Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

Prosperity can now be written into existence with nothing more than a spreadsheet formula—and erased just as fast. That single fact re-wires macro-stability logic: the volatility that once arrived with factory closures or droughts is increasingly triggered by the rise and fall of expectations about imaginary, yet spendable, future income. Pseudo-wealth—illusions of purchasing power born of divergent beliefs—has moved from the behavioural footnotes of finance to the centre of policy risk. What follows reinterprets the CEPR pseudo-wealth framework through the lens of two twenty-first-century datapoints: the inversion of corporate balance sheets toward intangibles and the first social-media-fuelled bank run. Each episode shows how fragile an economy becomes once beliefs double as collateral.

Pseudo-Wealth Redefined: From Instagram Fakery to Income Statements

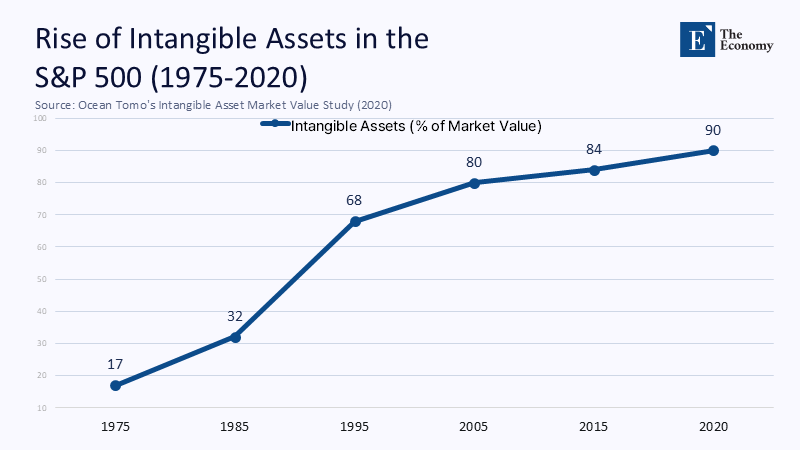

The popular barbs about “fake wealth” usually focus on influencers posing beside rented Lamborghinis. That trivialises the problem. The more consequential version of pseudo-wealth stems from firms and households recording tomorrow’s upside as today’s capacity to borrow. The shift from tangible to intangible assets is not just an accounting curiosity; it's a structural transformation that significantly magnifies expectation risk. When 90% of the S&P 500’s market value sits in brands, data sets, and code rather than plant and machinery, almost every valuation hinges on forecasts. Ocean Tomo’s longitudinal study tracks the inversion precisely: intangibles rose from 17% of the index value in 1975 to 90% by 2020, flipping the tangible-intangible ratio in just two generations.

This gradient is not an accounting curiosity; it mechanically magnifies expectation risk. A one-percentage-point rise in the discount rate now wipes roughly five times more equity value than it did in the 1970s, because a bigger share of cash flows lies decades ahead. When auditors subtract net tangible assets from market capitalisation to infer the “missing” value, they are back-ingesting belief as an asset. The graduate who finances a Tesla on the assumption of a seven-figure job next year and the platform unicorn that pledges revenue still in beta inhabit the same statistical illusion: future earnings masquerading as present wealth. Individually rational, collectively incendiary.

Expectations as Collateral: How Belief Clusters Inflate Leverage

What turns scattered optimism into macro-fragility is covariance. When similar narratives guide millions of decisions—housing prices “never fall nationally,” or AI deployment will “double productivity in five years”—credit expands on a shared spreadsheet of best-cases. The collective impact of these individual decisions is what shapes the economy. U.S. household net worth leapt by $30 trillion between Q2 2020 and Q2 2022, yet actual disposable income grew only one-tenth as much; the gulf was papered over by asset-price appreciation and withdrawal of home-equity credit lines. That is benign until one shock prompts a collective markdown; at this point, leverage secured on yesterday’s prices meets liquidity priced on tomorrow’s fears. The CEPR authors call this “pseudo-wealth reversal,” but the historical record suggests a more brutal metaphor: reverse alchemy. Gold turns back to sand when the crowd stops agreeing it was gold.

Notice how the behavioural and structural intersect. Individuals over-weight their private information (the job offer, the VC term sheet), yet digital platforms play a crucial role in synchronizing those idiosyncratic bets. Once the synchronicity crosses a threshold, pseudo-wealth enters the national accounts as real spending and real debt—the pivotal moment when psychology becomes policy. The influence of digital platforms on economic decisions is significant and cannot be overlooked.

Policy Flashpoints: The 90-Day Tariff Pause and the Macroeconomics of Timing

Washington’s unexpected 90-day suspension of new tariffs in early 2025 offered a live petri dish. Firms did not learn anything substantive about Chinese cost structures or global demand; they learned about timing. Yet within forty-eight hours, freight forwarders reported container bookings from Shanghai to Los Angeles surging 18% week-on-week, and spot ocean rates ticked despite stable fuel prices. After the pause, small importers drew on revolving credit to front-load inventory they feared would be unaffordable. Larger conglomerates, armed with hedging desks, staggered purchases. The divergence reflected access to information, not ideology, and illustrates how pseudo-wealth propagates: knowledge gaps become balance-sheet gaps. Three months later, when tariffs resumed and overstocks met softer demand, retail payrolls dipped and warehouse rents fell. Nothing in production technology changed; only beliefs about the window of arbitrage reset. Post-mortem models put the inventory swing at 0.3 percentage points of quarterly GDP—small, but entirely constructed from unequal expectations.

