Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

If markets and households now digest policy shocks in months rather than years, every extra quarter in a forecast is not a source of clarity but a liability.

The eight-quarter playbook is obsolete

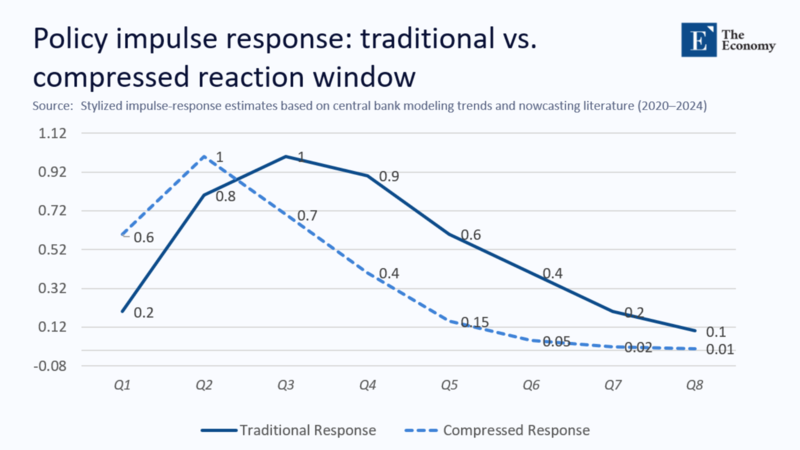

For half a century, the standard impulse-response chart in a central bank briefing deck peaked around quarters 2-4 and gracefully faded by quarter 8. That stylized fact underpinned New-Keynesian calibration and gave officials time to “look through” noise. Recent evidence of “lumpy forecasts” – professional forecasters who update infrequently because new information rarely alters the two-year outlook – codifies the assumption that policy takes time to take effect.

But 2020--25 tells a different story. The economic landscape is rapidly changing. Pandemic cheques hit bank accounts, and retail sales spiked within three weeks; “flash” CPI prints move wage demands before they reach the official bulletin; algorithmic market-makers front-run the rumor of a policy hint. The half-life of a macro shock is collapsing, leaving the last four quarters of the traditional window empty of signal and full of risk.

A shrinking impulse-response window

The chart (below) contrasts a textbook monetary policy shock with the compressed pattern observed in recent high-frequency estimates. The traditional curve peaks only in quarter 3 and still shows sizeable traction in quarter 6. The compressed curve maxes out in quarter 2 and is mostly spent by quarter 4. The practical consequence is stark: modeling or targeting quarters 5-8 is statistical noise.

The Bank of England’s 2024 Monetary Policy Report acknowledges that near-term GDP and price dynamics are now “dominated by data revisions inside each quarter rather than between quarters,” prompting staff to publish monthly growth nowcasts alongside the customary fan charts. In the United States, the Bureau of Economic Analysis (BEA) disseminates near-real-time card-transaction indices that revise personal consumption estimates every Friday.The message is uniform: policy relevance decays faster than the calendar used to allow.

Faster feedback loops – and fatter tails

Compression amplifies volatility. When inflation expectations adjust weekly – as the ECB’s Consumer Expectations Survey now shows – wage bargains cascade into price-setting with little lag. Credit spreads swing wider because lenders’ machine-learning risk engines digest real-time defaults. Overshooting (a policy move that bites harder than intended) and undershooting (one that fails to anchor narratives) become symmetric dangers in such an environment. The once-comfortable idea that “policy errors wash out over two years” is gone; today’s miss-timed hike can trigger an unemployment spike by Christmas.

The flash-flood analogy applies to inequality as well. High-frequency data from the Opportunity Insights Economic Tracker show low-income consumption responding within days to gas-price moves, whereas upper-quintile spending barely twitches. Faster cycles, therefore, widen distributional gaps before quarterly survey instruments can even log them.

From reactive to pre-emptive policymaking

If the game accelerates, the strategy must shift from feedback to feedback. Central banks already experiment with “decision-dependent” forward guidance, conditioning future rates on incoming high-frequency indicators rather than backward-looking thresholds. But guidance alone is toothless unless supported by equally agile operational tools:

- Smaller, sooner moves. A 10 bp tweak every meeting can substitute for a single 50 bp shock delivered after lags confirm the trend.

- Event-triggered facilities. Standing repo lines that auto-activate when market-based inflation swaps break preset bands reduce the need for crisis-meeting theatrics.

