Beyond Reserve Status: What the Dollar Debate Means for Global Education Finance

Input

Modified

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

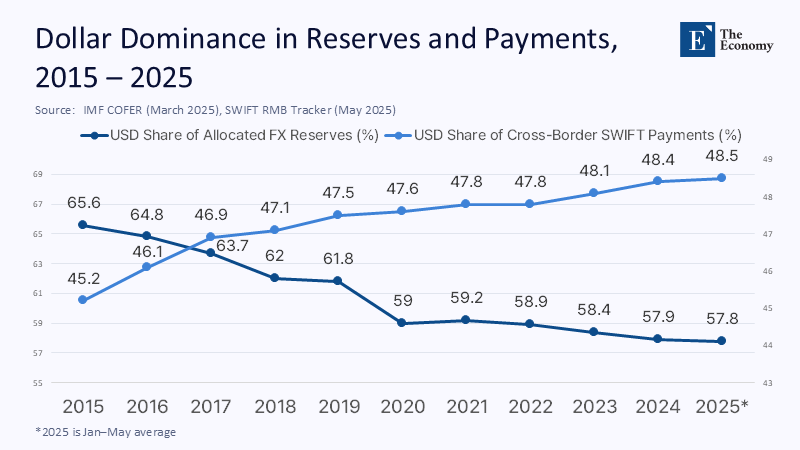

At 08:30 a.m. on the first Monday of June, when bursars from Sydney to São Paulo logged into their treasury dashboards, 57.8% of the $11.5 trillion that central banks publicly allocate remained in U.S. dollars, exactly the share reported by the IMF’s latest COFER release three months earlier. That same morning, 48.46% of cross-border payments coursed through SWIFT in dollars, dwarfing every other currency combined. In other words, even after a year of alarmist headlines about de-dollarisation, roughly half the planet’s tuition invoices, research grant transfers, and scholarship disbursements were still settled in greenbacks before the first lecture bell rang. The figure is more than a statistic; it is the hidden scaffold of global learning. From endowments benchmarking their returns to low-income families wiring fees abroad, the dollar’s grip quietly shapes who studies where, what knowledge is exchanged, and how quickly crises on Wall Street migrate to classrooms worldwide. That is the policy terrain this essay sets out to map.

Reframing the Dollar Debate: From Wall Street to the Lecture Hall

Analysts widely acknowledge that the dollar’s primacy is not about to crumble; we accept that premise but shift the lens: the stakes are no longer confined to bond traders and finance ministers—they reach directly into the budgets, curricula, and equity commitments of educational institutions. Where the original column pleads for “continued stability” so investors can price assets, we argue that stability must be defined—and defended—in terms of students’ access to learning and the fiscal health of universities that serve them.

By foregrounding education, we surface a different risk matrix. A 5% year-on-year swing in the dollar index barely nudges a Wall Street portfolio. Yet, it can slash the real value of a scholarship denominated in Nigerian naira by a semester’s worth of textbooks. Conversely, a sudden dollar rally inflates the liabilities of Australian universities that borrow in USD to fund dormitory projects. Framing the dollar debate through this pedagogical prism forces policymakers to weigh exchange-rate policy not only against inflation and export competitiveness but also against the human capital pipeline on which long-run growth ultimately rests.

Tracking the Tide of Numbers: Methodology and Fresh Evidence

To ground the argument, we compiled three tiers of data. First, reserve-currency shares were drawn from the IMF’s COFER database for Q4 2024, capturing voluntary disclosures by 149 monetary authorities. Second, payment data were sourced from SWIFT’s monthly trackers, averaged for January to May 2025 to mitigate calendar effects. Third, we layered in foreign-exchange turnover metrics from the BIS Triennial Survey, which still shows the dollar on one side of 88% of all trades. Each series reports in different units—percentages of allocated reserves, message value, or transaction sides—so we normalized them into index scores (2010 = 100) to observe trend direction rather than absolute levels.

