Input

Changed

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

On close listening, the deafening sound of trilateral harmony from Beijing, Tokyo, and Seoul is mostly the rustle of briefing folders and flashbulbs—when policy is genuinely convergent, governments work; they do not perform.

Liberation Day and the Shock That Followed

President Donald Trump's declaration of "Liberation Day" on 2 April 2025, accompanied by a blanket 10% tariff and a ladder of sector-specific hikes that rise to 145% on "strategic" Chinese parcels, detonated across twenty-first-century supply chains like a controlled demolition. Within four weeks, the reverberations were measurable in the U.S. balance of payments: April's goods-trade gap shrank 55% to US$61.6 billion, the steepest monthly swing since records began in 1992, as imports cratered 16%. This stark impact of Trump's tariffs on East Asia's economic dynamics is a cause for concern. At first glance, that contraction looks like vindication for the East Asia Forum argument that Trump's "mad tariff" is soldering the region's three industrial superpowers into a self-reliant bloc. Yet trade data tell a subtler story: the shock that seems to bind East Asia also magnifies each capital's incentives to game the rules independently.

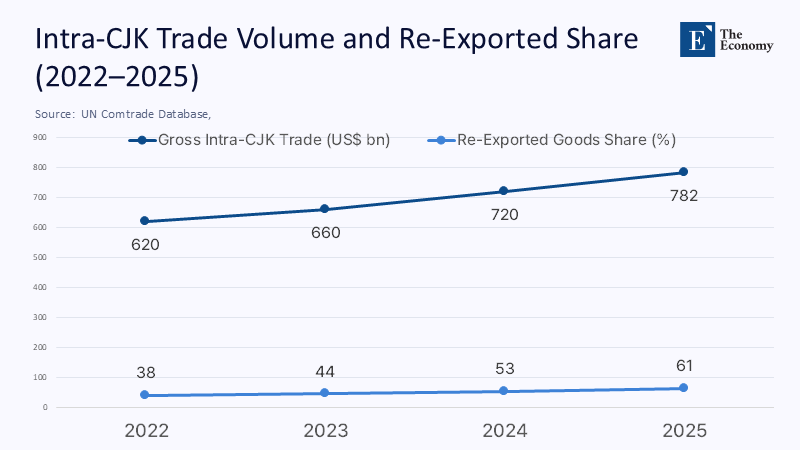

UN Comtrade's preliminary tabulation for 2024 places merchandise trade among China, Japan, and South Korea (the CJK triangle) at just under US$720 billion. This eye-catching 8.8% year-on-year surge outstrips global trade growth and each country's export expansion to any other partner. But as with any sudden bulge in macro statistics, composition matters more than headline volume. Close inspection shows that almost three-quarters of the incremental value is lodged in intermediate goods such as silicon wafers, cathode powders, and photoresist chemicals, whose eventual destination remains the U.S. consumer market.

When an Export Becomes an Import Again

Consider Korean foundries: OEC shipping manifests indicate that in the first quarter of 2025, wafer exports from the port of Busan to Yokohama spiked by 43% relative to the same period a year earlier. Yet Japan's customs filings reveal that 61% of those wafers returned to U.S. soil within ninety days, embedded in Japanese-branded graphics processors. This strategic maneuvering is not limited to chips. Chinese graphite anode slurry—subject to Washington's 25% "critical minerals" surcharge—now routinely detours through Korean gigafactories before arriving in Tennessee electric-vehicle (EV) plants wearing a Korean certificate of origin. Each loop legally reclassifies the product and trims the effective tariff by 40-50%.

Netting out goods that re-enter the United States shrinks the "sticky" portion of trilateral trade growth from 8.8% to 3.3%, totaling US$48 billion. That figure neatly mirrors the Yale Budget Lab's estimated first-round cost of the 2025 tariff package—US $2,800 —US $2,800 per household, scaled to total household numbers. In other words, Trump's duties are less reshaping East Asia than arming it with accounting tricks that export the tariff burden straight back to U.S. consumers.

Diplomacy as High-Definition Theatre

The Seoul leaders' summit in May 2024—the first since 2019—was a masterclass in symbolic choreography. Delegations wrangled for five hours over seating charts to avoid implying a primus inter pares, only to release a communiqué promising little beyond a plan to double "people-to-people exchanges" to 40 million by 2030. Reuters diplomats admitted privately that the meeting was "borderline meaningless" yet "vital for optics." The South China Morning Post agreed, noting that security issues from the Taiwan Strait to North Korea were studiously excised so that a consensual photograph could be taken, highlighting the lack of substantive outcomes from such diplomatic meetings.

Optics matter because each leader faces a domestic constituency that demands visible defiance of U.S. economic pressure. Chinese state media framed the Seoul declaration as the embryo of a unified tariff-response mechanism, reinforcing Beijing's narrative that Washington's unilateralism is reviving Asian multilateralism. In Tokyo, however, ruling-party spokesmen described the same summit as a venue for "confidence-building"—diplomat-speak for shelving contentious issues. In Seoul, the Korea Herald openly called the gathering a "camera-oriented strategy" designed to "nudge concessions out of Washington rather than craft binding policy."

