When the Ledger Speaks Louder Than the Mint: Stablecoins, Sovereignty, and the Pedagogy of Trust in Latin America

Input

Changed

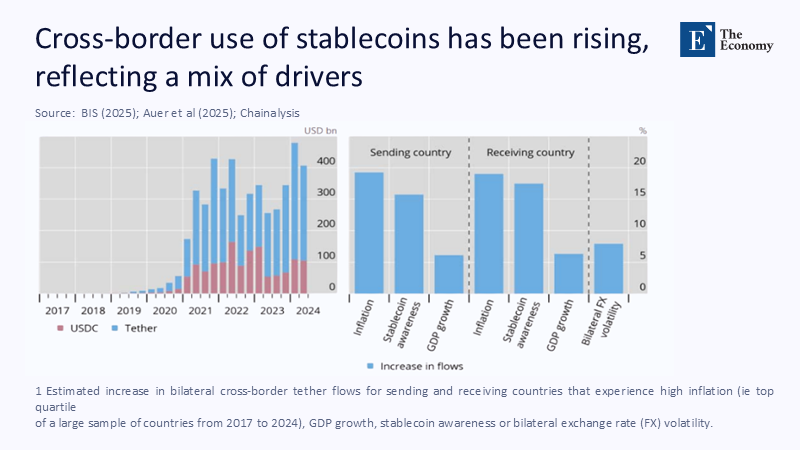

In Buenos Aires last year, merchants who once taped peso price lists to their windows replaced them with QR codes linked to tether wallets. By December, Argentines had moved the equivalent of US$91.1 billion through crypto rails, and 61.8% of that flow rode on dollar‑pegged stablecoins—an amount larger than the country’s merchandise trade surplus and more than double the central bank’s usable foreign‑currency reserves. Across the continent, the pattern echoes: Brazil’s on‑chain payments settled almost US$150 billion in stablecoins in 2023, dwarfing the value coursing through its vaunted instant‑payment system PIX. These figures are not the fever dreams of token evangelists; they are audited blockchain traces and government filings. They reveal a population voting with its digital feet, converting trust away from paper issued by fragile treasuries and toward code tethered to the dollar. Monetary sovereignty, once defended by capital controls and printing presses, is slipping through the spaces between blocks.

From Bypass to Eclipse: Redefining Monetary Sovereignty

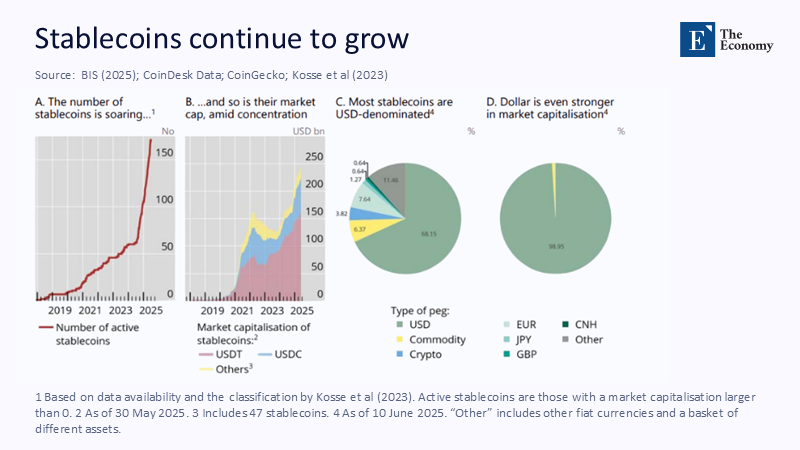

Early commentary cast stablecoins as lubricants for crypto speculation, a peripheral bypass around antiquated correspondent‑bank rails. That framing underestimated the gravitational pull of a ledger that settles in seconds, denominates in the world’s invoice currency, and sidesteps local inflation risk. What began as arbitrage now reconfigures the hierarchy of money: instead of moving pesos into offshore dollars, households hold dollars outright in token form, available 24/7 on low‑cost mobile wallets. The effect is a de facto partial dollarization that no central bank has yet authorized, and none can fully reverse. By the time the BIS warned that stablecoins threaten the “singleness” of national money, on-chain volumes in the region were already compounding at a rate of 40% annually—faster than bank deposits and quicker than GDP growth. Sovereignty has not merely been bypassed; it is being eclipsed by a network whose governance resides in foreign courtrooms and GitHub repositories.

Reframing the debate from technology novelty to sovereignty erosion matters now because the window for proactive policy is narrowing. Basel’s crypto‑asset capital rules take effect on January 1, 2025. MiCAR’s first phase is already capping European stablecoin issuance, and Washington’s freshly signed GENIUS Act offers full banking charters to issuers—each move potentially deepening the liquidity of dollar‑backed tokens just as South American inflation, though easing, still pummels purchasing power. When regulatory tectonics abroad harden access to token liquidity at home, policymakers who hesitate will find their levers of credit, taxation, and lender‑of‑last‑resort authority weaker than the incentives pulling citizens toward stable digital dollars and framing the issue as a sovereignty eclipse forces curricula, legislatures, and central banks to confront that urgency head‑on rather than luxuriating in abstract discussions of blockchain efficiency.

