Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

The Undead Balance Sheet

When a country crawls out of a banking collapse, the greatest menace is not the mountain of bad debt it confesses to the world but the debt it quietly refuses to bury. Greece learned that lesson the hard way. At the height of its sovereign debt trauma, half of every corporate euro on Greek bank ledgers had stopped paying, and nearly one firm in five could not cover interest without lender mercy or state largesse. These companies were not sick; they were economically dead—kept on their feet by a drip of evergreened credit and political forbearance.

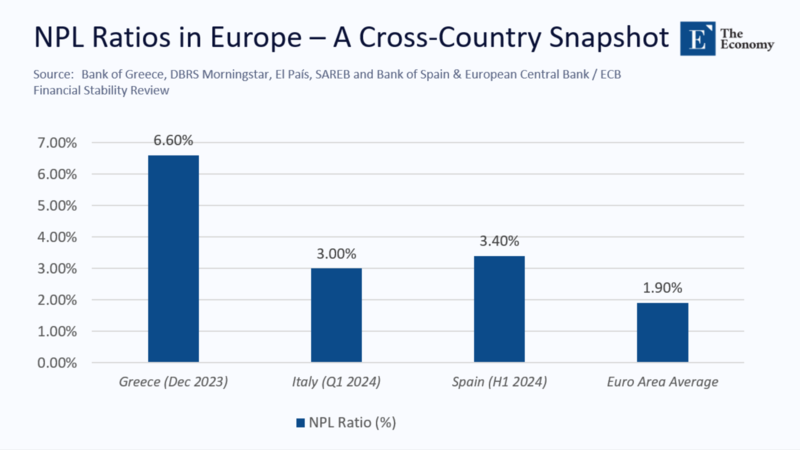

By December 2023, the non-performing-loan ratio (NPL) inside the Greek banking system had collapsed to 6.6 %, a dramatic improvement from the 50 % peak that once froze new lending in its tracks. Yet victory is uneasy: tens of thousands of micro-enterprises remain trapped behind legacy arrears, and more than €70 billion of old corporate debt still sits with specialist services with little incentive to restructure quickly.

How Zombies Tax the Living

Zombie firms are not quaint curiosities; they are congestion charges on growth. Japan supplied the cautionary metaphor during its Lost Decade, when one-quarter of listed manufacturers staggered on despite negative cash flow, suppressing wages and innovation across the economy. The contagion is now global, with a 2023 CEPR panel tracking 114,000 companies in 64 countries, finding that zombies make up roughly 10% of listed businesses and depress the sales growth of their healthier peers by up to three percentage points.

The mechanics are simple. Capital misallocation diverts scarce euros from ventures that could expand. Subsidized firms undercut market prices, crushing margins for innovators—weak banks, terrified of recognizing losses that would obliterate thin capital buffers, pretend and extend. The bill appears not in the budget but in productivity statistics, wage stagnation, and the start-ups that never receive seed funding.

Anatomy of a Clean-Up

Athens's successful rescue plan rested on three pillars. The Hercules Asset Protection Scheme (HAPS) offered state guarantees on the senior slices of NPL securitizations, triggering €75 billion in portfolio sales and forcing banks to face market prices. A single insolvency code adopted in 2021 reduced average restructuring times from five years to twelve months. And a newly licensed servicer industry took huge swathes of bad debt off bank books, releasing capital and nudging lenders back toward fresh credit.

As a result of these measures, Greek banks today boast core-equity ratios above 15 %, more than double the anemic levels in 2015. Credit flows have resumed, and the country’s investment gap versus the euro-area average—once seven percentage points of GDP—has narrowed sharply, offering a beacon of hope for other economies grappling with zombie firms.

A European Scoreboard

The Greek sprint is impressive, but context matters. Figure 1 contrasts today’s NPL ratios in Greece, Italy, Spain, and the euro-area aggregate.

Italy’s earlier GACS guarantee scheme reduced its NPL burden to roughly 3% by 2024, although the first wave of securitizations underperformed due to servicers still learning the craft. Spain chose a different path, warehousing toxic assets in its SAREB “bad bank”; progress has been slower—more than 40 % of SAREB’s housing stock was still vacant late last year. Greece falls between those poles: faster than Spain, slower than Italy, but still nursing a stock three times the euro-area norm.

