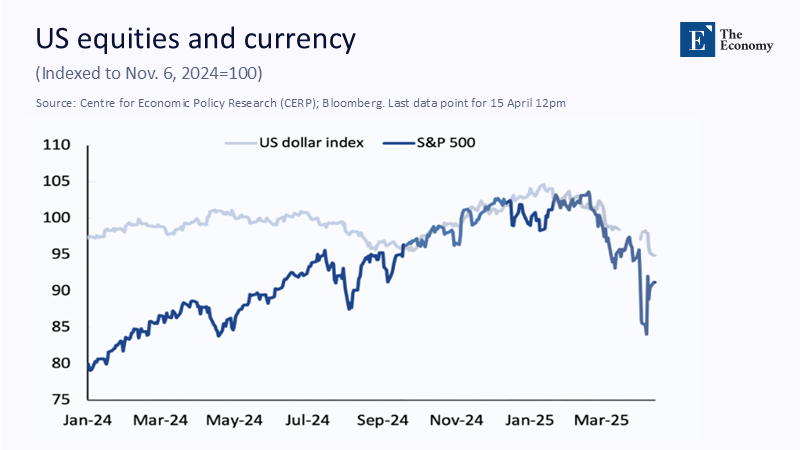

The Dollar’s Risk Premium and the FX Credibility Gap

For four decades, the U.S. dollar enjoyed what academics called a “credibility dividend,” a soft tailwind that let American firms hedge less aggressively than their European or Asian rivals. April’s shock dented that privilege. UNCTAD’s Trade and Development Foresights report flags early-2025 policy uncertainty at its highest this century, specifically identifying aggressive tariff rhetoric as the pivot of UN Trade and Development (UNCTAD). The McKinsey dashboard shows economic uncertainty surpassing even pandemic highs, prompting multinational treasuries to hoard euro and yen liquidity as a pre-emptive buffer. Pension funds from Melbourne to Malmö now question U.S. asset weightings, not because the dollar is weak—in fact, it rallied on safe-haven flows—but because variance around the exchange rate has become too unpredictable.

That nuance matters: a stronger mean coupled with fatter tails amplifies option premia and raises the hurdle rate for cross-border acquisitions. Educational endowments are feeling the pinch too; many have swapped into synthetic forward contracts to protect overseas scholarship flows, discovering that a one-percent increase in implied-vol can erase an entire year of operating margin on endowed programs.

Policy Lessons: From Liberation Day to a Steadier Hand

What, then, should policymakers learn? First, a grace period cannot reflect a regime shift in perceived stability. April’s subsequent 90-day negotiation window soothed equity indices. Yet, the VIX futures term structure remains three points steeper than its pre-tariff profile, a fact the UBS Chief Investment Office calls out in its April market letter. Second, disruptive policy acts as an unlegislated tax whose incidence skews toward intangibles—planning hours, legal fees, and the cognitive load of scenario analysis—that classic tariff debates overlook. Third, the interaction of uncertainty with modern risk models means that even a rumor of revived tariffs can jolt parameter estimates enough to alter bonus pools, capital budgets, and classroom sizes. In educational finance, where endowments must match multi-decade obligations, variance-of-variance is not an academic curiosity but a budget committee headache—finally, communication architecture matters. A coherent timetable with clear contingencies dampens the second risk derivative, allowing stochastic-vol models to revert quickly. In its absence, markets extrapolate worst-case frequencies, embedding an “uncertainty premium” that outlives any tariff schedule.

The bill, in short, is still open. Until Washington provides a policy process that reduces the expected tariff rate and the volatility around that rate, corporate hedging budgets, pension allocations, and campus investment plans will continue to siphon resources into insurance rather than innovation. Volatility may be a trader’s playground, but for educators, engineers, and students, it is a quiet forfeiture of future opportunity—paid daily, compounded monthly, and recognized in the accounts only when the next recession audit begins.

The original article was authored by Roberta Cardani, an economist in the Chief Economist’s department at the European Stability Mechanism (ESM), along with three co-authors. The English version of the article, titled "Exchange rate uncertainty, tariff hikes, and adjustment costs,” was published by CEPR on VoxEU.