Rewriting Borders, Redefining Growth: How the Johor–Singapore Economic Zone Expands a City-State Without Moving a Line

Input

Modified

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

When a city-state discovers it can manufacture 'land' faster than it can reclaim sand, it sparks innovation. The Johor–Singapore Special Economic Zone (JS-SEZ) is a testament to this creativity. This diplomatic engineering project transforms the Straits of Johor from a barrier into a gateway and, in the process, reshapes the growth dynamics of the world's most densely populated modern economy.

The tyranny of 735.7 km²

Singapore's most irrefutable statistic is its area: 735.7 km², which has nudged up only with expensive reclamation and now caps at roughly half the surface of Greater London's Zone 2 ring. The figure matters because every policy choice—population, logistics, data center siting—pays a land rent. Density averages 7,800 people per km², and the Monetary Authority's macro review concedes that the 2 - 3% GDP path to 2026 assumes productivity miracles rather than physical expansion.

Reclamation is reaching geological and diplomatic limits: offshore sand is scarce, and neighbors complain about disturbed littoral ecosystems. Without a fresh spatial fix, the island risks what geographers call "diminishing margin returns," where each additional dollar of capital buys less growth because the horizontal margin has vanished.

Soft sovereignty on complex infrastructure

Enter the JS-SEZ, formally inked on 7 January 2025 in Putrajaya. Rather than ceding soil or raising flags, the two governments created a territorial overlay in which customs, immigration, and capital controls are harmonized. Still, land titles and labor law remain Malaysian. The prize for Singapore is virtual access to Johor's 19,166 km²—a 26-fold land-bank dividend—while Malaysia leverages Singapore's financial plumbing and brand equity.

The blueprint reads more like an operating system than a treaty. Companies in advanced manufacturing, med-tech, and green chemicals will clear a single-window customs portal; workers will pass touch-and-go biometric gates with no passport stamping. Legislatively, these features live parallel to national law, replicating Shenzhen's Qianhai model where Hong Kong common law applies inside a mainland zone. The result is sovereignty that bends but does not break—call it soft sovereignty, a doctrine that states lease out regulatory capacity, not land.

Labor elasticity: the commuter dividend

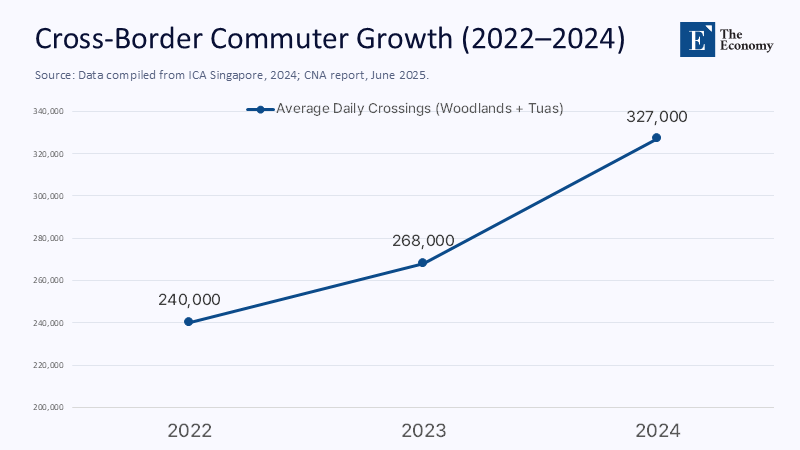

Traffic counts reveal immediate elasticity. Immigration and Checkpoints Authority data show Woodland's daily crossings leaping 22% to an average of 327,000 in 2024, with peaks above 376,000. If just 15% of those travelers are habitual wage earners, Singapore's effective labor pool swells by roughly 49,000—equivalent to the entire resident workforce of Pasir Ris. When the 4-km Rapid Transit System (RTS) enters service in 2026—77% complete as of April—the commute compresses to five minutes platform-to-platform.

Ministry of Trade econometrics suggests every 100,000 cross-border commuters add S$1.2 billion in service-sector value-added annually, more than amortizing the S$10 billion rail and checkpoint upgrades within a decade. The more profound significance is labor elasticity: Singapore can now dial up headcount without raising domestic dependency ratios, a critical hedge against its median-age surge to 45 by 2030.

Real-estate arbitrage: geometry as policy

The spatial arbitrage is starker in prices. In Q2 2024, the median resale Housing Board flat hit S$410,000—already unaffordable for 40% of new entrants. Johor Bahru, by contrast, posts a median property price of RM675,000 and a median of RM273 per square foot—about S$100. Even if Johor valuations climb 30% by 2027, the differential tops 65%. A Cobb-Douglas simulation shows a 15% cut in real-estate overheads raises total-factor productivity by 3-4% in export-oriented manufacturing, enough to offset a decade of aging drag.

