Input

Changed

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

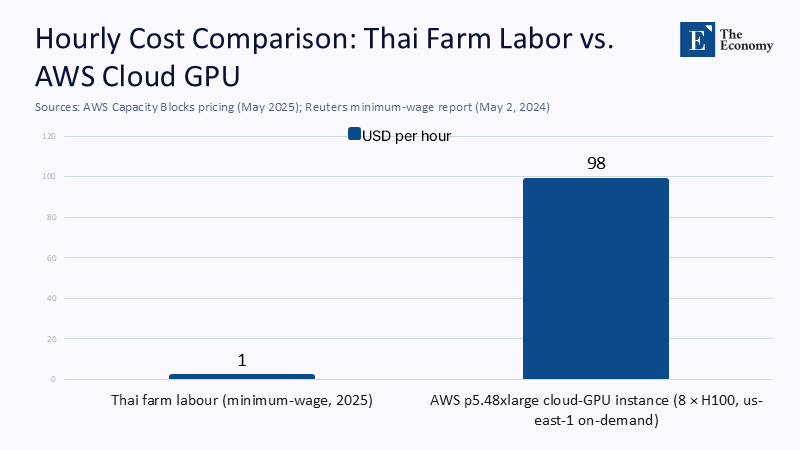

Renting just one hour of cloud time on an AWS p5.48xlarge server stocked with eight H100 GPUs costs US$ $31.46 in Northern Virginia and US$ $43.42 in Jakarta. Even in the cheaper zone, that compute hour equals the legal daily wage of almost three Thai farm hands, or seventy-two workers per hour at Thailand’s new floor rate of 400 baht. Until that basic equation reverses, fully autonomous agriculture across Southeast Asia will remain the exception, not the rule.

The cheap-labour paradox that glossy policy papers skip

Wage pressure is the fulcrum on which most Californian or Hokkaido robotics business cases pivot, yet ASEAN’s rural labour market looks nothing like rich-country agriculture. Thailand’s 2025 minimum of roughly US$ $10.8 per ten-hour day works out to just US$ $1.35 per hour; Vietnam’s region-IV statutory floor sinks below US$ $0.70. In Indonesia, smallholders still sink 83.26 manual days into every hectare of rice they plant—labour that, at local wage rates, costs about US $877 per season. This 'cheap-labour paradox' refers to the situation where the labor cost is so low that it makes it difficult for robotics to compete without policy sweeteners. Governments frequently warn of “labour shortages”, but the malaise is demographic rather than monetary: the median paddy worker is over 50, yet the raw cost of a workday remains so low that robots struggle to compete without policy sweeteners.

When the robots pencil out—and when they do not

Take a stylised hectare of irrigated rice. Swapping backpack sprayers and manual fertiliser broadcasting for drones plus edge-AI crop-scouting cameras removes roughly 24 of those 83 human days. A service contractor in Vietnam’s Mekong Delta will spray or fertilise for just US$ $0.60–0.68 per hectare per flight; five flights per season and two seasons a year total at most US$ $6.80. Add an NVIDIA Jetson Orin Nano Super module (US$ $249) as the on-farm processor and a soil multi-sensor kit (≈ US$ $800), and annualised hardware and service costs reach US$ $233 per hectare over a five-year life. Those savings look dazzling until the arithmetic folds the remaining 59 manual days back in: at Thai wage levels, the net cash benefit drops to about 25% and pushes break-even to seven seasons—perilously close to typical land-lease cycles.

The invisible cost centre called compute

Hardware you can touch is only the visible tip of the cost iceberg. Upstream compute for model training, fine-tuning, and multi-season forecasting devours orders of magnitude more cash. This 'invisible cost centre called compute' refers to the significant costs associated with the computational resources required for model training, fine-tuning, and multi-season forecasting. OpenAI alone is projected to burn US$ $7 billion on training and inference in 2024—double Cambodia’s agricultural GDP. A single high-resolution plant-disease model, trained for ten epochs across 256 H100s, racks up US$ $25,000–30,000 even at discounted hyperscaler rates—greater than the gross annual revenue of ten average Vietnamese rice farms. Edge inference can classify pests locally, but the heavy lifting of multimodal training sits on data-centre clusters that no provincial cooperative can finance. Prototypes risk stranding when promotional cloud credits expire: cameras in fields, but no GPU time to crunch the frames.

