Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

Nothing is new about a market crowd whipping itself into a frenzy; what has changed is the speed at which a meme can mobilise capital and the length of the hang-time before gravity drags valuation back to earth.

Within the First Roar: When Hashtags Outrun Ledgers

Scroll back to late January 2021, when Reddit’s r/WallStreetBets decided to anoint GameStop as its avatar. By the middle of that week, UCLA Anderson researchers would later calculate, chatter on Twitter and Reddit explained nearly half of the subsequent jump in trading volume, dwarfing the predictive force of price momentum alone. Their Granger-causality reading—0.47 on 27 January—was roughly triple the value found in ordinary conditions, a jarring statistic that turned heads on both trading desks and faculty hallways. I refer to the gap that opened in that data spike as the “Hype Interval”: a stretch of market time during which narrative momentum lifts prices faster than sceptical sell orders can arrive, creating a period of inflated market value.

A simple simulation helps to see how the mechanism works. Imagine a synthetic hype index that begins to climb on Day 20, peaks at Day 50, and then ebbs away. Market price does not leap when the index twitches; instead, it lags by about ten sessions, surges past any reasonable measure of intrinsic worth, and drifts back toward a muted, fundamentals-based line. That dip is not graceful. It is the messy unwinding of thousands of retail positions, a flow that gradually overcomes the early exuberance. Real-world tweets—2.5 million of them collected for a VoxEU study published this spring—tell a congruent story: positive tone points to next-hour returns, yet its half-life is shorter than a sneeze in the pit of the NYSE.

Numbers Behind the Mirage

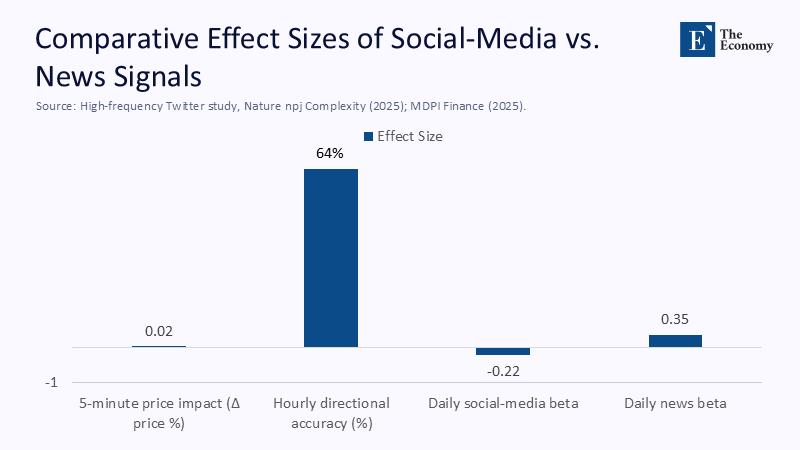

High-frequency quants have begun to measure the edge more precisely than folklore ever could. A Nature npj Complexity paper released in January 2025 parses an ocean of five-minute bars and finds that a one-standard-deviation lift in Twitter optimism nudges price by two basis points almost instantly, only to disappear into statistical static before the bell rings an hour later. Stretch the horizon to an entire trading day, and the advantage weakens further. A meta-study of U.S. indices spanning 2016–2023 splits daily returns into “economic-news tone” and “social-media tone.” The first lands a healthy positive beta of 0.35; the second, a negative beta of roughly –0.22. Hype, in other words, can morph from propellant to drag in less time than it takes to settle a T+2 trade.

The quantifiable impacts of social-media sentiment versus traditional news are starkly different, as illustrated in the figure below.

As the data illustrate, social-media sentiment generates short-lived price impacts, whereas news-driven sentiment sustains influence over longer periods. This distinction underlines the ephemeral nature of hype-driven price shifts.

