Input

Changed

Joint Warning: "Semiconductor Supply Chain at Risk" Signs of Retraction Emerge, Suggesting a 'Graceful Exit' Strategy Rising Consumer Prices and Decreased Spending—U.S. May Bear the Brunt

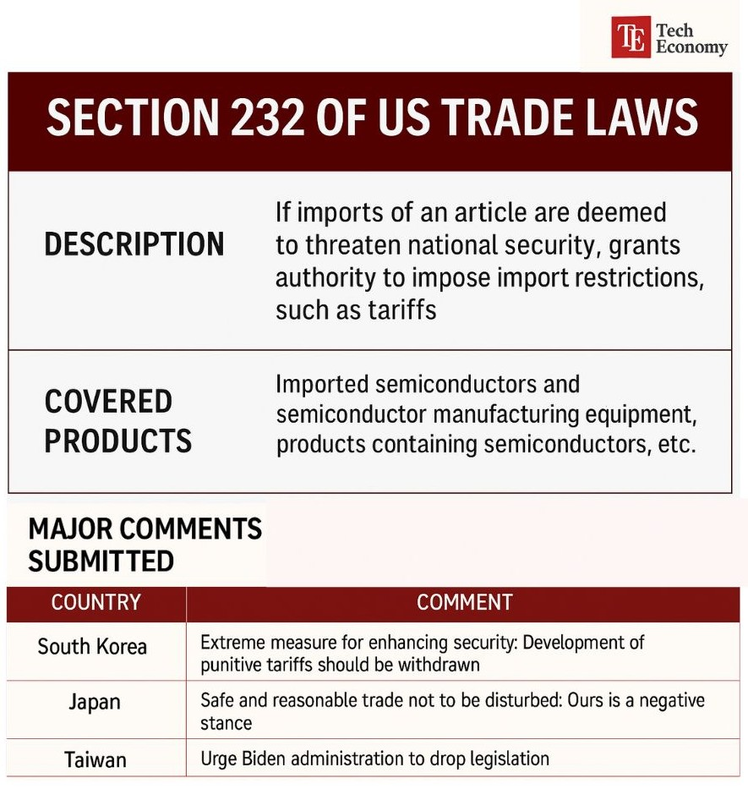

South Korea, Japan, and Taiwan have publicly opposed the United States' recent imposition of semiconductor tariffs, expressing concerns over potential disruptions to the global chip supply chain and adverse effects on their economies.

"A Unified Voice: Negative Impact on Global Semiconductor Industry"

On the 21st May (local time), the Federal Register reported that the U.S. Department of Commerce has initiated an investigation into semiconductor-related products under Section 232 of the Trade Expansion Act. As of the 7th, a total of 206 written comments had been submitted. Section 232 grants the U.S. President the authority to take measures such as imposing tariffs if the import of certain goods is deemed a threat to national security. The law also mandates the collection of opinions from stakeholders and foreign governments during the investigation process.

The South Korean government, in its submitted comments, emphasized the mutually complementary relationship between the two countries. The Ministry of Trade, Industry and Energy stated, “To ensure U.S. leadership in artificial intelligence (AI), avoiding bottlenecks in the semiconductor supply chain is essential.” It particularly highlighted that Korea’s high-bandwidth memory (HBM) and advanced DRAM technologies are “critical to the expansion of U.S. AI infrastructure.”

The Korean government also stressed that Korean semiconductor firms are planning to invest $43 billion (approximately 60 trillion KRW) in the United States, warning that “imposing tariffs on semiconductors will ultimately increase chip manufacturing costs within the U.S.” Beyond the government, organizations such as the Korea Semiconductor Industry Association (KSIA), the Korea Display Industry Association (KDIA), and SK Hynix also submitted written comments to the Department of Commerce expressing serious concerns about the proposed tariffs.

Other countries involved in the semiconductor supply chain with the U.S. voiced similar objections. Taiwan argued that if tariffs were imposed on Taiwan-made semiconductors and related products, “the production costs for U.S. companies will rise, innovation and market competitiveness will decline, and Taiwanese firms’ willingness to invest in the U.S. will inevitably weaken.” It added that such measures would negatively affect U.S. defense technology, AI, and other advanced technology industries, with potentially harmful consequences for the U.S. economy and national security strategies.

The Japanese government also voiced opposition, stating that “no country can internalize the entire semiconductor value chain.” While reaffirming its commitment to cooperation in strengthening the U.S. semiconductor supply chain, Japan urged Washington to reconsider tariffs on semiconductor equipment, materials, and derivative products. It also warned that the downstream effects of tariffs could boomerang back onto U.S. chip designers and end-users, causing unintended domestic harm.

