Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

The Silent Crisis in Commercial Real Estate

With nearly one in five U.S. office floors now dark, the real danger lies in the invisible ties that bind these buildings to Wall Street’s balance sheet. This uncomfortable truth is at the heart of today’s commercial real estate drama. A structural demand shock has severed the economic floor from beneath trophy towers. Yet, the banking system remains quietly on the hook through credit facilities extended to the very real estate investment trusts (REITs) now struggling to survive. However, with swift and effective regulatory changes, the toxic mix of mark-to-market losses, contingent liquidity draws, and social media-accelerated deposit flight could be averted, thereby preventing a crisis of 2008 proportions.

Permanent Behavioral Shifts Break the Monetary Playbook

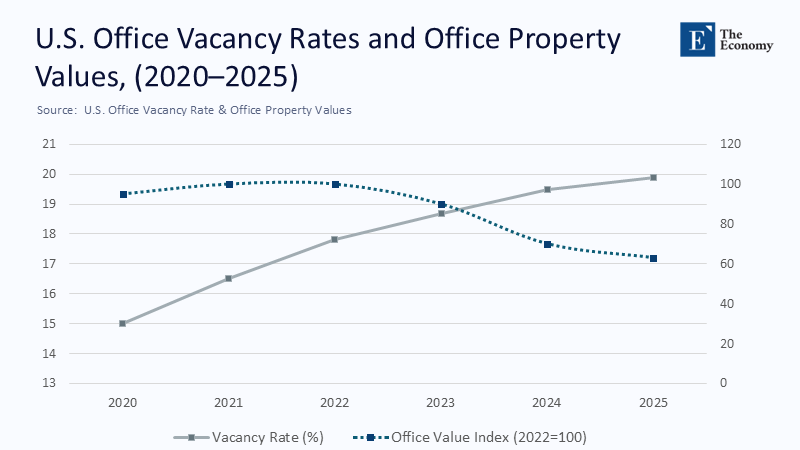

The scale of the demand shock is already visible in the data. Physical office attendance has settled at roughly fifty‑four percent for two consecutive years, and national vacancy has climbed to nineteen‑point‑nine percent, the highest since the savings‑and‑loan era. Over the same period, the Green Street Commercial Property Price Index shows that U.S. office values have tumbled thirty‑seven percent from their early 2022 peak, by far the deepest drawdown among core property types. Monetary policy can do little to reverse numbers of that magnitude because the root cause is behavioral, not financial: millions of workers have permanently repriced the pain of commuting. Capitalization-rate arithmetic is suddenly secondary; the cash‑flow numerator is evaporating.

Distress Surfaces Early, Before Debt Maturities

Distress is already bleeding into market pricing. In 2024, more than 10% of U.S. office transactions were classified as distressed, a 39% increase over the prior three-year average, and the typical troubled asset that changed hands exceeded 200,000 square feet. Auctions without bids in Chicago and thirty-percent price cuts in San Francisco are no longer one-off curiosities; they have become the market. The collateral backing approximately $ 1.4 trillion of outstanding CRE loans is therefore losing value, months—indeed, years—before many of those loans mature. Investors have noticed that spreads on single-asset, single-borrower commercial mortgage-backed securities (CMBS) backed by older office properties now hover roughly 450 basis points over swaps, implying double-digit loss-given-default assumptions.

The Hidden Risk Banks Prefer Not to Discuss

Most commentary stops at the direct loan book and concludes that "only" four or five percent of large‑bank assets are secured by offices. However, this benign surface figure misses a submerged iceberg: banks’ credit‑line promises to publicly traded REITs. Viral Acharya and his co-authors demonstrate that nearly half of the aggregate bank credit-line exposure to non-bank financial institutions is concentrated in REITs, and that utilization rates surge precisely when markets tumble. A May 2024 look‑through study translated those patterns into regulatory arithmetic, highlighting the need for transparent reporting. It showed that once such commitments are treated in the same way stress affects them, adequate CRE exposure at the largest U.S. banks is roughly forty percent higher than headline numbers suggest. For a firm like JPMorgan or Citi, the hidden tranche represents tens of billions of contingent assets that convert into funded loans at the worst possible moment.

How REITs' Leverage Turns a Slow Crisis into a Fast One

The leverage multiplier does not end there. Even after the significant deleveraging that followed the global financial crisis, equity REITs still had debt-to-market-asset ratios of about 33.8 percent entering 2025, lower than in 2007 yet substantial given today’s valuation decline. When redemption requests for flagship non-traded vehicles, such as Blackstone’s BREIT and Starwood’s SREIT, slammed, both trusts reached for backup liquidity embedded in bank lines that had stood fully undrawn just a few quarters earlier. Those lines, until tapped, carry minimal capital charges because they sit off the balance sheet. The moment they are drawn, the risk migrates into the banking system, amplifying the hit that direct CRE loans are already absorbing.