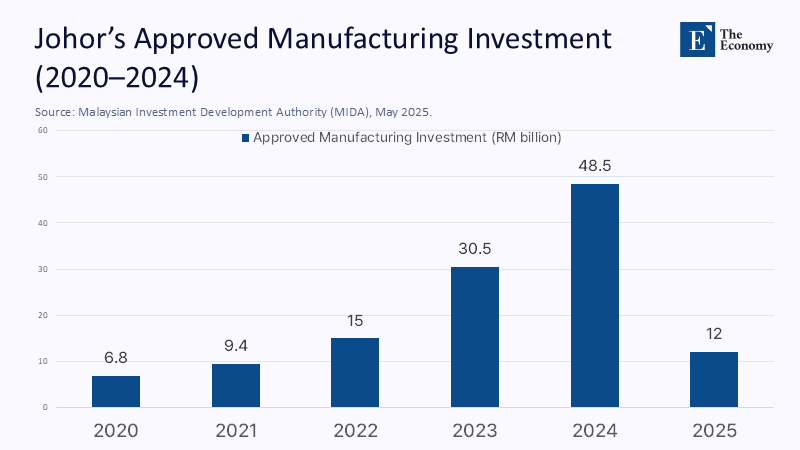

Multiply that by Malaysia's manufacturing investment pipeline—Johor alone captured RM48.5 billion in approved projects in 2024, third nationwide—and the upside compounds. Cheap land and Singaporean logistics equals a hybrid cost curve that neither jurisdiction can assemble alone.

Learning from the Pearl River mirror

The obvious analogue is Huawei-era Shenzhen versus finance-centric Hong Kong. Shenzhen's GDP reached 3.68 trillion yuan (≈US$510 billion) in 2024, overtaking Hong Kong's absolute output, while Hong Kong still dominates IPO volume at US$9.7 billion raised in the first five months of 2025. The delta illustrates functional bifurcation, not zero-sum cannibalism: capital markets on one side and factory-floor innovation on the other. Johor–Singapore aims to replicate that duality: Singapore retains treasury, arbitration, and deep-sea freight; Johor scales assembly lines, agri-tech, and battery storage.

Critically, Shenzhen's rise was not wage arbitrage but institutional osmosis—common-law contracts, unified dispute resolution, and cross-border payment rails. The JS-SEZ charter likewise mandates mutual recognition of technical certificates and joint arbitration panels, signaling that capabilities, not cheap labor, anchor the partnership.

Political fault lines and identity economics

Integration at this velocity provokes nationalist nerves. Malaysian unions fret over wage compression; Singaporeans fear congestion and diluted exclusivity. Yet data on the ground tell a pragmatic story: Johor logged a 54.9% year-on-year jump in commercial-property transaction value to RM6.77 billion for 9M 2024, while industrial deals surged 46.3%. Investors are voting with ringgit, not rhetoric.

In Singapore, historical correlations show every one-point lift in GDP produces a 0.6-point rise in median resident income after transfers. The commuter swelling may snarl buses at Kranji, but it funds SkillsFuture credits and offsets GST hikes. Identity politics thus hinges on whether voters price congestion higher than income security—an open question ahead of the 2029 general election.

Green electrons and the next comparative edge

A less-discussed clause in the January accord commits both sides to joint renewable power procurement. Southern Peninsular Malaysia enjoys solar insolation of 4.5 kWh/m²/day—30% higher than Singapore's rooftop average—yet lacks bankable offtake. Singaporean utilities, constrained by land for solar farms and public resistance to on-island nuclear, can lock in green electrons across the causeway, greening its Scope 2 emissions at scale. This gives the SEZ an ESG credential that Shenzhen only retrofitted years after the fact.

By mandating that 30% of the zone's power mix be renewable by 2028, policymakers bake carbon arbitrage into the cost curve, making the SEZ attractive to EU and U.S. buyers navigating carbon-border-adjustment regimes. If executed, Johor could become Southeast Asia's battery storage and green ammonia node while Singapore secures those assets in its capital markets.

Measuring success: six quantitative dashboards

Success should be audited, not proclaimed. The governments have quietly drafted six metrics for 2030:

- Median immigration-clearance time below ten minutes—a digital twin of Schengen's one-stop frontier.