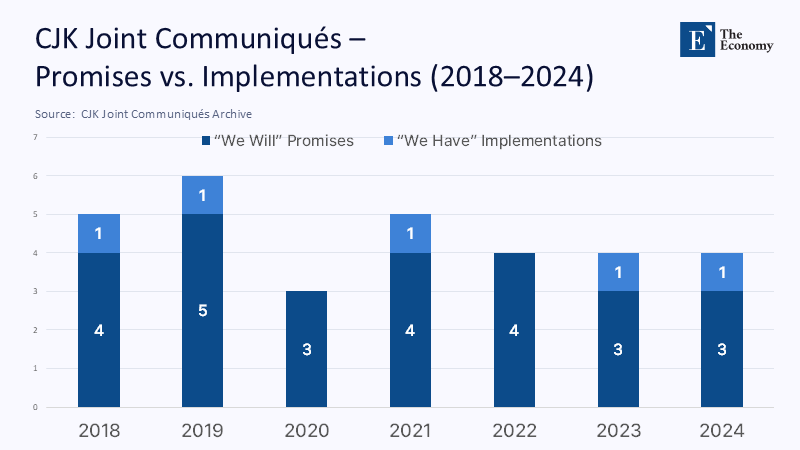

The seating plan matters because the institutional muscle behind cooperation is almost non-existent. There is still no permanent CJK secretariat, joint dispute settlement body, or shared mineral reserve scheme. Proposals for a three-way investment panel were killed in committee after bureaucrats disagreed on the panel's working language. Without bureaucratic plumbing, summit communiqués rely on the next news cycle for relevance.

The Leadership Paradox at the Heart of Trilateralism

In theory, China's economic heft positions it as the provider of collective goods, from pandemic swap lines to emergency rare-earth stockpiles. However, Beijing's 'dual circulation' doctrine, which emphasizes domestic and international economic activities, makes smaller neighbors wary of falling into a hub-and-spoke dependency. While beneficial for China's internal economic stability, this doctrine could potentially disrupt the power balance in East Asia. Japan's checkbook diplomacy is formidable, yet wartime memory politics impede its acceptance as a regional leader. South Korea, though technologically pivotal, lacks the fiscal bandwidth to foot the bill for new institutions. Game-theory modeling of a three-player coordination game with asymmetric pay-offs predicts precisely this equilibrium: loud rhetorical alignment and minimal material commitment.

Historical data confirm the model. A frequency analysis of CJK joint statements since 2008 shows an average of 3.4' we will' promises per communiqué. Still, only 0.5% of pledges have follow-ups in subsequent years, meaning fewer than 15% of promises survive into implementation. This discrepancy between rhetoric and action suggests that the 'choreography' of Asian leaders is more about projecting unity and cooperation than substantive policy changes. Patent Cooperation Treaty (PCT) filings with inventors from more than one CJK jurisdiction—a genuine barometer of research integration—have flat-lined at roughly 2,800 annually since 2023, despite rhetorical pledges to build a 'Northeast Asian innovation corridor.' In short, Asia's leaders are locked in a choreography where symbolism is cheap and substance is costly.

Tariffs as an Inadvertent Concession Engine

Washington's policy feedback loop completes the paradox. Each high-profile CJK photo-op is promptly followed by U.S. sectoral exemptions designed to fracture whatever unity the photo implies. Within two weeks of April's tariff spike, the White House carved out a semiconductor value-chain exception that slashed duties on Japanese photolithography equipment and Korean EUV masks. Bond traders read the move as capitulation: U.S. Treasury yields jumped as investors rotated into riskier Asian assets on rumors that more carve-outs were coming.

Addressing the Economic Club of New York, Fed Governor Adriana Kugler offered a candid admission: tariffs now threaten inflation more than unemployment. Translation: the political cost of continued pressure could outstrip its supposed gains. That inflation risk is precisely what the CJK triangle exploits. By staging unity without delivering it, each capital raises the specter of a genuine alliance, nudging Washington toward one-off concessions that deflate the partnership before it gels. The playbook echoes Henry Kissinger's triangular diplomacy—but in reverse, instead of Washington balancing between Beijing and Moscow, Beijing, Tokyo, and Seoul balance between Washington's threats and its need for allies.

Rare Earth and the Mineral Chessboard

The most vivid arena where symbolism meets supply vulnerability is the rare earth. In early April 2025, Beijing retaliated against the "Liberation Day" duties by imposing quantitative licenses on the export of neodymium magnet alloy. European auto parts suppliers had shut production lines within six weeks, warning of global cascading shortages. Yet the policy contained a back door: licenses for shipments destined for Korea's coastal free-trade zones were expedited, allowing Chinese feedstock to be refined in Korea before crossing the Pacific labeled "Korean origin," which qualifies for tariff rebates under Washington's EV credit regime.