The Silicon Valley Bank Warning: Bank Runs in the Age of Apps

If the left hand of the crisis resembles 2008’s credit‑line dynamic, the right hand is pure 2023: the social‑media‑fueled deposit run. Silicon Valley Bank lost forty‑two billion dollars in scarcely ten hours because a liquidity rumor went viral across Slack channels and X feeds. Commercial real estate losses unfold less explosively, but the mechanism—crowd‑accelerated doubt about a lender’s solvency—works the same. Once uninsured depositors learn, perhaps from an analyst tweet, that their regional lender’s CRE book is fifty percent larger than disclosed, they can move funds at the speed of an app. Price declines force REITs to draw lines; drawings erode bank capital; rating downgrades spook depositors; deposit outflows require asset sales or discount‑window borrowing, which in turn confirms market fears. A lower federal funds rate cannot short‑circuit that loop.

Why Downtown Redevelopment Won't Rescue CRE in Time

Optimists counter that downtown skylines will morph into much‑needed housing, but the conversion thesis is more mirage than salvation once the economics are scrutinized. Nationwide, approximately 71 million square feet of obsolete office space are in the planning pipeline for conversion to apartments. Yet, recent feasibility studies reveal conversion costs hovering near 685 square feet, compared with approximately 600 for brand-new multifamily construction. Even before considering construction risk, developers need at least a 25% land-based discount for the numbers to pencil out. In comparison, the discount available in most coastal CBDs is still only fifteen to twenty percent. Unless municipalities offer Calgary‑style subsidies or radically rewrite zoning codes, most vacant towers will not be repurposed quickly enough to protect lender collateral.

Regulatory Blind Spots Are Bigger Than Policymakers Admit

Against this backdrop, policymakers face an unpalatable reality. The Federal Reserve’s April 2024 Financial Stability Report certainly flags CRE valuations as stretched; yet, its econometric models still rely on historical mean reversion in cap rates—an assumption invalidated by the behavioral shock described earlier. Capital rules, meanwhile, give undrawn corporate lines only fifty percent credit‑conversion factors, and some internal models assume even less for well‑rated borrowers. That benign treatment is misaligned with how REIT lines function under stress. Acharya’s utilization curves suggest that conversion factors for such facilities should be closer to 75% in regular times and 100% in stress scenarios, with matching risk-weight add-ons.

A Playbook for Containing the Crisis Before It Erupts

What must change? First, regulators should mandate look-through stress testing that treats REIT commitments as live risks, not theoretical exposures. Quarterly disclosures are inadequate in an era where bank runs can trend on social media before a regulator drafts a press release; large banks should furnish at least monthly data on both outstanding and committed REIT lines. Second, capital buffers must expand in line with those stress-based utilization rates, incorporating the 20% jump in required capital that Acharya’s empirical work projects once off-balance-sheet REIT behavior is modeled. Third, governments serious about downtown revitalization must hardwire incentives—such as refundable tax credits, expedited permitting, and modular-construction subsidies—so that conversion math closes without relying on heroic rent growth assumptions. Fourth, the discount window must modernize itself: daylight overdraft tolerance, pre-positioned collateral, and public-communication frameworks that strip away stigma are no longer luxuries but necessities in preventing app-speed contagion.

Calm Is Not Stability: A Warning from the Future

The surface calm of 2025 evokes 2006. Default rates remain low, equity markets are nonchalant, and policymakers cling to the hope that maturity extensions will buy enough time for demand to return. Yet the structural vacancy problem will not fade, and every quarter that passes pushes more REITs into the cash‑burn territory, raising the probability of synchronized credit‑line drawdowns. In a world where rumors spread faster than regulators can respond, hidden leverage is no longer a quaint academic concern but an existential threat to financial stability. Unless supervisors force sunlight onto contingent exposures and governments make conversions genuinely affordable, the next systemic shock may arrive not with subprime-mortgage acronyms, but with four empty letters glowing on city rooftops: W-F-H.

The original article was authored by Viral Acharya, a C. V. Starr Professor of Economics in the Department of Finance, along with three co-authors. The English version of the article, titled "Non-bank financial institutions’ reliance on banks for contingent credit under stress and its consequences,” was published by CEPR on VoxEU.