Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

Conventional wisdom still whispers that women “choose security” while men court risk. But two decades of data—and a new wave of causal, longitudinal evidence—paint a sharper, more policy-relevant picture. When girls are exposed to entrepreneurship at an early age, they go on to found companies at rates and with quality levels that match or surpass those of their male peers. What often appears as an innate aversion to risk is, in fact, a shortage of access to information, networks, and visible pathways. Remove that fog, and entrepreneurial female talent floods the ecosystem, unlocking a powerful layer of previously dormant productivity.

This insight demands more than acknowledgment. It mandates action. Public institutions, educators, and investors must address the systemic barriers that have obscured this talent from the market. The evidence shows clearly that exposure is the catalyst, and misallocation is the cost.

Deconstructing the “Risk-Averse Woman” Myth

The idea that women inherently avoid risk has long distorted policy and perception. However, a comprehensive Danish study tracking nearly 800,000 individuals over two decades discredits this assumption. The study revealed that girls whose school peers had more entrepreneurial parents were 4% more likely to own an employer firm by age 35 and spent 6% longer in entrepreneurship. Crucially, the same exposure had no impact on boys.

This revelation transforms the narrative's trajectory: girls aren’t choosing differently because of biology—they respond differently to visibility. Entrepreneurship is not a male-coded trait but a social function reinforced by familiarity.

This aligns with landmark research by Hsieh, Hurst, Jones, and Klenow (2019), who found that reallocating women and minorities into better-matched occupations accounted for 20-40% of U.S. productivity growth between 1960 and 2010. Entrepreneurship, long the final frontier of misallocation, now stands as the highest-potential sector for economic correction.

A 25-Year Surge in Female-Led Startups

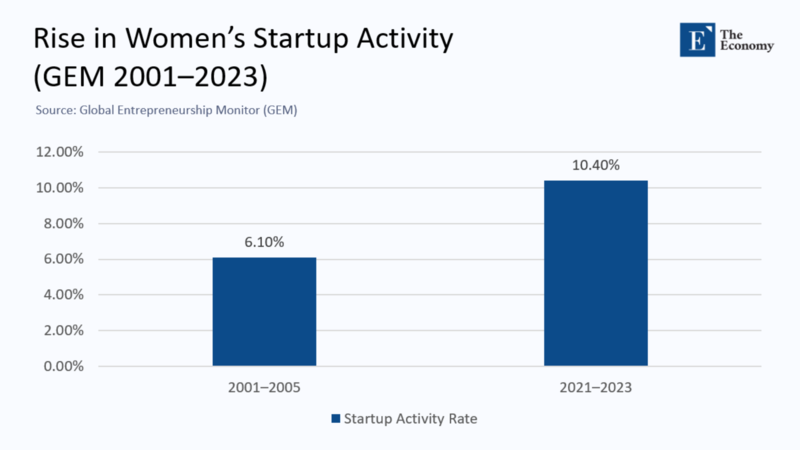

The Global Entrepreneurship Monitor (GEM) data quantifies the transformation: in 2001–2005, just 6.1% of working-age women in 30 surveyed countries engaged in startup activity. By 2021–2023, that figure had surged to 10.4%—a 70% increase in participation over two decades.

This growth is not accidental. It corresponds with increased visibility—female CEO role models in mass media, the rise of youth entrepreneurship programs, and countries actively celebrating female founders in national innovation campaigns.

Some states saw exponential growth. France, for example, more than doubled female startup rates after embedding entrepreneurial skills into secondary education. Similarly, Hungary and the Netherlands implemented mixed-gender accelerator programs that not only increased female participation but also narrowed the gender gap in firm valuation.

Reallocating Talent Pays Off: Why Women-Led Ventures Outperform

The more profound fear underlying some critiques is that expanding access will dilute quality. However, the Danish data strongly counters this narrative. Startups led by women who were "exposure-induced" are not just as durable—they are more durable and scale better than the median startup.

Nationwide projections suggest that if this exposure effect were generalized across the economy, projected employment levels would rise by 3%. This is the essence of a talent-matching dividend: reallocating high-ability women from underpaid, low-autonomy roles into high-impact leadership unlocks growth that cannot be replicated by sheer capital input.

A 2023 OECD study supported this finding: female-founded firms had a higher average compound annual growth rate (CAGR) in revenue over their first five years (13.2%) compared to their male-led peers (11.4%), controlling for industry and funding stage.

