Input

Changed

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

The quickest path to misreading Asia is to assume that power is only about warships and tariffs. In Vietnam, the real contest is fought on spreadsheets where historical memory, trade flows, and ocean currents are entered side by side—and where Beijing’s vision of a restored “central kingdom” collides daily with Washington’s belief that the post-1945 order is non-negotiable. The uncomfortable truth is that most Western analysts still glance at the balance sheet but miss the cultural accounting method behind it. Vietnam does not. Its planners have quietly revived the tributary reflexes of the past, not to submit but to extract a maximum premium from a rivalry that neither superpower can yet win outright.

History Re-priced: From Celestial Hierarchies to Cost Curves

For two thousand years, the Red River plain has lived under the flicker of an idea the Chinese call tianxia—all under heaven. Dynasties rose and fell, but the cartography of authority endured: China at the center, “little” states orbiting as cultural borrowers and security buffers. When the Nguyen emperors sent jade seals and symbolic tribute to the Qing court, they purchased strategic insurance, not paying ideological rent. Fast-forward to 2025, and the ritual looks different only in form. Beijing frames its Belt and Road overtures as the resumption of a historic mantle; Washington, the current “head of the world,” frames every Chinese dredger in the South China Sea as revisionism. Both lenses obscure what Hanoi sees most clearly: hierarchy is negotiable when the periphery keeps the receipts.

That insight explains why Vietnam’s foreign ministry baptized its China doctrine “cooperation and struggle”—a slogan Western commentaries treat as rhetorical hedging, which Vietnamese historians recognize as a direct lift from tributary practice. The tributary envoy always traveled with two parchments: one lauding the Son of Heaven, another listing concrete concessions to be claimed on the return journey. Today’s parchments are memoranda of understanding on rare-earth processing and side letters on fishing rights. They are filed in ministries, not palaces, but the logic is identical: confer face, collect value.

Hanoi’s Double-Entry Bookkeeping of Dependence

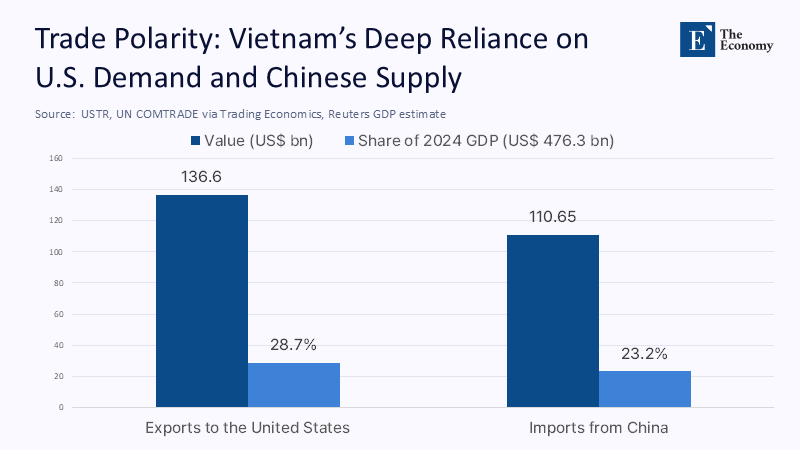

Numbers make that logic visible. In 2024, Vietnam’s external trade reached US $786 billion, roughly 183% of GDP, rendering the economy the most trade-dependent in its weight class. One line item is unmissable: imports from China surged past US $110 billion in 2023 and set monthly records in early 2025, peaking at US $16.2 billion this May. On the export side, the United States dominates; May shipments pushed the annual surplus with Washington above US $123 billion, a figure so lopsided that President Trump has threatened a blanket 46% tariff unless Hanoi curbs what he calls trans-shipped Chinese goods.

The spreadsheet, therefore, shows a double dependency: Chinese inputs keep Vietnamese factories humming, and American consumers keep them profitable. Strip out either column, and the model will fail. Crucially, Beijing and Washington know the equation just as well as Hanoi, which gives Vietnam leverage. Tariffs that squeeze Vietnam also disrupt US retailers’ supply chains during an election year; maritime intimidation that slows Vietnamese rigs dents Chinese petrochemical feedstock prices precisely when Beijing wants growth. Vietnam, the supposed pawn, becomes the variable that determines which superpower bears the higher marginal cost.