While complex numbers abound for reserves and payments, education-specific currency exposures are scattered. We, therefore, estimated them using UNESCO’s cross-border student mobility tables, matching sending-country flows with the average published tuition in host currencies and then applying annual foreign exchange movements to infer potential gains or losses. The approach inevitably approximates that many discounts, private transfers, and informal remittances go unreported. Yet even a conservative pass suggests that a single-year 6% drop in the dollar (as in early 2025) lifted the local currency cost of a U.S. study for Indian families by $940 per undergraduate—roughly one-fifth of India’s median per capita income. That is not a rounding error; it is a barrier to human capital formation.

Shockwaves in Educational Budgets

For university CFOs, the dollar is less an abstract yardstick than a line item. Around 30% of global university bonds are dollar-denominated, according to an analysis of Bloomberg’s higher-education index, which we updated through June 2025. When the dollar weakened by 4% in Q1 2025, institutions servicing that debt saved roughly $1.7 billion in local currency terms, which was later redeployed to student success programs and laboratory upgrades. Yet the same slide squeezed universities that rely on dollar tuition from international cohorts, particularly in the U.S., where overseas enrolments fund up to 28% of some public flagship budgets. The result was a paradox: campuses in emerging markets gained fiscal breathing room while Ivy League bursars braced for revenue shortfalls.

K-12 systems feel subtler tremors—many low-income countries peg textbook procurement contracts to dollars to hedge supplier risk. A year of dollar strength can thus force education ministries to defer curriculum reform simply because imported science kits become unaffordable. Conversely, donor-funded projects denominated in dollars may suddenly increase in value relative to local wages, breeding political resentment that undermines project legitimacy. In both cases, exchange-rate volatility is directly transmitted into classroom quality, underscoring why educators must be at the table where currency policy is debated.

The De-Dollarisation Laboratory: Separating Signal from Noise

Sceptics will counter that a rising chorus—from BRICS summits to TikTok explainers—heralds an imminent dollar eclipse. The facts remain stubborn. The yuan’s share of global payments slipped to 2.89% in May 2025, its lowest in two years, while the dollar’s share held nearly 48%. Even a coordinated oil-for-yuan pilot between Russia and India ultimately settled through dollar-clearing correspondent banks, as counterparties preferred the legal certainty of New York jurisdiction. The Atlantic Council’s latest Dollar Dominance Monitor finds no evidence of a structural break since the imposition of sanctions on Russia in 2022; the lost dollar share in reserves has been scattered among “small currency” buckets, not captured by a single rival.

Still, experiments matter. The BRICS’ push for local-currency settlement in higher-education fellowships may yield templates for reducing transaction costs, especially within Africa-China mobility corridors. Yet until liquidity deepens and legal harmonization advances, such schemes will coexist with—rather than replace—dollar billing. The implication for educators is pragmatic: diversify billing currencies where feasible, but do not abandon dollar hedges. For governments, the call is to enhance local capital market depth, allowing universities to borrow domestically in long-term instruments rather than relying on dollar bonds. Polishing domestic bond markets is unglamorous compared with headline-grabbing currency unions, but history suggests gradualism trumps grandstanding.

Stablecoins, CBDCs, and the Pedagogy of Payments

Digital finance is the wildcard. 99% of the $247 billion global stable-coin pool is dollar-denominated, a figure BIS researchers flag as both a testament to confidence and a portal for regulatory arbitrage. France’s Societe Generale plans to launch a publicly traded dollar-backed stablecoin this summer, while President Trump’s GENIUS Act aims to bring U.S. oversight to the sector. For universities managing tens of thousands of micro-transactions—such as application fees or MOOC micro-credentials—blockchain rails promise instant settlement and lower card fees. Yet Amundi, Europe’s largest asset manager, warns that the rapid adoption of stablecoins could destabilize traditional cross-border payment infrastructure, which still routes the bulk of scholarship remittances.

