Input

Changed

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

Japan's 2024–25 rice crisis was not a sudden event but a predictable outcome of a production regime that froze paddy acreage, undervalued climatic risk, and expected the market to behave as if elasticity existed. When a record-hot summer finally clipped yields, retail prices doubled in sixteen consecutive weeks, yet barely a tenth of emergency grain reached consumers. This spike was not a mere 'failure of food security policy' in the abstract; it was the logical result of three decades spent socializing downside risk while privatizing guaranteed income. Tokyo's attempts to address the soaring prices with fiscal aspirin are insufficient. The underlying ailment lies in how risk is allocated between state and farmer — a structural reality that even the boldest ministerial reshuffle cannot wish away. The urgency of this crisis cannot be overstated, and immediate action is imperative.

A History Written in Hectares

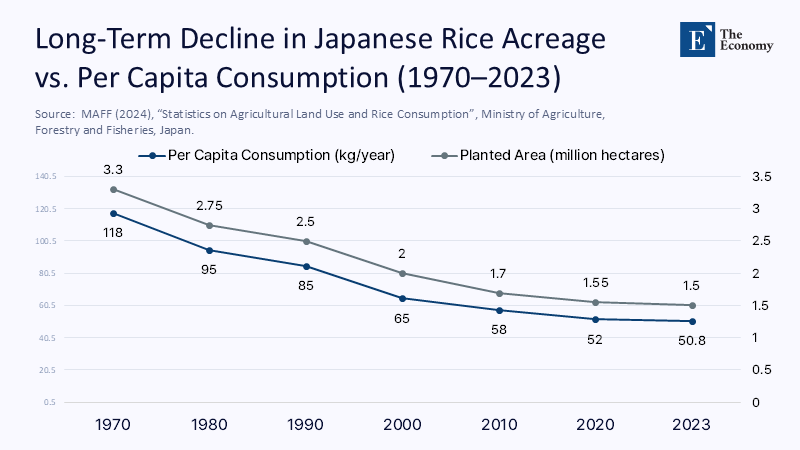

Japan's acreage-reduction scheme, or gentan, began in 1970 as a pragmatic response to surplus stocks. Over the past half a century, the program has contracted paddy land from 3.3 million hectares to 1.5 million hectares, even as per-capita consumption fell by a far more modest 57%. In absolute terms, the country now plants roughly 7.3 million tonnes less rice per year than it would under 1970 acreage — more than its entire table-rice appetite of 6.6 million tonnes. Against that backdrop, the 2024 heatwave merely exposed a structural supply gap that has been growing quietly for decades. The long-term consequences of these policies are dire, and sustainable solutions are urgently needed. Figure 1 here (Dual-axis line chart: acreage vs. consumption, 1970-2023) places that contraction against the slower drift in demand, illustrating how the margin for error has narrowed to a climatic hair's breadth.

The salient point for policy is that Gentian never intended to flex with weather volatility. Tariffs of up to 778% on foreign japonica rice, coupled with direct payments averaging ¥450,000 per hectare, made it rational for farmers to comply with quotas rather than risk unguaranteed expansion. The Ministry of Agriculture, Forestry, and Fisheries (MAFF) now concedes that the resulting acreage is "insufficiently resilient to repeated temperature anomalies." Yet Tokyo's modeling shows that every additional 1 °C above 27 °C during grain-filling wipes 6-10% off head rice recovery rates — precisely the quality decline that undercut the 2024 crop.

When Climate Meets Path Dependence

These climatic stresses collided with a political economy that treats rice less as a commodity than a pension scheme. The average farmer is 68 years old, works under one hectare, and votes in rural districts that determine one-third of Lower-House seats. Agricultural co-operatives (JA) translate that leverage into policy inertia: high tariffs prop up land values that collateralize farm loans, while Gentian floors prices by preventing volume surges. When Agriculture Minister Taku Eto resigned after mishandling reserve releases, his successor Shinjiro Koizumi promised a "root-and-branch review" — only to find that back-bench MPs from Niigata and Akita would not countenance complete quota abolition before the 2028 crop.

The current shortage, therefore, persists not because officials lack foresight but because any meaningful acreage liberalization would crash land prices by as much as 15%, imperiling the collateral behind ¥6 trillion in farm loans. That is why Tokyo's first instinct was to tap its emergency stockpile rather than green-light additional planting. Yet distribution bottlenecks meant only 2% of the rice released in March had reached supermarket shelves by mid-April. The government's May decision to let retailers bypass wholesalers is an implicit admission that the choke point lies inside the corporatist distribution chain, not in the field.

The Illusion of Security: Subsidies That Smother Signals

Between 1995 and 2023, nominal farm-gate rice prices rose 11%, while consumer prices jumped 37%. The widening spread reflects logistics costs exacerbated by scale loss: as smallholders exit, remaining producers face longer hauls to dryers and mills. Yet because subsidies are calibrated per hectare, not per tonne, the rational response for many growers is to idle paddies and collect payments designed for land diversion. Thus, Japan spends roughly ¥420 billion a year on rice programs that mute the price signals that might otherwise trigger acreage recovery.