Real-time dashboards. The Bank of Canada’s now-casting lab scrapes point-of-sale prices hourly; several G20 treasuries already license private credit card feeds for fiscal monitoring. The message is clear: we need more agile operational tools to keep up with the pace of change.Pre-emption trades magnitude for timing accuracy – precisely what a world without quarters 5-8 demands.

How the modelling stack must evolve

Dropping the dead weight of long lags does not mean naïvely truncating DSGE systems; it means re-engineering them to run on higher-frequency, richer information sets:

| Design Feature | Legacy Quarterly Models | Next-Gen High-Frequency Models |

| Data feed | National accounts, quarterly surveys | Card swipes, online prices, mobility, micro-wages |

| Horizon | 8 quarters | 12 months (or weeks) |

| Behavioural layer | Representative agent, rational expectations | Bounded rationality, attention constraints (rational inaction) |

| Shock propagation | Linear, sector-agnostic | Non-linear, network paths (e-commerce supply chains) |

Network propagation is pivotal. A semiconductor shortage once rippled through global output over six quarters; today, automotive plants halt within six weeks as inventories vanish just in time. Embedding graph-theoretic structures into VARs captures the speed and topology of such contagion.

The private sector’s timing edge

Private firms dominate high-frequency data: Stripe sees consumer checkout flows in milliseconds; UPS tracks real-time shipment weights; Google logs mobility by the hour. These streams shape corporate decisions on pricing, inventory, and hiring days before official statisticians confirm a trend. Markets, therefore, lead policy – sometimes forcing the hand of central banks. The 2023 gilt rout in the UK, triggered by algorithmic traders hedging pension liabilities, compelled the Bank of England into an emergency bond-buying spree that stabilized yields only after volatility had already spilled into mortgage pricing.

The asymmetry is structural: firms can update dashboards at will; central banks are tethered to scheduled meetings, consultation periods, and parliamentary testimony. Unless the public sector narrows that cadence gap, credibility will continue to migrate toward swap curves and option-implied inflation, not communiqués.

Filling the forecast gap with monthly granularity

With the outer quarters gone, policymakers need new “terrain markers” to navigate between one press conference and the next. Three pillars are emerging:

- Monthly macro scorecards. Composite indicators built from payments, container throughput, ad-spend, and online prices deliver near-contemporaneous reads.

- Micro-experiments, such as regional lending caps or targeted VAT rebates running for 60 days, provide causal identification that retrospective datasets cannot.

- Scenario narrative bundles. Instead of a single baseline with symmetric fans, central banks outline discrete pathways (e.g., “AI-productivity boom”, “energy-price reversal”) and attach live probabilities updated every fortnight.

Empirically, the shift pays off. Bank of England staff back-tested a monthly Bayesian VAR using payment data and found root-mean-square-error improvements of 25% at the six-month horizon compared to the classical quarterly model.

Precision over breadth: policy design in a flash-cycle economy

A shorter horizon magnifies the penalty for wrong size-right sign moves. A 100 bp hike that overshoots neutral now grinds real activity within a semester; the luxury of mean-reversion before the next wage round is gone. Policymakers must therefore:

- Formalise loss functions in weeks, not years. Tail-risk weightings should reflect the new speed at which the error compounds.

- Invest in probabilistic comms. Like market option strips, stochastic policy paths tell households how likely different rate levels are by Christmas, not just in “the medium term.”

- Link regulation to tempo. Counter-cyclical buffers switched on annually are ineffectual; automated daily capital-requirement scalers tied to market stress indices could dampen pro-cyclicality.

Time is the new policy instrument

The disappearance of quarters 5-8 is not an arcane modeling footnote; it eliminates the buffer that once absorbed analytical inertia, bureaucratic latency, and political indecision. In today’s data-saturated, hyper-connected economy, timeliness is as binding a constraint as fiscal space or the zero lower bound.

Economists who cling to the comfortable two-year horizon risk advising in a vacuum. Policymakers who wait for quarterly confirmation may discover that the cycle they meant to steer has already been completed. The strategic imperative is, therefore, temporal minimalism: compress measurement to months, interventions to weeks, and learning cycles to days.

Failure to do so will cause macro management to become an exercise in post-mortem commentary rather than real-time stewardship.

The original article was authored by Isaac Baley and Javier Turen. The English version of the article, titled "Lumpy forecasts: Rational inaction in professional forecasting,” was published by CEPR on VoxEU.