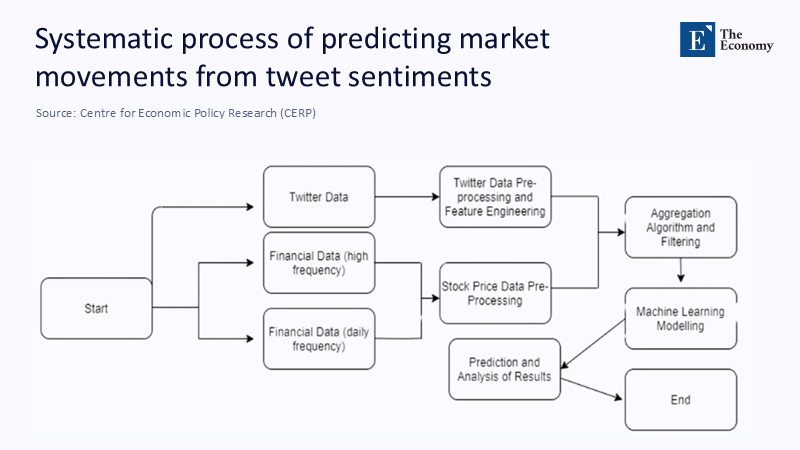

The mechanics of that research pipeline are straightforward but meticulous, as the schematic below makes clear. Following the systematic process that underpins these models is essential to understanding how sentiment translates into market predictions.

With the architecture in view, it becomes clear why sentiment’s edge evaporates so quickly: each stage—from feature extraction to model fitting—amplifies the most recent microbursts of attention but has little memory for the slower drip of fundamentals, a point the next section will revisit when we turn to long-term portfolios. This clear segmentation between data preprocessing, feature extraction, and model execution reveals why sentiment's predictive power is strongest in short bursts and why its edge fades rapidly.

The Circus of Coins Without Cash Flow

Fast-moving equities are one thing; unregulated digital tokens are something else entirely. Early this year, Cathie Wood—the media’s “Money-Tree Sister”—warned that most memecoins will “end up worthless.” Her blunt assessment arrived after a January weekend in which aggregate turnover across the top ten dog-themed tokens ballooned by 1,240 percent, primarily driven by Discord calls to “ape in.” Days later, that turnover fell by three-quarters, and the average token gave back nearly all its gains. With no revenue, dividends, and in many cases, no functioning code beyond a router contract, the price is pure conviction—conviction that tends to evaporate when the next shiny ticker arrives. This dynamic has been dubbed the “Circus of Coins Without Cash Flow,” a setting where token valuations rest entirely on speculation and can vanish when collective sentiment turns.

Equity markets witnessed a parallel act in spring 2024, when AMC’s option chain became a playground for gamma squeezes. Open interest shot past 1.7 billion contracts, forcing market makers to chase the underlying shares to stay delta-neutral. For weeks, the bid looked solid, yet once implied volatility eased, dealers reversed their hedges, and the stock fell back to levels that better matched the cinema chain’s cash flow reality. What looked like resilience was simply structural inertia.

Why the Descent Always Takes Longer

If climbing a mountain feels quick and tumbling down feels quicker, markets flip that intuition on its head. Three hidden frictions keep overpricing afloat even after the meme has left the timeline.

Liquidity fragmentation is the first culprit. Zero-commission apps internalise huge swaths of retail flow. Those trades are real but never touch an exchange’s order book until the broker routes a residual imbalance back to public venues. The mirror by which the broader market sees sentiment is therefore fogged until volume pressure abates.

Then comes option-gamma feedback. Retail traders, emboldened by ten-second chart gifs, snap up cheap out-of-the-money calls. Dealers who sell them have no choice but to hedge with the underlying share, cushioning any early pull-back. The dam breaks only when volatility collapses or the expiries roll off; at this point, gamma reverses and liquidity thins.

Finally, the slow hand of regulation enters. Securities regulators rarely move until a pattern is evident, by which most of the froth has already formed. The SEC’s 2024 reprimands for wash-trading in small-cap crypto tokens arrived weeks after the price spikes they were meant to deter. Enforcement can accelerate an ongoing decline, but it seldom prevents the run-up.