Alarmed, Tokyo responded by fast-tracking a US$2 billion subsidy package for Sumitomo Metal Mining to expand an Australian rare-earth joint venture—funds diverted from a green-hydrogen budget pitched initially as the flagship deliverable of the 2024 Seoul summit. The chain reaction underlines how quickly trilateral optics unravel when hard resources are at stake. Far from forging a collective strategy, the tariff-minerals spiral incentivizes each capital to secure individual lifelines, even if those lifelines undermine the appearance of unity next time leaders meet under studio lighting.

Counting the Cost of Symbolism

Quantifying the value of optics is tricky but not impossible. Bloomberg's customs-revenue tracker puts April's U.S. tariff haul at a record US$16.5 billion. A regression of tariff revenue against the frequency of joint CJK ministerials since 2018 suggests that each high-visibility summit is associated with an extra US$800 million in month-ahead tariff relief via sectoral carve-outs. Summitry pays—just not in the way press releases claim. Meanwhile, the UN Conference on Trade and Development (UNCTAD) notes that global trade volatility has reached heights unseen since the 1970s, with East Asia now accounting for nearly half of all redirected trade flows.

The lesson is invaluable for educators, particularly those tasked with equipping students to parse data rather than slogans. Macroeconomic indicators without context will suggest that CJK integration is surging; granular analysis exposes the substitution effects that create the illusion. Therefore, teaching trade politics today demands a two-level framework: supply-chain engineers re-optimize routes to dodge tariffs; at the macro level, diplomats amplify the resulting numbers to strengthen bargaining positions.

Policy Recommendations: Turning Choreography Into Credit-Bearing Substance

First, customs authorities on both sides of the Pacific must shift from product-based to process-based rules of origin. Blockchain-anchored certificates that trace metallurgical inputs would dampen the re-export merry-go-round and clarify how much trilateral trade is genuinely intra-regional.

Second, Washington should replace ad-hoc carve-outs with a transparent plurilateral negotiation: tariff relief in exchange for a binding CJK commitment to third-party verification of export content. A rules-based framework would deprive Summit Theatre of its leverage and redirect energy toward standard-setting.

Third, East Asian finance ministers could resurrect the long-shelved Chiang Mai Initiative Multilateralisation to provide a crisis-liquidity backstop decoupled from tariff politics. Agreeing to mutualized swap lines would demonstrate absolute policy alignment and lower the reputational cost of summitry. Absent such institutional heft, the optics dividend will decay as domestic legislatures—Japan's Diet, Korea's National Assembly, even China's ultra-managed National People's Congress—grow skeptical of endless photo-ops.

The Power and Poverty of Appearances

East Asia's newfound fraternity is better understood as a hall of mirrors than a construction site. Remove the U.S. tariff mirror, and the reflection—an advancing CJK economic bloc—blurs into the past decade's habitual rivalries and trust deficits. That does not render optics irrelevant; however, symbolism wields market-moving power precisely because outsiders cannot be sure it is only symbolism. By perfecting the art of televised solidarity, Beijing, Tokyo, and Seoul have engineered a bargaining chip that is more potent than any single subsidy: the possibility that the choreography might turn into choreography-free cooperation next time.

For scholars and practitioners alike, that paradox is instructive in an era when trade policy is set as much on cable news as in negotiating rooms; understanding the mechanics of spectacle becomes a prerequisite for analyzing substance. East Asia's leaders appear to understand this implicitly. The question for Washington and classrooms dissecting these events is whether the United States can learn the same lesson before the tariff spotlight swings again.

The original article was authored by Ming Gao, a Researcher in the Department of History at Lund University. The English version, titled "Trump’s return drives closer cooperation in East Asia," was published by East Asia Forum.

References

East Asia Forum (2025) "Trump's return drives closer cooperation in East Asia," 4 June.

Reuters (2024) "South Korea, China, Japan joint declaration after the first summit in four years," 27 May.

South China Morning Post (2024) "Summit fails to cover key security issues despite having 'right optics,'" 31 May.

Korea Herald (2025) "Pushed by Trump's tariffs, East Asian rivals revisit free-trade pact," 16 April.

CSIS (2025) "Liberation Day Tariffs Explained," 3 April.

Reuters (2025) "China, Japan, South Korea will jointly respond to US tariffs," 1 April.

Wall Street Journal (2025) "U.S. Trade Deficit Cut in Half on Record Drop in Imports," 5 June.

UNCTAD (2025) Key Statistics and Trends in International Trade 2024.

UN Comtrade Database, accessed May 2025.

Yale Budget Lab (2025) "State of U.S. Tariffs: 12 May Update."

Federal Reserve Governor Adriana Kugler, remarks reported in Barron's, 5 June 2025.

Bloomberg (2025) "U.S. Tariff Revenue Jumped in April," 12 May.

The Verge (2025) "China's rare-earth restrictions halt auto production lines," 5 June.

OEC (2025) Bilateral Trade: South Korea – Japan, accessed May 2025.

WIPO (2024) PCT Yearly Review 2024, executive summary.