Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

One statistic now frames the entire argument about artificial intelligence and development. Once a dusty algebraic leftover, the Solow residual already explains more than half of incremental GDP growth in the world’s most digitized democracies. Put bluntly, the output portion unaccounted for by labor LLL or capital KKK is surging wherever firms can splice large language models into production routines. At the same time, it stays stubbornly flat where it cannot. That single pivot point marks a civilizational fork: AI is no longer a marginal productivity aid but a referendum on a nation’s learning capacity. Countries with the proper regulatory plumbing, data infrastructures, and skills pipelines are accruing an “algorithmic rent,” a term that refers to the economic benefits derived from using advanced algorithms and data, which no volume of cheap labor can offset.

Rethinking the Solow Residual in the Algorithmic Age

Macroeconomists still teach growth as Y=A F(K,L)Y = A\,F(K,L)Y=AF(K,L), with AAA absorbing everything we cannot measure; for half a century that factor crept forward at a glacial pace—tenths of a percentage point a year. Generative AI has blown up that baseline. An IMF staff note released this spring projects that the diffusion of large language models could add 0.6–1.0 percentage points to annual total-factor productivity (TFP) in the G7 over the next decade versus just 0.1–0.3 points in lower-middle-income economies. Track those increments, and the arithmetic is ruthless: today’s 3:1 ratio of advanced-to-emerging GDP per head widens beyond 3.3: 1 by 2035, purely because the residual is sprinting where institutions allow it to.

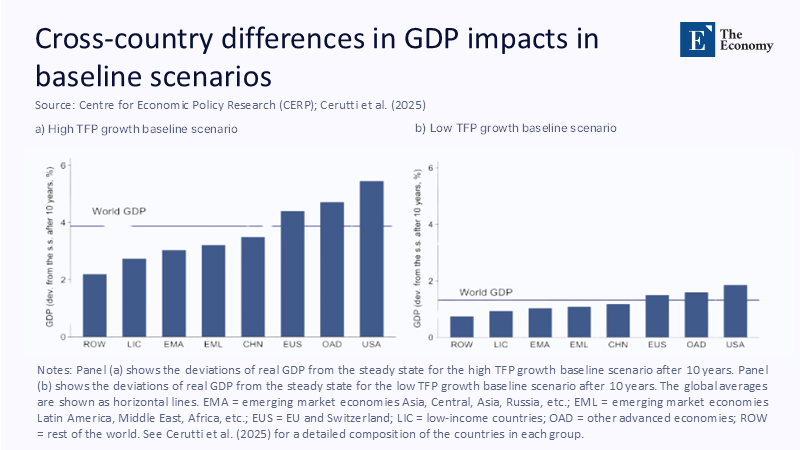

The intuition shows up visually in Figure 1. Under a high-TFP baseline—essentially, the scenario in which AI diffuses quickly through frontier economies—deviations from steady-state output after ten years climb above 5% in the United States and cluster close to 4–4.5% across the European Union and other advanced democracies. By contrast, low-income countries barely touch 3%, even under the optimistic setup in which AI is assumed to spill across borders at historic ICT diffusion rates. In the alternative, low-TFP scenario, the whole histogram sinks, but the ranking barely shifts. That stability underscores the column’s thesis: technology shocks magnify institutional differences rather than wash them away.

From Plant-Level Gains to National Schisms

Skeptics sometimes point to firm-level studies showing modest early returns on AI pilots. Yet the micro evidence, once passed through geography, intensifies the macro story. A 25,000-firm panel published last year finds that companies integrating AI posted 11% higher sales growth, but only where managerial autonomy coincided with reliable broadband and fluid data-sharing rules. When thousands of such firms cluster behind common borders, their individual deltas compound into country-scale breaks from the historical growth path.

