Input

Changed

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

Liquidity, though still attractive, has lost its previous unassailable status. For the first time in seventy-five years, central bank treasurers are no longer willing to accept currency losses as an inevitable part of their operations. The truth is dawning on them: the greenback’s dominance can be eroded, portfolio line item by portfolio line item. This realization, accelerated by a 9 percent dollar slide following a fresh round of Trump-era tariffs, has elevated diversification from a mere talking point to a crucial operational priority. The dollar is not on its deathbed, but a truly multipolar reserve order is on the horizon, and the data are already outlining its shape.

A Demand Shock in Reverse: Tariffs, Real Yields, and Eroding Seigniorage

When the US Treasury launched the first post-election bond auctions in January, foreign official bidders demanded a yield concession of twenty-four basis points versus domestic investors, more than double the five-year average. The cost of anchoring a fiscal deficit north of seven percent of GDP rises precisely as the White House pursues a deliberate weak-dollar strategy to offset tariff-induced price spikes. For overseas reserve managers, the arithmetic is brutal: a 9 percent currency loss on Treasuries is the equivalent of wiping out two years of coupon income at today’s maturities.

Historically, that pain was swallowed because the United States offered the deepest repo market, the safest payment rails, and a near-monopoly on sanction-proof trade finance. Yet technological and geopolitical frictions have diluted each pillar. Saudi Arabia’s decision last year to join Project mBridge — a BIS-sponsored, China-led cross-border CBDC network now live at the minimum-viable-product stage — signals that at least some oil trade will graduate from letters-of-credit in dollars to programmable settlement in e-yuan. Parallel rails reduce the greenback’s transactional gravity, the silent force that once guaranteed automatic reinvestment of petrodollars into Treasuries.

Decoding the Data: How Fast Is Dollar Primacy Eroding?

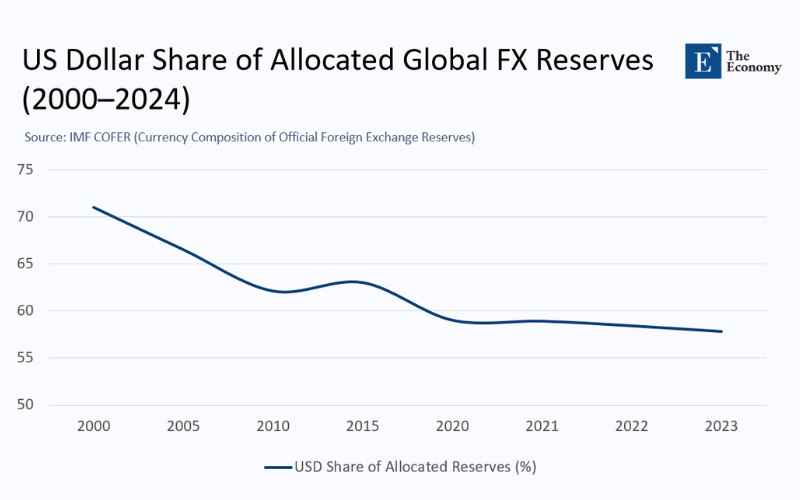

The International Monetary Fund’s COFER tables, which capture allocated reserves (those whose currency composition is reported), peg the dollar’s share at 57.39 percent in the third quarter of 2024, down more than seven percentage points from 2016. A modest mark-to-market rebound in Q4 lifted that number to 57.8 percent. Still, the trend remains unambiguous: approximately half a percentage point of market share has been lost every year for two decades, and the pace has accelerated since the onset of the pandemic.

Projecting that slope forward without adjustment would cause the greenback to drop below the psychologically resonant 50 percent line in 2030. But the hill is likely to steepen for one reason: reserve stewards now have credible liquidity alternatives.

Peripheral Currencies: From Afterthought to Anchor

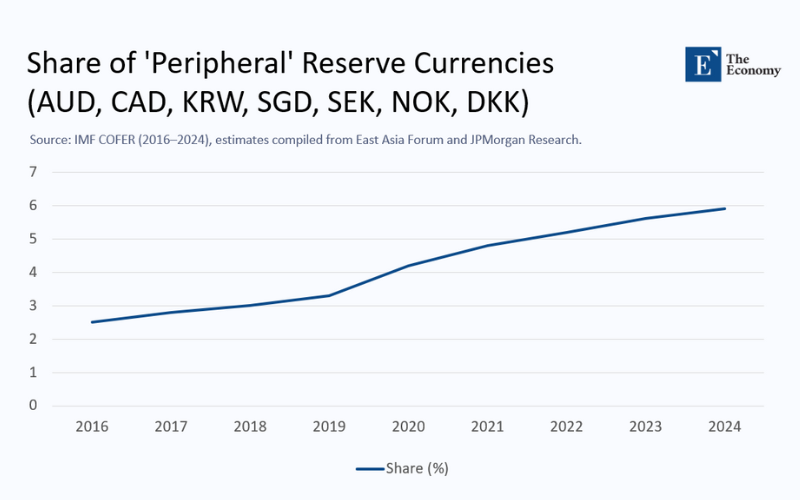

The biggest surprise in the reserve ledger is not the renminbi—it still struggles to hold a three-per-cent share because of convertibility limits—but a constellation of midsize, free-floating units. IMF data show that the combined share of the Australian dollar, Canadian dollar, Korean won, Singapore dollar, and the three Nordic currencies more than doubled from 2.5 percent in 2016 to almost 6 percent by the end of 2024.