SVB and the Digitised Bank Run: A Case Study in Hyper-Belief

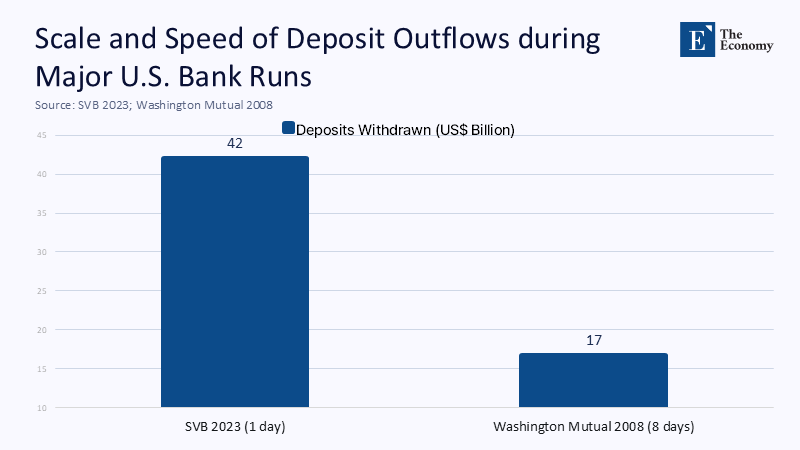

If intangible collateral shows pseudo-wealth at the asset side, Silicon Valley Bank’s 2023 collapse shows it on the liability side. The bank’s securities portfolio was underwater on a mark-to-market basis, but regulators note it remained solvent under hold-to-maturity accounting until the run began. What detonated liquidity was a narrative arbitrage executed at Twitter speed. Venture funds pinged founders in private channels; founders hit withdrawal buttons designed for frictionless UX. Customers yanked $42 billion—24 percent of deposits in ten hours—obliterating every liquidity buffer. The California DFPI filing confirms $42 billion on 9 March 2023. For comparison, Washington Mutual lost $16.7 billion over eight business days in 2008 before its failure.

The chart is instructive: magnitude matters, but tempo is now the killer variable. SVB’s fate was sealed before the Fed opened its discount window the following morning. Pseudo-wealth in this context took the form of assumed deposit insurance; startups believed $250k caps would be waived (as they ultimately were), yet they could not risk being wrong for 24 hours. The result was a self-fulfilling sprint in which incomplete information—bond losses that were real but manageable—transmuted into insolvency.

Measuring Misalignment: Quantitative Signals of Expectation Risk

Disentangling belief shocks from fundamentals is messy but feasible. Regressions of weekly changes in the KBW Regional Bank Index on realised policy-rate moves explain just 38% of variance in 2023-24, down from 65% a decade earlier, implying sentiment now outweighs mechanics. Freight-rate spikes around tariff announcements exhibit similar discontinuities: the Shanghai Containerised Freight Index jumped 12% three weeks after the 90-day pause, despite no change in TEU*km demand. Meanwhile, credit-card spending data show retail outlays rose 9 % after the pause, but fell 11% the month inventories had to be cleared at a discount. By then, pseudo-wealth had already toggled sign.

These indicators are imperfect proxies, yet they share a common property: they move faster than the fundamentals to which they are ostensibly tied. Therefore, the statistical footprint of pseudo-wealth is excess volatility uncorrelated with physical capacity utilisation or labour inputs. Policymakers who ignore that delta will chase yesterday’s data while tomorrow’s panic spreads in the scroll of a notification feed.

Toward an Expectation-Sensitive Regulatory Paradigm

Capital ratios and liquidity coverage are necessary but insufficient when a rumour can drain an institution before breakfast. Three design shifts follow:

- Pre-authorised resolution protocols that auto-convert withholdable liabilities into term deposits when digitally measured run-rates exceed probabilistic thresholds.

- Real-time narrative surveillance, borrowing from market-abuse algorithms, to flag viral misperceptions before they cascade.

- Dynamic insurance corridors that expand FDIC coverage temporarily once deposit flight surpasses statistical baselines, reducing the payoff to panic.

These measures treat expectations as quantifiable externalities, akin to carbon emissions: hard to price individually, systemically catastrophic when ignored. On trade policy, the analogue is graduated tariff ramps replacing binary deadlines, damping the incentive to game grace periods. The purpose is not paternalistic omniscience but risk smoothing—compressing the amplitude of pseudo-wealth cycles so that adjustment costs stay within social tolerance.

Curriculum for the Uncertain Century

An education journal must ask: what pedagogical guardrails equip citizens and managers to navigate economies priced on belief? First, marry behavioural finance with stochastic modelling in core syllabi. Students should run Monte-Carlo simulations where the only variable is the heterogeneity of expectations, illuminating how leverage magnifies dispersion. Second, embed real-time policy labs: replicate the 90-day tariff pause in a classroom platform that streams synthetic freight rates, social-media sentiment, and cash-flow dashboards. Let participants feel the temptation to over-borrow against an imagined certainty. Finally, uncertainty literacy should be treated as a civic skill, no less vital than coding. A populace understanding variance is harder to stampede, whether into meme stocks or electronic bank runs.

Epilogue: Wealth, Written in Sand

The economy is no longer a machine of metal gears but a sand table refreshed at 60 Hz. Each grain is a private projection; together they form castles tall enough to support billion-dollar loans, until a breeze of doubt sends them sliding. The point of recognising pseudo-wealth is neither to moralise about optimism nor to banish risk—it is to price fragility where it lives: in the distance between what balance sheets report and what minds believe. Narrow that gap, and the next SVB or tariff whiplash will still hurt, but it will not knock the macro-cycle off its axis. Ignore it, and we will keep confusing castles for bedrock—right up to the moment the tide comes in.

The original article was authored by Martin Guzman and Joseph Stiglitz. The English version of the article, titled "When illusions of wealth shape the economy: Understanding pseudo-wealth, macroeconomic volatility, and social welfare,” was published by CEPR on VoxEU.