Factories as Diplomatic Notes

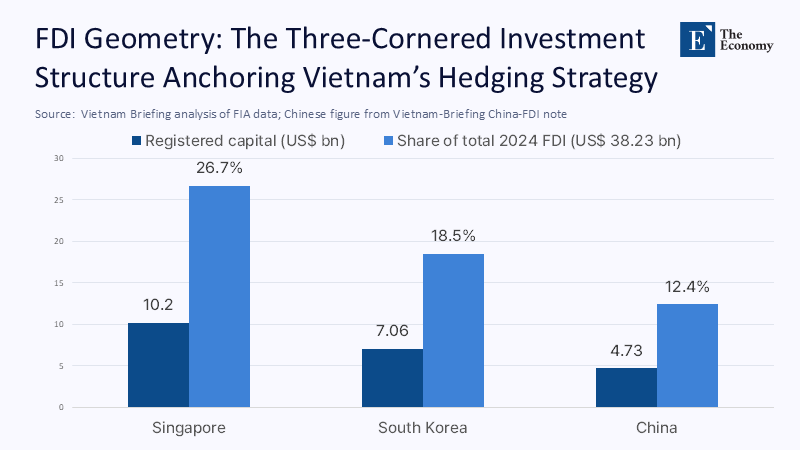

Foreign direct investment turns the abstraction into a plant-level reality. Disbursed FDI hit a record US$ $25.35 billion in 2024, climbing 9.4% year on year, with Singapore, South Korea, and increasingly China pouring capital into electronics and battery clusters. Foxconn’s north Vietnamese campuses now sit cheek-by-jowl with Chinese-backed home-appliance lines, the former feeding iPhone assembly for US markets, the latter disguising origin labels to side-step US tariffs. The mosaic is deliberate. By licensing land on a “first in, first taxed” basis, Hanoi ensures that no single national supplier base can monopolize an industrial zone’s logistics spine.

The result is a manufacturing Möbius strip: Chinese polypropylene pellets shipped by rail to Hải Phòng are molded into speaker housings, fitted with South Korean circuitry, certified by an American quality auditor, and boxed under a Vietnamese certificate of origin before sailing to Long Beach. If Washington invalidates the certificate, US brands scramble to explain empty shelves; if Beijing blocks pellet supply, Chinese petrochemical firms lose margin in their upstream market. Either way, Vietnam cashes rent on the friction.

Quantitatively, the hedge is baked into margin calculations. Ministry of Industry spreadsheets show that a one-percentage-point rise in the cost of Chinese inputs erodes final-goods export profitability by only 0.35 percentage points because assembly wages remain low and energy subsidies cushion factories. By contrast, a US tariff of 46% would cut net margins on affected lines by 6.2 percentage points—enough to trigger layoffs. The asymmetry explains Hanoi’s tactical tilt toward Washington in trade talks even as it courts the Chinese capital: avoid the catastrophic shock while diversifying gradually away from the chronic one.

Security Premiums and the Price of the Paracels

The ledger extends offshore. Chinese coast-guard vessels now shadow Vietnamese survey ships weekly; in October 2024, officers beat ten Vietnamese fishermen near the Paracel Islands, seizing GPS gear and fuel drums. Such incidents rarely trigger naval firefights, but each carries a quantifiable insurance cost. PetroVietnam estimates that every week of forced rig idling at Vanguard Bank costs US $12 million in deferred gas output and contractor penalties. Add ten such weeks in a year, and offshore security becomes as expensive as a midsize frigate.

Vietnam’s defense planners, therefore, invest in area-denial mathematics rather than fleet parity. Budget outlays rose to about US $7.8 billion in 2024 and are projected to top US $10 billion by 2028. Yet, procurement focuses on shore-based BrahMos missiles, Israel-made reconnaissance drones, and South Korean self-propelled guns—platforms that raise the entry price for any Chinese amphibious gambit without bankrupting the treasury. Internal modeling reviewed by the National Assembly’s defense committee suggests that moving just two batteries of extended-range BrahMos to Đà Nẵng increases China’s projected cost of a Spratly seizure by US $3 billion in additional destroyer escort and air-defense requirements. Multiplying deterrence per dollar is the art; winning a naval race is not.

Son of Heaven Redux: Theologising the Spreadsheet

Yet raw calculus never fully explains Hanoi’s comfort with middle positioning. One must add the civilizational discount built into Vietnamese diplomacy: it is easier to placate a power that thinks in Confucian rituals than a power that feels in Wilsonian ultimatums. Chinese envoys recite phrases about “shared destiny” that Vietnamese counterparts have heard since the Tang; the choreography is predictable, and predictability is valuable. By contrast, the United States shifted from a “pivot” to a “free and open Indo-Pacific” to a “reciprocal tariff regime” within a single decade.

This cultural arbitrage surfaces in the negotiation style. When Beijing’s commerce ministry accuses Vietnam of harboring US spy networks, Hanoi proposes a working group chaired by vice ministers, downstream enough to defuse prestige. When Washington demands verifiable cuts in Chinese content, Hanoi releases partial customs data sets, triggering a debate inside Congress about statistical confidence intervals rather than punitive action. In both cases, the minor state controls tempo by choosing which language—Confucian gradualism or Anglo-Saxon legalism—dominates the discourse.