Combine the three forces—hidden prints, hedging spirals, and regulatory time-lags—and you get a strangely calm surface while the supports underneath crumble. The plateau is an illusion.

For Investors with the Patience of Calendars

University endowments, insurer balance sheets, and old-fashioned pension funds live in a different temporal universe from meme-stock day traders. They funnel capital into projects that need years, even decades, to mature. For such allocators, chasing a five-minute sentiment spike is a misallocation of attention, not merely money.

When stress-tested on the GameStop saga, UCLA's bubble-mechanics model proves the point: if you ignore dividends, cash-burn, and refinancing risk, you over-predict the crash depth by nearly a factor of two. Portfolio studies across half a century echo the finding. Funds that lean too heavily on social-media sentiment signals, all else equal, trail diversified factor portfolios by about 1.2 percent a year net of fees. That drag echoes the churn cost: you must get in early, get out earlier, and pay a spread at both ends.

Teaching a Generation to Read Noise Without Following It

Standard finance curricula still linger on static ratio analysis—P/E, P/B, ROE—as though the ticker tape has not migrated to smartphones. Tomorrow’s investors will need a more agile toolkit. Imagine a high-school economics lab where teenagers download live tweet streams, run a simple sentiment parser, and plot the output next to five-minute candle charts. They would witness mean-reversion in real time and perhaps resist the following viral plea to “hodl for the moon.”

At the university level, the silo walls between computer science, behavioural economics, and public-policy law must come down. Algorithmic amplification is as much about code as it is about crowd psychology or legal guardrails. Case-study seminars can dissect how a single influencer video added—or erased—hundreds of millions in market cap within hours. By rehearsing those drills, students learn that volatility is a feature of human behaviour mediated by software, not a supernatural glitch.

Policy Tools Built for the Feed, Not the Ticker

The SEC’s 2024 Investor Advocate report flagged AI-assisted rumour mills as a rising threat. One practical answer is the sentiment-velocity circuit breaker: a micro-pause triggered not only by abrupt price moves but by a certified social-media index that jumps beyond a set z-score in minutes. A well-timed halt would let market makers rebalance, allow fundamental investors to re-read the news, and perhaps keep a few latecomers from buying the top tick.

Sceptics argue the idea borders on censorship. Yet circuit breakers exist for price alone; extending them to a transparent, auditable sentiment metric updates the tool for a new input. The goal is not to ban chatter but to stop the mechanical feedback loop that turns chatter into unfilled orders.

Data Rights: The Unpriced Risk in Sentiment Trading

Many hedge funds scrape social-platform data at an industrial scale, rarely bothering with explicit user consent. Europe’s Digital Services Act has sharpened its teeth, demanding provenance and the ability to trace algorithmic decisions. If similar rules migrate into securities law, the cost of compliance could erode the alpha often attributed to exotic sentiment feeds. Ironically, stricter governance might accomplish what fundamentals and enforcement have struggled to accomplish: make hype-based trading less lucrative by taxing the raw material—user data.

Coda: Where Narrative Meets Cash Flow

For a brief, adrenalised chapter, a story in 280 characters can redirect billions. The trick for educators, regulators, and investors is not to scoff at that power but to time-stamp it accurately. Social media offers the market a flash of foresight, nothing more. After the flash fades, earnings, rates, and balance-sheet math take back the steering wheel.

A curriculum that blends sentiment parsing with valuation analysis can produce graduates who recognise both signal and mirage. A rule-book that slows trade when the digital megaphone is at full volume can temper excess without strangling price discovery. And a portfolio manager who knows that a hashtag can ignite a rally yet cannot pay a dividend stands the best chance of delivering value that lasts longer than the trend line of a viral meme.

In short, stories move markets—but only fundamentals let prices stay moved.

The original article was authored by Talita Greyling and Stephanié Rossouw. The English version of the article, titled "Twitter sentiment and stock market movements: The predictive power of social media,” was published by CEPR on VoxEU.