"Trapped in Price Wars and Oversupply: Only 10% of Chinese EV Makers to Survive in Five Years"

Input

Changed

Amid Market Saturation, Fierce Competition in China’s EV Industry "Only 15 Out of 129 Brands Expected to Survive" Excessive Price Wars Leave Most Firms Unprofitable

China’s electric vehicle (EV) industry is facing a dire outlook, with projections suggesting that the majority of its manufacturers will vanish over the next five years. As the crisis narrative intensifies, a new analysis estimates that by 2030, only 15 of the current 129 EV and plug-in hybrid brands will remain in the market—roughly one-eighth of today’s total. Industry observers are divided on whether this shakeout signals a healthy consolidation or if it foreshadows a “second Evergrande” crisis.

Currently 129 Companies, Fierce Competition Spurs Industry Restructuring

According to Reuters on July 6 (local time), global consultancy AlixPartners predicts that China's EV market will undergo massive consolidation due to fierce competition. Of the 129 companies currently selling EVs or plug-in hybrid vehicles, only 15 brands are expected to survive by 2030. These surviving firms are projected to command approximately 75% of China’s EV and plug-in hybrid market by that year. Each will reportedly manufacture an average of 1.02 million vehicles annually. The report did not identify which companies are likely to survive.

Stephen Dyer, head of AlixPartners' Asia automotive division, noted that consolidation in China’s auto sector will proceed more slowly than in other countries. That’s because local governments may support firms that fail to turn a profit but are vital to regional employment, supply chains, and economic activity. “China is home to one of the most competitive new energy vehicle markets globally, driven by price wars, rapid innovation, and startups that constantly raise the bar,” Dyer said. “This environment has resulted in remarkable advancements in technology and cost efficiency, but it has also made sustainable profitability elusive for many firms.”

More Firms Going Bankrupt Than Entering the Market

China’s auto industry is currently under dual pressure from price wars and supply gluts. Except for top players like BYD and Li Auto, most firms reportedly fail to post annual profits. Industry watchers believe the shakeout is now entering a full-fledged phase. According to AlixPartners, the number of Chinese EV firms jumped from 34 in 2018 to 80 in 2023, but fell back to 77 last year—a turning point in growth. The drop came as 16 firms shut down operations.

Discounting wars have also intensified. JP Morgan reported that Chinese automakers’ average discount rate stood at 8.3% last year, but rose to 16.8% by April—almost doubling. This year, price competition has grown even more fierce. In June, BYD launched a massive promotion slashing prices of 22 models by up to 34%, prompting about 10 other automakers, including Chery and SAIC, to enter a price-cutting “chicken game” with discounts of up to 47%.

While falling prices may appear favorable for consumers, the underlying risks are significant. Volatile pricing undermines consumer trust. On Chinese social media, growing numbers of users express concerns such as “What if the price drops again right after I buy the car?” Automakers, in a bid to survive, may slash spending on quality, safety, and after-sales service. Even as BYD boosts its market share with aggressive pricing, deteriorating industry-wide profitability seems unavoidable. After peaking in late May, BYD’s market capitalization plunged by about $28 billion.

Concerns Over a “Second Evergrande”

The root cause of this crisis lies in China’s excess production capacity. Around 2020, government incentives triggered a surge in EV startups, while traditional automakers rapidly expanded their EV production facilities. According to Chinese market research firm Gasgoo, the average factory utilization rate in China’s auto sector stood at just 49.5% last year—nearly half of all factories sat idle.

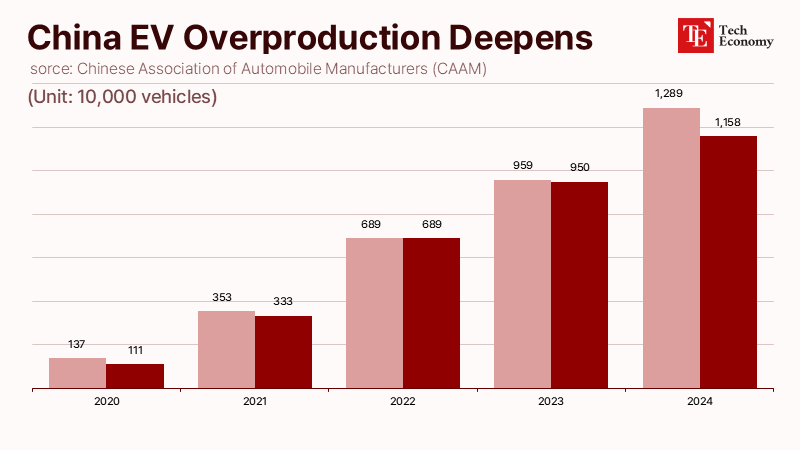

EV sales have not kept pace with output growth. China produced about 12.89 million EVs last year, a 34% increase from the previous year, but domestic EV sales rose only 22% to 11.58 million units. Although China’s EV market is still expanding—unlike the stagnating markets in the U.S. and Europe—the supply growth is clearly outstripping demand.

As a result, a dubious practice is spreading across China: manufacturers register new cars as sold, then resell them as “used” vehicles with almost no mileage. Morgan Stanley estimates that nearly 13% of China’s used car market—or 19.6 million vehicles—are models released within the past three months and driven fewer than 50 kilometers.

Voices of concern are rising within the industry. In a May interview with Chinese media outlet Sina Finance, Wei Jianjun, Chairman of Great Wall Motor, said, “Evergrande already exists within China’s auto industry—it just hasn’t burst yet.” He likened the current trend of sacrificing margins for volume in a price-cutting frenzy to the behavior of property developer Evergrande, whose reckless expansion and eventual collapse triggered a broader economic downturn.