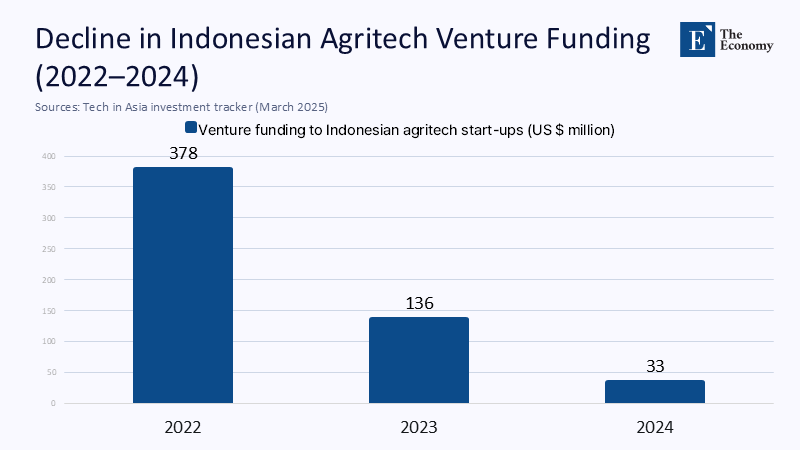

Talent and capital: the dual throttle on ambition

Money is not the only missing input; brains are scarcer still. The inaugural ASEAN Digital Integration Index scores the region just 48 out of 100 on its Digital Skills & Talent pillar—barely half of the benchmark level ASEAN says it needs to support deep digital trade. This 'dual throttle on ambition' refers to the twin challenges of attracting both talent and capital to the agritech sector in Southeast Asia. Venture investors are already voting with their wallets. Agritech funding in Indonesia, the bellwether market, cratered from US$ $377.6 million in 2022 to US$ $135.6 million in 2023, then collapsed to US$ $33.2 million in 2024 after scandals at flagship startups.

With private finance in retreat, the burden shifts to ministries whose combined ag-R&D outlays hover below 0.3% of regional GDP—pennies against the multi-billion-dollar envelopes required for sovereign AI clouds or mass sensor deployment. The talent pipeline faces a similar drought: Singapore graduates world-class machine-learning engineers, but Laos scores below 45/100 on the same skills index; brain drain funnels the scarce technologists to Jakarta fintechs or Singaporean banks, not to farm-field startupsstartups.

Policy calibration: subsidies that move the ledger

Japan’s 2021 Smart Agriculture Act demonstrates one path: low-interest loans from the Japan Finance Corporation underwrite on-farm robotics and guarantee off-take contracts for inputs such as drone-sprayed biocontrols. Malaysia has copied parts of that playbook through a dedicated smart-farming window inside its AgTech matching-grant system, though at only tens of millions of dollars. ASEAN could move the needle by redirecting a sliver of its inward foreign direct investment—FDI inflows hit US $224 billion in 2022—to a pooled “green-digital” facility managed by the ASEAN Infrastructure Fund. 5% of the 2023 inflow would seed an US $11 billion purse: enough to stand up a shared GPU cluster, subsidise curated open datasets and bulk-procure edge sensors for member states. Regulatory sandboxes can further compress pay-back periods by guaranteeing market access for AI-enabled services such as aerial biostimulant application, allowing service providers to amortise drones over hundreds of smallholders instead of a handful.

Climate arithmetic: why postponing digitisation is not free

Autonomy sceptics often plead, “Labour is cheap; wait ten years.” Climate models refuse to wait. A Mekong Delta study that coupled the ORYZA crop model with RCP 4.5 and 8.5 scenarios shows that under severe salinity intrusion and flooding, winter–spring yields fall by up to 13.6% by the mid-2030s without adaptive measures. Labour can be hired; lost tonnes cannot. Early-warning systems powered by satellite fusion and local IoT sensors can slash disaster losses. Still, they, too, require the same computing backbone and data-engineering talent that is currently underfunded. Myanmar’s internet penetration is only 44%, and rolling shutdowns illustrate how fragile that backbone is. In other words, climate resilience and digital readiness are two faces of the same coin.

A realistic path: incremental intelligence, not instant autonomy

Given these constraints, wholesale robot farming by 2030 is a mirage. The pragmatic avenue is a hybrid decade in which specific drudgery—herbicide spraying, granular fertiliser application, seed broadcasting—is handed to low-cost drones while transplanting, harvesting, and local troubleshooting remain human chores. Service cooperatives turn capital items into per-hectare fees that align with smallholder cash flows. Regional compute cooperatives, modelled on the Pacific’s Ocean-Predict consortium, could pool GPU time for multi-national crop models, amortising the backbone cost. Human-centred design should cast AI as an augmentation for extension agents—mobile vision apps that diagnose brown planthoppers in seconds, rather than as a metallic replacement for farmers. Success in 2030 should be measured not by counting autonomous farms but by comparing marginal cost curves: are labour-plus-AI systems delivering rice at a lower unit cost and smaller carbon footprint than labour alone?

Discipline before disruption

Artificial intelligence will ultimately reshape ASEAN’s paddies, orchards, and palm groves, yet its timetable will be governed less by hype than by stubborn arithmetic. Rock-bottom wages, thin venture pipelines, and fragile connectivity currently outweigh the seduction of glossy robotics demos. Policymakers therefore confront a stark choice: sink scarce public funds into capex that looks futuristic but will never match today’s labour economics, or double down on targeted, cost-justified interventions that build data infrastructure, spread compute costs, and professionalise drone services. The latter course demands fiscal discipline and patient roll-out—traits that seldom make headlines but prevent AI ambitions from rusting away, forgotten, in the monsoon-drenched fields.

The original article was authored by Mae Chow, a Researcher at the Centre on Asia and Globalisation (CAG) at the Lee Kuan Yew School of Public Policy, National University of Singapore. The English version, titled "AI can sow the seeds for ASEAN's food security future," was published by East Asia Forum.