K-Batteries Pushed Back by China’s ‘Low-Price Surge,’ Survival Clock Ticking in Reverse

Input

Changed

Korea’s Top 3 Battery Firms See Market Share Drop from 44.1% to 39% China Grips Material Supply Chain, Rapidly Advances in Technology Structural Weakening Visible Across Both Upstream and Downstream Industries

South Korea’s battery industry—once considered a linchpin of the nation's high-tech economy—is now confronting an existential crisis. Once lauded for leading global battery innovation, Korean firms are witnessing their dominance unravel under the pressure of China’s rapid rise. What started as a quiet erosion of market share has become a full-scale industrial reckoning. With Chinese battery makers gaining momentum in both scale and technological sophistication, and Korean EV manufacturers floundering under market volatility, the challenges now appear deeply structural rather than cyclical.

This is no longer just about outperforming rivals in quarterly numbers. It’s about survival. Without bold reforms and forward-looking strategies, South Korea risks not only falling behind—but being shut out from the future of global mobility altogether.

Chinese Latecomers Surge Ahead, Igniting K-Battery Crisis

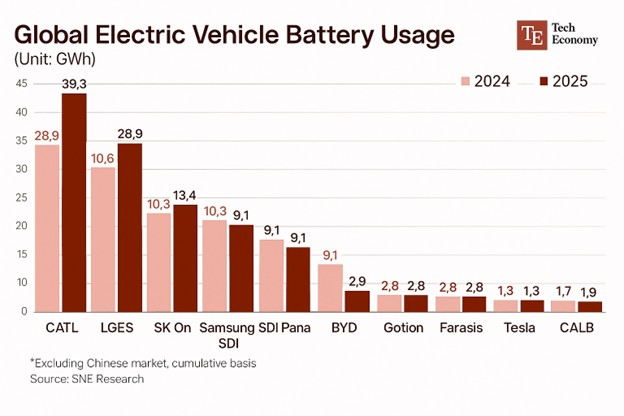

The warning signs are clearly visible in market data. Between January and April 2025, global usage of EV batteries, excluding China, surged by 26.8 percent year-over-year to reach 132.6 gigawatt-hours. Yet during this period of strong global demand, Korea’s top battery manufacturers—LG Energy Solution, SK On, and Samsung SDI—saw their combined market share shrink from 44.1 percent to 39 percent.

LG Energy Solution remained the world’s second-largest battery supplier with 28.9 gigawatt-hours, marking a 15.6 percent year-on-year increase in usage. However, its market share declined from 23.9 percent to 21.8 percent. SK On also experienced growth, expanding by 24.1 percent to reach 13.4 gigawatt-hours, but its share edged down from 10.3 percent to 10.1 percent. Samsung SDI suffered the most, with its battery usage falling by 11.2 percent to 10.3 gigawatt-hours and its market share dropping from 11.1 percent to just 7.8 percent.

In stark contrast, Chinese battery manufacturers posted explosive gains. CATL’s battery usage rose by 36 percent to 39.3 gigawatt-hours. BYD achieved a staggering 127.5 percent increase, reaching 9.1 gigawatt-hours. Gotion High-Tech doubled its usage to 2.6 gigawatt-hours, while CALB rose by 47.1 percent to 2.5 gigawatt-hours. When the domestic Chinese market is included, the gap becomes even more stark. In the first quarter of 2025, CATL alone held a global market share of 38.3 percent—more than double the 18.7 percent combined share of Korea’s top three battery firms.

Industry analysts agree that Chinese firms have evolved far beyond basic cell assembly. Today, they are asserting themselves as leaders in battery innovation, armed with advanced technologies and an aggressive global investment strategy. The Korean battery industry, by contrast, is now being squeezed on three fronts: it must enhance its technological edge, secure diversified and resilient supply chains, and become more price competitive—all at once. According to SNE Research, China’s expansive overseas ventures and relentless investment represent a formidable new phase in global battery competition, suggesting that Korean firms may face further market share erosion if they fail to adapt.