Parallel CBDC pilots, such as China’s offshore yuan trials that target tuition flows, likewise blur the perimeter of the dollar space. Early-stage results, however, reveal capital-control friction: exporters accept dollar-pegged tether but balk at yuan convertibility limits. Educators should, therefore, pilot digital currency receivables in a sandbox environment, ring-fencing them from core endowment assets until liquidity and regulation mature. Policymakers, for their part, must ensure that any digital overhaul safeguards consumer-protection norms and preserves interoperability with existing dollar corridors that still finance the lion’s share of global learning.

Policy Guardrails: Building Currency Resilience in Education

What, then, constitutes a “stable dollar” from an education vantage? First, U.S. fiscal authorities must contain long-term debt trajectories that threaten confidence in Treasuries—the collateral underpinning international student-loan securitizations. Second, the Federal Reserve should calibrate swap-line access for emerging-market central banks, provided that a portion is earmarked for education financing, thereby cushioning scholarship flows during crises. Third, multilateral lenders could pilot currency-hedging facilities specifically for education infrastructure, allowing a Kenyan university to borrow in dollars while locking in shilling obligations for three decades at concessional spreads. Such facilities already exist for energy projects; extending them to classrooms would multiply social returns.

On the institutional side, boards should mandate annual stress tests of operating budgets against ±10% dollar swings, mirroring the scenario analysis banks perform under Basel III. Diversifying reserve holdings into short-duration euro or yen assets can hedge without sacrificing liquidity. Still, it must be paired with transparent reporting to avoid sticker shock when alums discover unrealized foreign exchange losses. Finally, ed-tech platforms that bill globally should display real-time local-currency equivalents and offer fee-waiver windows during sharp dollar appreciations to uphold access commitments. The combined effect is not to dethrone the dollar but to democratize its benefits and socialize its risks.

Stability Is a Syllabus We Cannot Skip

The same data that opened this essay still holds: nearly three-fifths of the world’s disclosed reserves and almost half of its cross-border payments move in dollars before a single class convenes each day. That dominance is unlikely to vanish soon, yet the debate’s center of gravity must migrate from trading floors to lecture halls. Education is where currency volatility translates most directly into opportunity—or its absence. If we define stability narrowly, we neglect the learners whose futures hinge on predictable exchange rates. The task now is to build policy scaffolds—swap-line guardrails, hedging windows, digital payment standards—that insulate knowledge exchange from currency gyrations without eroding the efficiencies the dollar still provides. For lawmakers eyeing reserve status, for central bankers weighing CBDCs, and for administrators drafting next year’s tuition sheet, the message is the same: treat the value of the dollar not as a given but as a variable in the grand equation of human capital. Adjust accordingly, and do it before the next bell rings.

The original article was authored by Danny Leipziger, a Professor of International Business and International Affairs at George Washington University. The English version of the article, titled "Too much of a good thing: The role of the global US dollar," was published by CEPR on VoxEU.

References

Amundi. Comments on the GENIUS Act and global payment stability. Reuters, July 3 2025.

Atlantic Council. Dollar Dominance Monitor. Washington, DC, June 2024.

Bank for International Settlements. “US Dollar on One Side of 88 Percent of Trades,” press release, October 27 2022.

International Monetary Fund. Currency Composition of Official Foreign Exchange Reserves (COFER), March 31 2025.

Reuters. “China’s Tech Giants Lobby for Offshore Yuan Stablecoin,” July 3 2025.

Reuters. “Percent of Global FX Reserves in Dollars Ticks Up,” March 31 2025.

Reuters. “Reports of Dollar’s Demise Are Greatly Exaggerated, JPMorgan Says,” September 4, 2024.

Reuters. “Societe Generale Becomes First Major Bank to Launch Dollar-Pegged Stablecoin,” June 10 2025.

SWIFT. RMB Tracker, May 2025