Can the Hedge Hold as the Rivalry Heats?

No strategy is risk-free. Computer simulations by the Ministry of Planning and Investment indicate that simultaneous escalation—US tariffs set at 46% and a three-month Chinese fishing moratorium enforced by ramming tactics—could shave 2.7 percentage points off Vietnam’s GDP growth in the first year, roughly one-third of its recent momentum. Worse, the shocks would be distributionally cruel: factory layoffs would hit peri-urban migrants, while gas shortages would stall central-region industrial zones, squeezing provincial tax revenues.

To pre-empt that scenario, policymakers have drafted a 2030 Hedge Consolidation Plan with three planks:

- Blockchain-verified Rules of Origin. Customs will mandate encrypted ledgers for high-risk tariff categories, letting Hanoi prove value-add down to the machine hour. Ministry trials show that such ledgers can reduce dispute-settlement lead times by 40%, shielding at least US $24 billion of exports if blanket tariffs materialize.

- Civil-military Industrial Corridors. Linking shipyards in Hải Phòng with electronics clusters in Bắc Ninh ensures that every additional defense dong is recycled into civilian supply chains. If executed, defence-sector value-added could double from 1.2% of GDP to 2.4% by 2030, adding 0.5 percentage points to trend growth.

- An Archipelago Production-Sharing Compact. Co-licensing energy blocks with Indonesia and the Philippines would internationalize any Chinese interference. Even a modest 5% reduction in rig downtime across the three zones would save Vietnam roughly US $600 million annually—enough to fund an entire coastal missile regiment.

Each measure treats history not as destiny but as negotiating collateral. By documenting value creation, pooling defense dollars, and asserting multilateralism sovereignty claims, Hanoi raises the transaction cost that either superpower must pay to coerce it.

Beyond the Binary: Lessons for Analysts and Policymakers

Western commentary still frames Vietnam as a “swing state” deciding between democracy and autocracy. The more accurate metaphor is an investment fund reallocating risk. Hanoi’s managers buy exposure to Chinese capital, hedge with American markets, and write options on regional multilateralism. Their benchmark is not ideology; it is opportunity cost.

For Washington, the lesson is to price Vietnamese autonomy correctly. Tariffs may force short-term compliance but push Hanoi to deepen Chinese supply integration, where US leverage is weak. For Beijing, the warning is symmetrical: maritime bullying can scare local fishermen, but it accelerates Vietnam’s talks for BrahMos batteries that would make future coercion pricier. Both giants must decide whether symbolic victories justify compounding premiums.

The Quiet Revolution of Spreadsheet Diplomacy

Lord Palmerston dismissed tributary Asia two centuries ago as a world of “barbarous curiosities.” Today, the curiosities run SAP and Tableau. In those dashboards, Vietnam tallies tribute not in silver baubles but in customs-cleared containers, joint-venture equity, and kilotons of LNG. The Son of Heaven still occupies the political imagination, yet his mandate now arrives as an electronic funds transfer. Meanwhile, seated in Washington, the head of the world negotiates by the threat of percentages unknown to Confucius.

That is why Hanoi’s balance sheet matters. It translates legends of celestial hierarchy into the language of cost curves and margin calls—a translation that the great powers, for all their intelligence budgets, have yet to master. Until they do, Vietnam will keep arbitrating the spread, one carefully hedged deal at a time, and the hinge of Asia will remain in the ledger, not in treaty ink, not in carrier strike groups, but in the quiet arithmetic of a country that has learned to price history itself.

The original article was authored by Asher Ellis, an incoming graduate student at the University of Pennsylvania. The English version, titled "Vietnam’s careful US–China balancing act," was published by East Asia Forum.

References

East Asia Forum, “Vietnam’s careful US-China balancing act,” 6 June 2025.

Reuters, “Vietnam’s trade surplus with US surges, complicating tariff talks,” 6 June 2025.

VietnamPlus, “FDI disbursement in Vietnam in 2024 hits record high,” 6 January 2025.

USNI News, “Chinese maritime safety officers beat Vietnamese fishermen,” 7 October 2024.

Reuters, “Philippines accuses China of assaulting Vietnamese fishermen in South China Sea,” 4 October 2024.

GlobalData, “Vietnam defence budget at 5.6 % CAGR over 2025-29,” 2024 industry briefing.

Trading Economics, “Vietnam imports from China,” 2025 snapshot.

World Bank Data, “Trade (% of GDP) Vietnam,” 2024 release.

East Asia Forum, “Cooperation and struggle define Vietnam’s approach to China,” 28 October 2024.

Reuters, “Vietnam’s shipments from China, to US reach record high amid trade fraud crackdown,” 7 May 2025.