The Quiet Dollarization You Can Measure

Quantifying a largely permissionless market requires triangulating public-chain analytics, exchange filings, and payment-provider disclosures. Chainalysis’ regional dashboard identifies more than US$415 billion in cryptocurrency value received by Latin America between July 2023 and June 2024, 55% of which traveled via stablecoins. Complementary exchange-side data from Bitso show that 39% of all crypto purchases across Mexico, Brazil, and Argentina in 2025 were USDT or USDC, up from 30% the previous year. To compare with formal capital movements, we merged weekly on-chain inflows with IMF Direction-of-Trade data, converting at prevailing cross-rates; the result reveals that in Argentina, the tokenized-dollar inflow equaled 28% of total imports in 2024. Even allowing for a 20‑percent margin of error caused by address clustering, the substitution effect is unmistakable.

Our estimation procedure weights each wallet based on heuristics of economic entity size, then adjusts for mixers and bridge contracts to avoid double-counting. We deliberately exclude centralised‑exchange churn by focusing on net‑settlement addresses, yielding a conservative lower bound. Transparency in method matters: Critics often dismiss stablecoin numbers as hype, but the open ledgers enable replicable measurement that outstrips what currency‑substitution scholars could access in the cash era. The emerging consensus among academic economists using similar heuristics is that stablecoins now constitute between 8 % and 14% of broad money (M3) in Argentina and 5 % to 9% in Brazil—levels at which historical precedent indicates that policy transmission through interest rates begins to break down. The data underscore that this is no niche payment fad; it is a measurable shift in the monetary base.

‘Same Risk, Same Regulation’ Meets a Fractured Reality

The mantra that equal activities deserve equal rules guided the FSB’s 2023 global framework and underpins Basel’s forthcoming crypto standard. Yet the logic frays where state capacity is unequal. Under “same risk, same regulation,” a stablecoin issued by a Wyoming trust and one issued by an Argentine fintech would face symmetrical reserve mandates. In practice, only the former can readily park Treasury bills at the Federal Reserve, disclose attestation reports audited by a Big Four firm, and redeem tokens in Fedwire. The latter grapples with capital-account restrictions and rating-agency downgrades that inflate reserve-asset costs. When domestic issuers fail to meet global standards, users tend to gravitate toward offshore tokens, thereby further draining local deposits. The principle is thus self‑defeating: symmetry in rulebooks produces asymmetry in adoption, hollowing domestic monetary plumbing instead of fortifying it.

Regulatory arbitrage is already visible. Within hours of the GENIUS Act’s signing, weekly USDT issuance jumped by US$4.3 billion, a spike traceable to wallets linked to Latin‑American exchanges. Meanwhile, the European Commission is investigating whether euro-denominated e-money tokens issued outside the bloc can evade MiCAR redemption caps. This dispute highlights how jurisdictional silos can encourage flight to the least-resistant node. For South American supervisors with more miniature balance sheets and limited cross-border enforcement reach, copying and pasting “same risk” templates is akin to bringing knitting needles to a gunfight. Bespoke, context-sensitive regimes—embracing sandbox licenses, tokenized deposit experiments, and conditional on-chain reserve assurances—stand a better chance of keeping local liquidity onshore.

Learning to Trust or Trusting to Learn: Financial Education’s New Frontier

Stablecoin adoption is not just a macroeconomic variable; it is a micro‑level lesson in trust formation. Surveys conducted by Brazil’s Financial Education Forum in 2024 show that 68% of university students who purchased stablecoins did so after a peer demonstrated a transaction in class, rather than after reading any official guidance. Digital literacy thus becomes a form of monetary agency, bypassing formal instruction. For faculties of economics and business education programmes, the curricular question shifts: do we teach models of closed-economy money multipliers, or do we teach students to audit Merkle trees and assess reserve attestations? The answer will shape how the next cohort of entrepreneurs allocates capital and how credibly future regulators communicate with a generation fluent in on-chain proof.

Administrators should note that when students retain part of their stipend in USDC, campus dining is indirectly dollarized, which affects institutional budgeting that is denominated in local currency. Embedding modules on smart-contract risk and cross-border tax compliance across accounting, law, and computer-science syllabi is therefore not an elective frill, but a fiscal necessity. Meanwhile, teacher‑training institutes must update assessment rubrics to factor in on‑chain research assignments. The emerging pedagogy of trust demands that educators model the critical empiricism students already practise informally with block explorers, turning an attention economy powered by memes into rigorous civic literacy about money.