Industry Alarm: "Korea Could Follow Japan’s Path of Decline"

Across Korea’s industrial circles, there is a growing acknowledgment that the country’s time at the top of the global battery hierarchy may be over. The competitive landscape has shifted. No longer is success solely determined by core cell technologies. The key battleground now includes control over battery materials, mastery of supply chains, and streamlined manufacturing efficiencies. On all these fronts, Korea’s response has lagged behind.

China, by contrast, has secured overwhelming control over the global supply of critical minerals such as nickel, cobalt, and lithium—resources essential for battery production. It has also achieved near-total dominance in the production of cathodes and anodes, leveraging both massive output and low prices to consolidate its grip on these crucial sectors.

In terms of next-generation battery technology, China is closing the gap with Korea at a rapid pace. From solid-state batteries and silicon anodes to advanced electrolytes, Chinese firms are catching up—and in some segments, they have already moved ahead. Companies like CATL and BYD are driving this leap forward with enormous research and development operations, generously supported by the Chinese government. Their technologies are increasingly shared with global automakers through OEM partnerships, accelerating their integration into the world’s EV platforms.

Korean battery firms, meanwhile, remain preoccupied with refining production yield. While operational efficiency is important, this narrow focus reveals a wider absence of strategic innovation. Many in the industry now fear that Korea is walking the same road as Japan, which lost its once-dominant battery position in the early 2000s due to stagnation in technological development and a lack of supply chain competitiveness.

Signs of a similar trajectory are already evident. Korean battery firms are losing ground, their market share slipping, and their influence over global supply chains diminishing. What is unfolding is not a short-term dip but a structural crisis. The absence of a bold, long-term roadmap for innovation, coupled with passive resource acquisition strategies, has left the industry vulnerable. Unless Korea fundamentally alters its course, many believe the label “the next Japan” may soon apply all too accurately.

EV Industry Shaken — Domino-Like Crisis Becomes Reality

The battery industry’s challenges are compounded by the turmoil in one of its most vital downstream markets: electric vehicles. As battery demand is inextricably linked to EV production, the weakening performance of major automakers has created a feedback loop of declining orders and stalled growth. Among the most visible victims of this trend is Hyundai Motor, South Korea’s leading car manufacturer.

Hyundai’s EV strategy has faced repeated disruptions. Despite earlier ambitions to aggressively capture a larger share of the global EV market, the company has struggled to gain meaningful traction. Ongoing confusion over strategic direction has led to multiple revisions of its production targets. The company is now reportedly preparing for a workforce reduction of up to 40 percent compared to original EV manufacturing plans—an alarming development that underscores the growing instability of Korea’s EV sector.

In contrast, China is leveraging its domestic EV market as a launchpad for global expansion. Companies such as BYD, Xiaomi, and Xpeng have rapidly increased their presence through aggressive low-cost strategies. These firms are not only satisfying domestic demand, but also penetrating global markets at a pace Korean automakers are struggling to match. Their success, in turn, is bolstering Chinese battery makers, who benefit from the expanded scale and sustained demand.

Central to China’s dominance is the tight integration between its EV and battery industries. These companies collaborate seamlessly across every stage of the supply chain, from cell manufacturing and material procurement to the design of battery management systems. This vertically integrated structure allows China to maintain a self-sufficient, demand-driven ecosystem that minimizes reliance on foreign partners and external volatility.

Korean firms, by contrast, remain locked in a contract-based supply structure dependent on foreign automakers. This model leaves them exposed to abrupt demand swings and weakens their ability to chart their own strategic course. Unlike their Chinese counterparts, they have yet to build a domestic ecosystem where battery production and EV manufacturing move in tandem.

As the future of mobility rapidly evolves, the consequences of these strategic differences are becoming painfully clear. South Korea is losing influence not only in batteries but also in electric vehicles—the two pillars of the next-generation transportation industry. What once seemed like temporary headwinds now appear to be a structural storm. The fear gripping the industry is no longer just about losing leadership. It is about being completely sidelined.