Liberty, Losses, and the Free-Market Myth

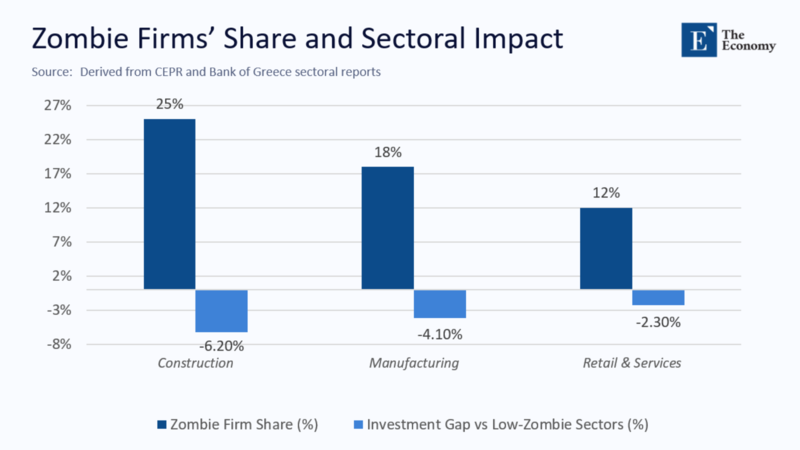

Owners of failing firms often invoke property rights: this is my factory, my life’s work—who is the state to pull the plug? Yet zombie preservation is not brave entrepreneurship but a hidden subsidy levied on everyone else. Taxpayers underwrite guarantee schemes. Depositors backstop banks that postpone write-downs. And, most perniciously, viable firms face crowded credit channels. According to Greece’s data, sectors with high concentrations of zombies saw investment by healthy competitors lag by up to six percentage points.

Free markets thrive on creative destruction, not creative hibernation. Insisting on indefinite resuscitation is not laissez-faire; it is anti-competition masquerading as compassion.

The Politics of Pain

Why do politicians tolerate this drain? Zombies are frequently local champions, providing large employment shares in single-industry regions. Closure, therefore, is electoral poison. The antidote is to protect people, not obsolete capital. Austria’s wage-insurance model, which cushions displaced workers with 80% of their previous earnings for up to two years, increases re-employment odds by nearly 20%. Portable skills vouchers tied to workers, not firms, replicate this approach at a modest fiscal cost.

Transparency is key. Greece's lack of an open reporting portal for NPL sale prices keeps bid-ask spreads wide and discourages fire-sale disposals. Ireland’s decision to publish anonymized averages shortened time-to-sale and narrowed discounts—sunlight works.

A Six-Point Plan for the Next Crisis

- Sunset is every guarantee. Five-year expiry dates on schemes like HAPS prevent moral-hazard rollover.

- Automate downgrades. Two consecutive years of negative EBITDA plus interest coverage below one should force banks to book Stage-3 provisions—no discretion, no delay.

- Mine tax data for early warnings. A sudden, standard-deviation plunge in VAT payments is often a zombie’s first groan; flag it for triage before default.

- Fund skills, not shells. Transition vouchers and wage insurance beat open-ended bail-outs hands down.

- Digital courts, 180-day targets. Liquidations that linger for years sentence assets to oblivion; electronic auctions can close the file within six months.

- Monthly dashboards for NPL markets. Price discovery accelerates when everyone can see where the last trade cleared.

Unfinished Business in Athens

Greece still needs to tackle its long tail of micro-zombies, whose share hovers near 7.8%. One fix would be a fast-track debt-forgiveness channel for debts under a modest ceiling, immediately restoring credit access for entrepreneurs with viable ideas but poisoned credit histories. Meanwhile, as Hercules III winds down in 2025, Athens could pivot unused guarantee capacity toward securitizing green transition loans, turning a cleanup device into a growth engine.

Competition in servicing also needs a jolt. With four large platforms controlling most legacy portfolios, workout incentives are blunt over time. Licensing a second tier of niche investors, as Spain did after SAREB sales stalled, could revitalize secondary pricing and speed restructurings.

A Moral Reckoning

Every percentage-point fall in Greece’s NPL ratio since 2017 coincided with about €4 billion in fresh credit and measurable productivity gains in once-zombie-ridden sectors. The arithmetic is brutal but clear: keeping the financially dead alive may feel benevolent, yet it quietly taxes future wages, pensions, and public services.

The choice is stark for nations staring at their post-crisis wreckage—whether in Southern Europe, Latin America, or the next emerging-market flashpoint. They can preserve yesterday’s enterprises and condemn tomorrow’s, or they can administer swift, transparent insolvency and free resources for the ventures that will define the next decade. Greece’s imperfect renaissance proves that once the undead are laid to rest, economies breathe again—and the living stop paying for the sins of the dead.

The original article was authored by Georgios Gatopoulos, the Head of Macro and Financial Studies at the Foundation for Economic and Industrial Research (IOBE), along with three co-authors. The English version of the article, titled "Resolving non-performing loans and zombie firms: A path to sustainable growth in Greece,” was published by CEPR on VoxEU.