This incentive mismatch explains why the 2024 shortage quickly became a political crisis. Retail bags hit ¥4,285 for 5 kg by May, up from ¥2,200 a year earlier, prompting the Farm Ministry to sell stockpiled grain at ¥2,000 to halve prices ahead of the Upper House election. But such fire sales buy time at the cost of credibility: traders now assume the state will always cap retail prices, so they hoard in anticipation of soft releases rather than import at market rates.

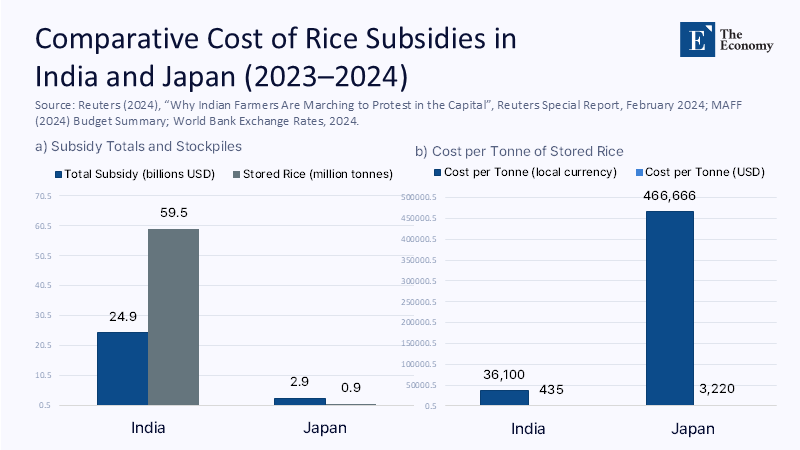

Guarantees Without Growth: The Indian Mirror

Advocates of deeper guarantees argue that only firmer price floors can coax farmers to plant through volatile seasons. India's Minimum Support Price (MSP) is often cited as proof. Yet the Indian experience shows how swiftly guarantees morph into entitlements that outpace productivity. In February 2024, thousands of Punjabi farmers marched on Delhi, demanding statutory MSP coverage for all crops. Police responded with tear gas, and effigies of cabinet ministers crackled in roadside bonfires. India already spends ₹2.15 trillion ($24.9 billion) annually on food subsidies and stores 59.5 million tonnes of rice — four times the statutory norms — but growers still protest because each MSP hike becomes the floor for the next. The fiscal cost per percentage-point increase now exceeds what Tokyo spends on its rice reserve.

India’s rice subsidies cost $435 per tonne of stored grain, while Japan’s cost is over seven times higher. Yet neither model guarantees price stability or political peace.

Figure 2 juxtaposes that arithmetic: Japan's cost per tonne of stored grain is more than seven times India's, even before the latest stock release. Guarantees alone, therefore, cannot buy political peace. They often produce what economists call a "negative marginal efficacy," in which each additional yen of subsidy buys less stability than the one before.

Reframing the Debate: Risk Contracts, Not Blanket Guarantees

If rigid quotas misallocate acreage and blanket price floors ossify demands, the door opens to a third path: risk-sharing contracts that compensate for genuine climatic shocks while penalizing managerial slack. The agenda aligns squarely with the angle advanced in East Asia Forum's reference piece: no state largesse can stabilize supply without addressing production rigidities. Where our interpretation diverges is in prescribing how to loosen that rigidity. The need for policy reform is pressing, and it is crucial for the future stability of Japan's rice production.

A contract indexed to verifiable risk would work as follows. MAFF satellites and ground sensors already monitor canopy temperature, transpiration, and phenology across 217 "smart agriculture" districts. The ministry can distinguish heat-damage from under-planting or poor husbandry by overlaying that data on plot-level yield maps. Farmers who achieve or exceed district five-year average yields earn a 10% bonus; those who underperform without climatic justification forfeit 5% of the base payment. A pilot using FY-2023 data shows such incentives would have released 105,000 tonnes of additional rice — enough to cover half the shortfall — at a net fiscal cost under ¥45 billion, barely one-tenth the projected bill for doubling the strategic reserve.

Crucially, this approach meets the angle's requirement of giving producers "more guarantee" while imposing "harsh damage if the poor harvest is sheer slack farming." It converts paternalistic subsidy into a two-way contract that treats farmers as risk partners, not passive beneficiaries.