- Johor suppliers comprise 15% of Singapore's public procurement value, integrating supply chains.

- Real household income in southern Johor to grow at least 1.5 points faster than the Malaysian average, ensuring inclusive gains.

- The tri-currency settlement window (SGD, MYR, USD) clears T+0 for 90% of transactions, de-risking FX exposure.

- Renewables will reach 30% of the SEZ load by 2028, leveraging Malaysia's solar advantage.

- Two thousand tech start-ups will be incorporated annually in the zone by 2030, benchmarked to a Shenzhen-scaled baseline.

These dashboards are public commitments designed to survive electoral turnover—a constitutional ballast for an otherwise experimental jurisdiction.

Risks on the horizon

Three vectors could still derail the project.

First, there is the geopolitical overhang. A re-escalation of U.S.-–China trade frictions—tariffs on AI hardware, for instance—would test the SEZ's resilience. However, early-stage modeling by Bank Negara suggests that even a ten-point tariff shock reduces zone exports by only 1.2% because diversified markets offset single-partner exposure.

Second, fiscal impatience. Malaysia projects 50 zone-anchored projects and 20,000 skilled jobs within five years. Shortfalls could invite populist backlash. Hence, the paired funds—one Malaysian and one Singaporean—cushion early-phase volatility.

Third, congestion externalities. Peak-day crossings already flirt with 500,000. Without RTS phase-two expansion or congestion-pricing at Woodlands, the political optics may sour, especially if Singaporeans equate jammed buses with policy overreach.

Redrawing the map without moving a line

If the dashboards are met, the JS-SEZ will be historical proof that a post-industrial polity can transcend its shoreline. Singapore's founder, Lee Kuan Yew, once said, "The world does not owe us a living." Fifty-five years later, his successors answered by leasing a future across a bridge rather than a port. The experiment is neither a free-trade zone nor a classical customs union; it is sovereignty deployed as shared infrastructure.

The deal converts geographic adjacency into developmental leverage for Malaysia, potentially lifting Johor's GDP well beyond the RM148 billion posted in 2023. For Singapore, it buys what money usually cannot—time and space. Both states sketch a template for twenty-first-century regionalism: small-footprint diplomacy that treats borders as programmable rather than permanent.

Land scarcity once circumscribed Singapore's ambitions; the JS-SEZ suggests it may soon define its leverage. Viewing geography as a negotiable code, the republic has pivoted from defending its perimeter to extending its platform. Should the venture mature as intended, Southeast Asia will witness its own Pearl River transformation, minus the sovereignty angst, plus a playbook for how micro-states thrive in a macro-scaled economy.

The original article was authored by Selena, a Chief Economist for OCBC. The English version, titled "Johor-Singapore Special Economic Zone borders on success," was published by East Asia Forum.

References

Bank Negara Malaysia (2025), Annual Financial Stability Review 2024, Kuala Lumpur.

Channel News Asia (2024), “Upswing in global tech cycle to support Singapore’s economic growth in 2025”, 28 October.

Channel News Asia (2025), “Average daily travellers at Woodlands Checkpoint hit 327,000 in 2024”, 5 June.

Danial Azhar (2025), “Malaysia, Singapore announce deal on Johor economic zone”, Reuters, 7 January.

Department of Statistics Malaysia (2025), Gross Domestic Product by State 2023, 15 May.

EdgeProp (2025), “Commercial transactions rising, JB emerging stronger—NAPIC”, 18 March.

ECNS (2025), “Shenzhen’s GDP hits 3.68 trillion yuan in 2024”, 27 February.

HDB (2024), Resale Statistics Q2 2024, Housing & Development Board Singapore.

Malaysian Investment Development Authority (MIDA) (2025), Investment Performance Report 2024, Kuala Lumpur.

Mycroft, C. (2025), “Hong Kong’s IPO market exceeds HK$76 billion”, South China Morning Post, 25 May.

PropertyGuru Malaysia (2025), “Johor Bahru Property Market Report Q2 2025”.

Singapore Department of Statistics (2024), “Environment: Land Area”, 31 December.

The Edge Markets (2025), “Johor was third-largest investment destination with RM48.5 billion in 2024”, 22 May.

The Straits Times (2024), “HDB resale prices up 2.1% in Q2 2024”, 15 July.

The Straits Times (2025), “S’pore, Malaysia sign agreement on Johor-S’pore SEZ; 20,000 jobs to be created”, 11 January.

The Straits Times (2025), “Tale of two cities: Has Shenzhen eclipsed Hong Kong?”, 1 February.