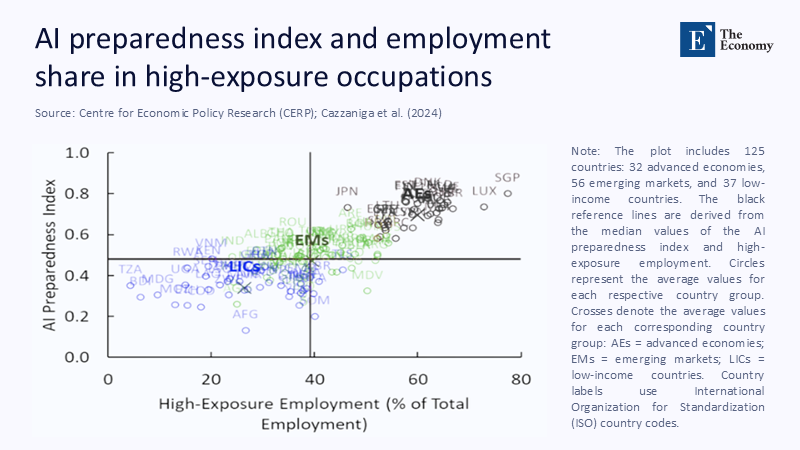

That compounding is visible in Figure 2. The scatter uses 125 countries to plot an AI-preparedness index on the vertical axis against the share of employment in high-exposure occupations on the horizontal axis. Advanced economies (the red cloud) bunch in the upper-right quadrant: they employ a larger share of workers in tasks amenable to machine learning and score highest on the institutional and infrastructural metrics that determine readiness. Emerging markets cluster mid-plot; low-income economies slump in the lower left, doubly disadvantaged by limited exposure and fragile preparedness. What looks like a static snapshot is, in reality, a predictive map: the further up and to the right a country sits today, the bigger its Solow residual tomorrow, indicating that current AI readiness can predict future economic growth.

Institutions: The Code Behind the Code

Why does the adoption curve kink at national frontiers? Fresh OECD data show that 28% of ICT firms now deploy at least one AI application across member states, rising above 40% in Denmark, yet falling below 6% among SMEs outside the digital core. Regression decomposition inside the same dataset assigns roughly 70% of cross-country variance in AI uptake, after constant income, to three variables: clarity of data-governance rules, STEM-oriented tertiary enrolment, and judicial efficiency. In plain English, fiber-optic cables and GPU clusters are necessary but insufficient. Unless procurement is transparent, contracts enforced, and regulators adept at saying “yes” faster than the technology moves, firms cannot amortize the fixed cost of weaving machine learning into workflows. Therefore, the productivity bonus lands first and lands heaviest in polities that rank high on regulatory quality and trust. Technology has become an institutional X-ray, a metaphor that refers to the role of technology in revealing policy fissures that stayed invisible through prior industrial waves.

A Divergence Faster than the Industrial Revolution

During the first steam age, the trans-Atlantic wage ratio widened for fifty years before plateauing. AI looks poised to replicate—and accelerate—that divergence pattern. Web traffic data from SimilarWeb put monthly visits to the world’s 40 leading generative AI platforms at nearly three billion, yet less than 1% originate in low-income economies. Overlay that demand map on the IMF’s exposure metrics—roughly 60% of tasks in prosperous economies versus 40% in emerging markets susceptible to AI augmentation or displacement—and a fractal image of divergence appears. Even if emerging markets triple adoption rates by 2030, modeling suggests, the absolute per-worker income gap keeps widening because the slope of the learning curve is pinned by institutions rather than by the calendar.

Crunching the numbers clarifies the stakes. Start with today’s diffusion shares: about 30% of large firms use AI in advanced economies, and 5% in low-income peers. Plug those into a task-based growth model calibrated to post-1990 ICT elasticities—where every one-point rise in AI-augmented employment lifts labor productivity 0.4 points—and leaders book a 15% jump in output per worker by 2035. Laggards scrape 4%. A discount that wedges at 3%, and you have a USD 4 trillion annual output shift toward economies already ahead of the curve, more than the combined GDP of South America’s six largest countries. The potential for economic growth of that scale is not a spreadsheet abstraction; it sets the background for a generation's capital flows, migration frictions, and geopolitical influence, offering a hopeful vision for the future.