Meanwhile, China, which is locked in a broadening trade dispute with the U.S., sharply criticized the move. The Chinese government stated, “Since 2017, the U.S. has increasingly expanded the definition of ‘national security’ to justify protectionist measures.” The European Union (EU) echoed similar concerns, warning that the proposed tariffs could jeopardize the global semiconductor supply chain, which has been carefully built over many years.

Even within the U.S., dissenting views are mounting. The Semiconductor Industry Association (SIA) cautioned that blanket tariffs could raise costs for domestic semiconductor manufacturing and R&D efforts. It proposed that if tariffs are imposed, mitigating measures such as tariff rate quotas (TRQs) should be introduced to minimize the potential damage.

A "Graceful Retreat" in the Works? U.S. May Be Preparing to Roll Back Semiconductor Tariffs

While the U.S. government outwardly maintains its stance on imposing semiconductor tariffs, signs are emerging that it is quietly laying the groundwork for a potential reversal. At a ceremony marking the 100th day of the Trump administration’s second term, the White House highlighted Taiwan’s TSMC and its investment in U.S. semiconductor factories as a key achievement, underscoring its commitment to continued cooperation. A senior U.S. Commerce Department official remarked that the groundbreaking of TSMC’s third Arizona plant was proof of America's success in attracting investment, adding that “We will accelerate investments in domestic production of semiconductors and other products to fulfill our promise of ushering in a golden era of American manufacturing.”

Industry insiders interpret this as a sign that the U.S. government recognizes the contributions of foreign firms like TSMC in expanding investment and creating jobs. It is also seen as an implicit acknowledgment of concerns surrounding tariffs, and perhaps even a prelude to their softening or reversal. Though the Trump administration continues to project a tough political stance, many in the sector believe that officials are quietly exploring an exit strategy behind the scenes.

That South Korea, Japan, and Taiwan have all voiced concerns simultaneously lends further weight to this interpretation. Analysts suggest that these coordinated appeals may be a form of diplomatic signaling designed to offer the U.S. a dignified path to voluntary withdrawal. Indeed, the Trump administration has a track record of first escalating political pressure and diplomatic friction, only to later grant tariff exemptions for specific countries or products. Recent tariff negotiations with the UK and China followed this same pattern.

At the end of last month, Chinese financial media outlet Caixin, citing government officials, reported that additional tariffs of up to 125% on eight categories of U.S.-origin semiconductor products had been lifted. Subsequently, in early May, the U.S. and China held talks in Switzerland and agreed to lower tariffs by 115 percentage points on certain items, while committing to 90 more days of further negotiations. CNN described the move as a kind of truce, noting that it reflects an acknowledgment by both countries that tariffs on irreplaceable strategic goods must be at least partially rolled back. The report also stated that such actions would directly benefit major tech companies in both countries that had been hit hardest by the duties.

Given these developments, many in the semiconductor industry believe a similar “graceful withdrawal” scenario could play out with semiconductor tariffs. This could involve invoking national security exemptions for select product categories or leveraging World Trade Organization (WTO) mechanisms under the pretext of supply chain stability. Such a carefully calibrated rollback would allow the Trump administration to preserve its hardline messaging abroad while quietly adjusting its actual policy. Ultimately, the prevailing view among industry and diplomatic circles is that the key question is no longer if Washington will retract its semiconductor tariff push, but rather how it plans to do so.

Corporate Profitability Declines as Industry Ecosystem Nears Breaking Point

Experts warn that if the U.S. government continues to pursue its semiconductor tariff policy, the consequences for its own domestic industries could be severe and far-reaching. Among the most immediate and direct effects would be a rise in semiconductor prices. As import costs climb, the manufacturing expenses for consumer electronics, automobiles, servers, and AI chips are expected to increase accordingly. These cost hikes would ultimately be passed on to consumers, fueling inflation. There is growing concern that such excessive tariffs could further stoke inflation in the U.S., potentially triggering a negative cycle of reduced consumer spending and overall economic contraction.

Profitability pressures are also becoming more visible for companies in the semiconductor equipment and materials sector. This is exemplified by the recent performance of ASML, the world’s leading semiconductor equipment manufacturer. In the first quarter of this year, ASML recorded approximately USD 4.35 billion in new orders, falling well short of Bloomberg’s market consensus of around USD 5.46 billion. Other companies with high exposure to the Chinese market, such as Lam Research, KLA, and NVIDIA, have also reported earnings that failed to meet investor expectations.

This turbulence is now rippling across the broader semiconductor supply chain. With production equipment shortages, delays in key component deliveries, and spiking procurement costs, the entire industry is mired in heightened uncertainty. While the U.S. seeks to onshore its semiconductor supply chain, experts argue that achieving self-sufficiency in the short term is virtually impossible. Given the globalized nature of the modern semiconductor ecosystem, which has moved away from single-nation dependencies, unilateral tariff measures are seen as ineffective and disruptive. The industry consensus remains clear: complex global supply systems cannot be controlled by isolated protectionist measures alone.