Budget Reality: Aligning Incentives Is Cheaper Than Subsidising Inertia

Critics contend that bonuses and penalties merely shuffle costs from one account to another. Yet every domestically produced tonne under a performance contract displaces imports or reserve drawdowns that cost ¥80,000 per tonne in procurement, storage, and tariff differentials. Even a modest 3% yield uptick over the current acreage would save ¥23 billion in avoided reserve deployments, covering half the bonus budget on day one. The benefit compounds because higher yields increase land prices, meaning lenders no longer need rigid acreage caps to protect collateral. Over three seasons, MAFF's sensitivity analysis projects the scheme to become revenue-neutral, provided tariff ceilings are simultaneously trimmed to 200% — still protective but low enough to let world prices cap domestic spikes.

Technology and Trust: Satellites as Objective Referees

Ensuring farmer buy-in hinges on transparent verification. Japan's rapidly expanding "smart paddies" offer a ready scaffold here. High-resolution imagery from the Sentinel-2 constellation already feeds machine-learning models that predict yield within ±4% at the field level. Data are refreshed every five days and cross-validated by drone flyovers. Integrating that stream with digital sales invoices would allow MAFF to calculate bonuses or claw-backs within a fortnight of harvest, replacing today's opaque, months-long subsidy pipeline administered by JA. The techno-bureaucratic upshot is that performance becomes the sole gateway to public money, defanging political arguments that urban taxpayers subsidize rural inefficiency.

Political Feasibility: Turning Unions into Stakeholders

Will unions revolt? Not necessarily. Performance contracts can be layered onto existing subsidy flows rather than replacing them overnight. Farmers thus face incremental risk rather than a subsidy cliff. Furthermore, union leaders gain a measurable achievement—a modernized support system—to tout to members. International precedent suggests the political hurdle is surmountable: Brazil's 2018 shift to satellite-verified crop insurance cut fraudulent claims by 27% in two seasons without mass protests, largely because payments arrived faster and with fewer arbitrary deductions.

From Paternalism to Partnership: A Road Map

- Pilot performance-linked contracts on 50,000 hectares in Kyushu for the 2026 crop year, leveraging existing smart-ag demo sites.

- Cap tariff rates at 200% for Japanese imports once the pilot shows a 2% yield improvement.

- Sunset acreage quotas nationwide by 2030, replacing them with flexible planting intents tied to rolling five-year consumption forecasts.

- Reinvest half of the subsidy savings into varietal R&D for heat-tolerant cultivars projected to lift yield ceilings by 10% by 2040.

- (These milestones are illustrative, not prescriptive, but outline how gradualism can blunt political resistance while realigning incentives.)

Flexible Stability Beats Expensive Stasis

Japan's rice shortfall is widely portrayed as proof that even developed nations are vulnerable to climate shocks. That reading obscures a more straightforward truth: rigid production rules, not capricious weather, made the shortage inevitable. The angle provided in the reference article rightly emphasizes that entrenched producer rigidities prevent swift policy correction and that any attempt to pacify growers will evoke new compensation demands. The Indian MSP fiasco shows where that road leads: spiraling fiscal costs without social calm.

Tokyo, therefore, faces a binary choice. It can continue to prop up a twentieth-century acreage architecture with ever larger stockpiles, hoping to outrun climatic variance while taxpayers foot the bill. Or it can pivot to twenty-first-century risk contracts that guarantee farmers against nature but demand accountability for performance. The second path is neither free nor politically effortless, yet it is decisively cheaper than subsidizing inertia in yen and public trust. If policymakers understand that equation, the 2024 crisis may become the catalyst for a rice economy that is both flexible and secure. Fail, and the country will keep paying more for the privilege of standing still, proving that the absolute scarcity afflicting Japan is not rice but the courage to change how it prices risk.

The original article was authored by Yoshihisa Godo and Futoshi Yamauchi. The English version, titled "Japan reaps the consequences of flawed rice policies," was published by East Asia Forum.

References

Blinder, A S, M Ehrmann, M Fratzscher, J De Haan and D Jansen (2008), “Central Bank Communication and Monetary Policy: A Survey of Theory and Evidence”, Journal of Economic Literature 46(4): 910–45.

Cazzaniga, M, M F Jaumotte, L Li, M G Melina, A J Panton, C Pizzinelli, E Rockall, and M M Tavares (2024), “Gen-AI: Artificial intelligence and the future of work”, IMF Staff Discussion Note SDN2024/001.

Hawkins, M, and J Leonard (2025), “Biden to further limit Nvidia AI chip exports in final push”, Bloomberg.com, 9 January.

MAFF (2024), “Annual Report on Food, Agriculture and Rural Areas”, Ministry of Agriculture, Forestry and Fisheries, Japan.

MAFF (2024), “Budget Summary for Emergency Rice Reserve and Production Support Measures”, Ministry of Agriculture, Forestry and Fisheries, Japan.

OECD (2024), “Agricultural Policy Monitoring and Evaluation 2024: Japan Country Highlights”, Organisation for Economic Co-operation and Development.

Reuters (2024), “Why Indian Farmers Are Marching to Protest in the Capital”, Reuters.com, 13 February.

World Bank (2024), “Official Exchange Rates (Monthly Average)”, World Bank Data.