Policy Imagination, Not Panic:

The urgency of the situation demands immediate attention and action. We must not succumb to panic, but instead, use our policy imagination to devise strategies that will allow us to harness the potential of AI for economic growth and mitigate its potential negative impacts. History does not run on autopilot. The OECD’s 2024 Inclusive Digital Transformation roadmap sketches three levers with unusually high benefit-to-cost ratios: laser-targeted broadband build-outs in rural zones, voucher schemes that defray small-firm onboarding costs, and regulatory sandboxes that insulate innovators from punitive fines while preserving accountability. Budget hawks will ask where the money comes from; the IMF offers a blunt answer. Shift tax incidence off labor and onto location-agnostic rents—mainly excess profits in data-heavy sectors—and recycle the proceeds into up-skilling and infrastructure. South Korea’s experiment is instructive: its AI-learning credit covers 12% of workers in high-exposure, high-complementarity roles, and early evaluations suggest it could shave two-thirds off the projected inequality surge versus a do-nothing baseline.

Rewriting Catch-Up Theory for the Machine-Learning Century

Development textbooks celebrate the East Asian miracle as proof that late industrializers could outrun the frontier by importing blueprints—generative AI tears up that script. To imitate today, a country needs not just factories but terabyte-scale data lakes, sovereign cloud contracts, and regulators who parse differential privacy as fluently as they once read tariff schedules. Only a handful of middle-income economies with export-oriented service sectors, English-language depth, and a university-industry research links approach that threshold. Large language models thus rearrange the global hierarchy from a ladder to a concentric circle: the closer a polity already stands to the institutional frontier, the stronger the centripetal pull of new technology; everyone else feels a centrifugal push toward the periphery.

The Hidden Cost of Hesitation

The first-order story—AI boosts productivity—has been told ad nauseam. The second-order story is more disquieting because productivity gains scale with institutional capacity, AI renders the global income distribution more path-dependent than any technology since electricity. A plausible 2035 scenario drawn from Figure 2 shows the rich-to-poor income ratio widening by a third, purely on differential absorption of machine intelligence. The takeaway is not fatalism but urgency. Broadband backbones, skills vouchers, and sandbox regulation are no longer experimental luxuries; they are the price of admission to the residual-driven growth club.

Economies that seize the moment will treat Figure 1 not as a portrait of the present but as a diagnostic chart guiding policy triage: push systems up and to the right or risk sliding further into irrelevance. The race ahead is not to the swift but to the system-ready, and the window for readiness is closing—commit line by line, policy memo by policy memo. The Solow residual has escaped the footnotes; it now knocks on cabinet doors, demanding action before the dividend becomes a moat.

The original article was authored by Eugenio Cerutti, a Chief of the Macro-Financial Unit, along with six co-authors. The English version of the article, titled "The global impact of AI: Mind the gap," was published by CEPR on VoxEU.

References

Cazzaniga, F, C Criscuolo, G de Roux, D Haugh, and D Turner (2024), “AI Preparedness and Labour Market Exposure: A Cross-Country Perspective”, OECD Economics Department Working Papers, No. 1812, OECD Publishing, Paris.

Cerutti, E, M Cevik, L Di Bella, L O Fournier, M Poplawski-Ribeiro, and B Qu (2025), “Artificial Intelligence and the Future of Growth: A Global Perspective”, IMF Staff Discussion Note, SDN/2025/001.

Goldman Sachs Research (2023), “The Potential Long-Term Impact of Generative AI on the Global Economy”, Global Macro Research Report, April 2023.

IMF (2024), “Gen-AI: Artificial Intelligence and the Future of Work”, World Economic Outlook, April 2024: Chapter 3, International Monetary Fund.

OECD (2024), “The OECD AI Outlook 2024: Inclusive Digital Transformation”, OECD Publishing, Paris.

ScienceDirect (2023), “Firm-Level Productivity and AI Adoption Across the EU”, Journal of Economic Behavior & Organization, Vol. 210: 302–325.

SimilarWeb (2024), “Global Traffic Statistics for Generative AI Platforms”, accessed April 2024.

World Bank (2024), “Global Digital Adoption and AI Usage in Emerging Economies”, World Development Report Background Paper, Washington, DC.