Three structural forces explain the climb. Positive carry tops the list: ten-year Australian Commonwealth bonds yield about 95 basis points (bp) over Treasuries, and with cross-currency basis swaps now pricing at single-digit premiums, hedged investors can pick up net income rather than pay for it. Liquidity deepening comes next; Korea’s inclusion in FTSE Russell’s World Government Bond Index this November is expected to pull nearly US$ 60 billion of passive flows, instantly tightening bid-ask spreads and broadening repo facilities. Sanction insulation completes the triad: Canberra, Ottawa, and Seoul do not unilaterally freeze reserves, a trait that has become a quantifiable risk variable since Russia’s 2022 asset seizures.

Gold: The Politically Neutral Balance-Sheet Hedge

No reserve conversation is complete without bullion. Central banks bought 1,045 tonnes in 2024, the third consecutive year above the 1,000-tonne threshold, according to the World Gold Council. Econometric work by Eichengreen shows that every one-point uptick in the World Uncertainty Index is associated with roughly 2.5 tonnes of incremental official demand, a relationship that held almost linearly in pandemic and post-pandemic stress episodes. Gold is more expensive to accumulate at US$ $2,900 an ounce — up 40 percent since January 2024, yet the optionality value of an asset immune to sanctions and default overrides valuation anxiety.

Digital Rails and the Petro-Yuan Question

Skeptics of de-dollarisation often point to invoicing inertia: roughly 80 percent of global trade is still priced in dollars. However, invoicing is not a settlement. Reuters reporting confirms that nearly all of China’s $60 billion annual oil imports from Russia are now settled in yuan, routed through the Cross-Border Interbank Payment System (CIPS) rather than the Society for Worldwide Interbank Financial Telecommunication (SWIFT). As settlement habits evolve, pricing conventions can lag for years and then shift suddenly, as seen with Brent crude becoming the benchmark in the 1980s without an OPEC vote. Project mBridge adds scale, as it already covers jurisdictions responsible for roughly 20 percent of global oil output. By linking to Ethereum-compatible code, the platform can host programmable escrow or carbon-adjusted invoices, services that SWIFT cannot match.

History Warns: Higher Rates Alone Cannot Re-Monopolize Reserves

The textbook fix for currency weakness is a policy-rate hike, but parallels with the sterling crises of 1956, 1976, and 1985 suggest caution. Britain’s tightening cycles halted momentary slides yet did nothing to restore the pound’s preeminence; once investors diversify, they rarely reverse course. The United States faces an additional constraint: with gross federal debt near 124 percent of GDP, each 100 basis points of additional interest cost equates to about $305 billion within two years, amplifying political deficits and undercutting the credibility that such hikes aim to restore.

Quantifying the Diversification Dividend

JP Morgan's ten-year simulation of a 60/40 reserve split between dollars and a market-weighted basket of non-traditional currencies paints an optimistic picture: a 17 percent higher volatility-adjusted return versus an all-dollar benchmark when extended through February 2025. Even if the dollar stabilizes, the Sharpe ratio advantage remains, as peripheral sovereigns tend to exhibit a negative correlation with U.S. T-bond returns during trade or technology shocks. This is a clear indication that diversification can bring significant benefits. Private actors have already noticed this, as the average hedge tenor on dollar receivables for US multinationals lengthened from nine to fourteen months this quarter, the first material extension since the Dodd-Frank mandates of 2013.

Three Plausible Reserve Scenarios for 2030

Baseline glide path: The dollar share declines by roughly half a percentage point per year, reaching a level of nearly 52 percent; gold inches toward 19 percent, while peripherals crest at 9 percent. Market volatility remains orderly.

Accelerated pluralism. A second tariff escalation, combined with a contested US election, undermines confidence, eroding the dollar by two points per year; peripherals reach double digits by 2028, and gold surpasses 20 percent. Liquidity premia on treasuries rose but remained within historical recession ranges.

Disorderly fracture. A US exit from the IMF — an option floated in recent conservative policy papers — triggers reserve selling that pushes the dollar below 45 percent within eighteen months. Treasury yields widen the gap, forcing fiscal retrenchment and global swap-line interventions reminiscent of those in March 2020. Probability today: low but rising.

Policy Implications on Both Sides of the Atlantic

For Washington: The path to a slower, more orderly erosion lies in scrapping punitive tariffs, re-embracing multilateral institutions, and signaling a medium-term fiscal glide path. Each deviation accelerates diversification, while every gesture of predictability stretches its timeline.

For peripheral issuers, yield alone is no longer sufficient; investors now demand deep repo pools, transparent climate risk disclosures, and credible inflation-targeting frameworks. Failure on any one metric risks relegating these currencies back to tourist status just as they approach reserve legitimacy.

For Europe and China, the gap between potential and actual reserve inflow remains large. Completing the Banking Union and introducing a market-based digital euro could help the single currency regain its share above 25 percent. Full yuan convertibility would be even more powerful, but Beijing’s capital-account caution is unlikely to vanish before 2030.

Managing the Inevitable

De-dollarisation is best understood not as a rebellion but as portfolio optimization in slow motion. The greenback retains unrivaled scale, yet its margin of supremacy is narrowing because alternatives have never been more liquid, yield-positive, or politically attractive. Investors under forty will regard a world where the dollar commands barely half of the reserves, as usual, not threatening. Policymakers' challenge is channeling that transition through the guardrails of liquidity and legal certainty. The more the United States respects those guardrails, the longer the dollar’s leadership will last. Ignore them, and the trickle out of Treasuries could become a flood.

The original article was authored by Barry Eichengreen, a George C Pardee and Helen N Pardee Professor of Economics and Political Science at the University of California. The English version, titled "Asia’s rise in the global currency game as uncertainties about the dollar grow," was published by East Asia Forum.