The Capital Chokehold—and the Need to Break It

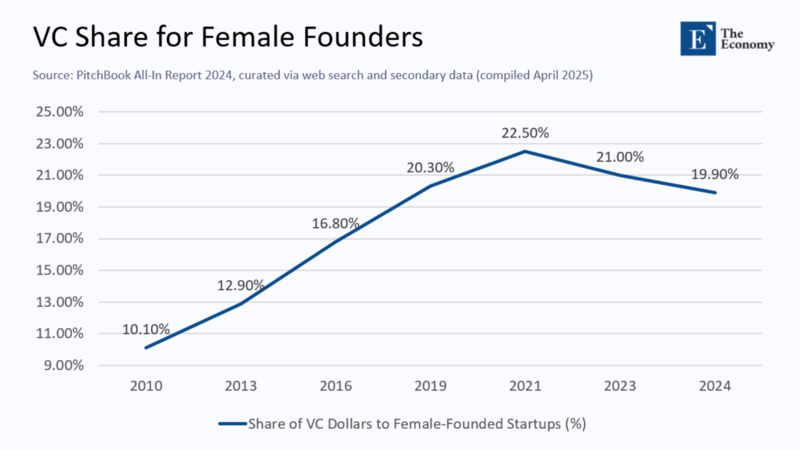

Yet even as intent and talent converge, finance does not follow. According to PitchBook’s 2024 All In report, U.S.-based female-founded companies raised $38.8 billion—a historic high in absolute dollars. However, their share of venture capital fell to just 19.9% of all funding. Worse still, all-female founding teams received barely 1% of capital.

This is not about merit; it is about pattern recognition bias in investment decision-making. Experiments show VCs pose prevention-focused questions to female founders (“How will you handle burnout?”) and promotion-focused ones to men (“What’s your growth strategy?”), regardless of pitch quality.

Investor homophily—where fund managers prefer founders who mirror their backgrounds—remains a structural bottleneck. Since most general partners (GPs) at venture capital (VC) firms are male, capital pools tend to flow predictably toward male entrepreneurs.

Intersectionality Matters: The Double Disadvantage

The analogy with Asian men in Western economies is illuminating. Despite equal or higher educational credentials, Asian founders are often underfunded in non-Asian markets due to cultural unfamiliarity and exclusion from informal networks. Women—especially Black, Indigenous, and migrant women—face similar, if not more severe, disadvantages.

The intersectional disadvantage is multiplicative. A study from ProjectDiane found that Black women received 0.27 cents for every dollar raised by white male founders. These disparities exist not because of lower quality, but because their networks, imagery, and narratives fail to align with the legacy archetype of what “success” looks like in tech.

Policy Roadmap: From Observation to Execution

The evidence now supports a robust, multi-layered policy toolkit. Below is an expanded roadmap:

| Policy Lever | Why it Works | Design Notes |

| Entrepreneurship modules in secondary education | Embeds early exposure during peak developmental years (13–16) | Curriculum co-created with founders and educators; requires gender-balanced case studies |

| National female founder registries | Substitutes for network effects lacking at home | Public speakers, media placement, school visit programs |

| First-loss capital guarantees | De-risks GP experimentation without mandating quotas | Conditions: 30% female founder share, transparent reporting |

| Gender-disaggregated funding data | Shifts investor behaviour through transparency and LP accountability | Monthly VC deal reports, published via national dashboards |

| Sector-specific teen apprenticeships | Leverages the “Danish elasticity” by linking exposure to outcome | Stipends for placements in growth sectors like climate tech and fintech |

If these policies were implemented across the OECD, simulations suggest a potential 1–2 percentage point uplift in GDP over a decade—entirely from better allocation of human capital.

Exposure is Cheap, Misallocation is Expensive

The empirical arc is now unignorable. Women are not naturally more cautious or less driven. They have lacked the compounding exposures that make entrepreneurship appear feasible, desirable, and familiar.

With each successful female founder who enters the mainstream—each unicorn, each IPO, each viral product—the narrative changes for the next generation. This is a flywheel of visibility, not a fixed slope of preference. Governments and financial institutions must act accordingly.

Let us be clear: the challenge before us is not cultural inertia or female reluctance. It is institutional inertia, policy neglect, and a continued failure to update the economic model to match the new empirical frontier. We need policy changes that support early exposure to entrepreneurship, address the capital chokehold, and promote diversity in the startup ecosystem.

The data is in, and the ROI is proven. Early exposure, not biology, is the key to unlocking a generation of founders the global economy cannot afford to miss. The economic benefits of supporting women's entrepreneurship are clear, with increased productivity, job creation, and revenue growth. It's not just a matter of equality, it's a smart economic strategy.

The original article was authored by Mikkel Mertz, a Research Officer at Centre For Research And Analysis Of Migration, along with two co-authors. The English version of the article, titled " Female representation and talent allocation in entrepreneurship,” was published by CEPR on VoxEU.