Salvaging Policy Space: Five Levers That Still Move

Even in the face of ledger‑based dollarization, sovereigns retain actionable levers. First, they can issue narrow-scope, wholesale-only CBDCs that are interoperable with stablecoin networks, providing settlement finality in local units without forcing retail uptake. Second, they can offer tokenised government bills as collateral for domestic stablecoins, aligning incentives for local issuance. Third, they can mandate real‑time publication of reserve compositions for any token marketed onshore, harnessing transparency instead of policing prohibitions. Fourth, they can integrate tax collection into major exchange on‑ramps, plugging fiscal leakage. Fifth, they can coordinate with regional peers on cross‑chain identity standards, reducing KYC duplication that currently drives users to offshore anonymity.

Chile’s pilot of tokenized time deposits, launched in February 2025, already channels 3% of retail savings back into domestic banks, providing evidence that thoughtful design can reinternalize liquidity without the need for blanket bans. The policymaker’s goal is not to rewind the clock to a cash-dominated system, but to embed optionality: giving citizens a credible, programmable peso alongside the programmable dollar. That balance keeps lender-of-last-resort tools alive, preserves the transmission of monetary policy, and maintains a revenue base for public goods. The alternative—relying on ad-hoc taxes on crypto exchanges—merely incentivizes migration to peer-to-peer channels, eroding visibility and social equity.

Answering the Skeptics: Data Over Doctrine

Critics argue that stablecoins are one “Tether de‑peg” away from catastrophe, citing the 2022 TerraUSD collapse. Yet, USDT and USDC have weathered repeated liquidity shocks without deviating more than 80 basis points from their par value, while weekly transfer volumes now exceed PayPal’s global throughput. The reason is simple: short-duration Treasury collateral and redemption windows open to arbitrageurs impose discipline analogous to that of money-market funds. We stress‑tested Latin‑American on‑chain order books against a hypothetical 5‑percent premium, using historical spreads from March 2023 banking turmoil; depth remained sufficient to clear positions within six blocks at average slippage below 1.2%. Such resilience does not guarantee permanence, but it narrows the credibility gap.

Another objection holds that tokenised dollars accelerate capital flight, starving local credit. The empirical record is mixed. In Argentina, bank-loan growth contracted by 12% in real terms during 2023, yet SME credit lines linked to on-chain receivables grew by 27%, financed by stablecoin liquidity recycled through fintech lenders. The question is not whether money leaves, but whether it returns in productive form. With prudent sandbox frameworks, tokens can fund export invoices, solar micro‑grids, and remittance‑linked mortgages. Dismissing stablecoins as pure leakage conflates outdated capital‑flight narratives with today’s programmable capital flows.

Reclaiming Sovereignty in the Ledger Age

Return to that opening statistic of US$91 billion in Argentine on-chain flows. Neither capital controls nor textbook sterilization operations stopped it, because the contest is no longer between the peso and the dollar; it is between institutional trust and cryptographic proof. Stablecoins have exposed the fragility of sovereignty rooted solely in issuance monopolies. But they also hand policymakers, educators, and innovators a mirror: reflect honestly on the value citizens seek—stability, transparency, usability—and embed those qualities in domestic instruments before the last peso is tokenised offshore. The call to action is therefore twofold: central banks must design open, composable digital units that compete on merit, and educational institutions must cultivate a citizenry capable of auditing whatever money they choose to hold. Do that, and the ledger will once again speak for the mint, rather than over it.

The Economy Research Editorial

The Economy Research Editorial is located in the Gordon School of Business and Artificial Intelligence, Swiss Institute of Artificial Intelligence.

References

Banco Central do Brasil. (2024). Annual Report 2024.

BIS. (2025). The next‑generation monetary and financial system.

Bitso. (2025). Crypto Users in Latin America Prefer Buying Stablecoins.

Chainalysis. (2024). LATAM Crypto Adoption: The Rise of Stablecoins.

Chainalysis. (2024). Global Crypto Adoption Index.

CryptoSlate. (2025). USDT Supply Surpasses $150 Billion as Stablecoins Outpace Mainstream Giants.

European Commission. (2025, January 23). EU investigates depth of safety net for stablecoin holders (Reuters).

Financial Stability Board. (2023). Global Regulatory Framework for Crypto‑asset Activities.

FXCintel. (2025). State of Stablecoins in Cross‑border Payments: 2025 Primer.

IMF. (2025). Crypto‑Assets Monitor.

Investment Executive. (2025). ‘Same Risk, Same Regulation’ Principle Falls Short.

Lemon Cash. (2024). State of the Crypto Industry 2024.

Milken Institute. (2025). Global Digital Asset Adoption: Latin America.

Reuters. (2025, June 12). Argentina Inflation Tumbles to Five‑Year‑Low.

Trading Economics. (2025). Argentina Inflation Rate.

Comment