Member for

3 months 2 weeksInput

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

Climate change, often confined to environmental discussions, has far-reaching implications that go beyond the melting of ice caps and the rise of sea levels. Unfortunately, many policymakers and business leaders tend to view climate-related events as isolated incidents, failing to recognize the profound and widespread economic disruptions they trigger. The comprehensive range of climate-induced economic vulnerabilities is glaringly evident in East Asia, where agriculture, culture, and politics are deeply intertwined. From South Korea’s apple shortage and Japan’s rice crisis to China’s pest outbreaks, these instances underscore a crucial lesson: even minor climate shifts can lead to extensive economic, social, and geopolitical consequences. It is crucial to acknowledge and tackle these interconnected risks to build resilient economies and ensure global stability.

South Korea’s Apple Crisis: From Orchard Decline to Political Upheaval

Apples have long symbolized South Korea’s agricultural prowess, contributing to the nation’s GDP and culinary identity. However, over the past three years, a series of unseasonal frosts and torrential rains—anomalies linked to shifting monsoon patterns—have decimated apple yields. Official data from Korea’s Ministry of Agriculture, Food, and Rural Affairs reveal a 25% decline in apple production between 2021 and 2023. The economic repercussions were immediate: wholesale apple prices surged by over 60%, inflating retail costs and squeezing household budgets.

Culinary and Commercial Ramifications

The acute price spikes forced restaurants across Seoul and other metropolitan centers to remove apple-based dishes and desserts from their menus. Iconic street vendors who once prided themselves on freshly pressed apple juices saw foot traffic plummet by as much as 40%. Small- to medium-sized enterprises in the food-processing sector—juices, canned goods, confections—faced rolling production delays and higher input costs, eroding profit margins, and undermining export competitiveness.

Social and Political Fallout

Beyond immediate economic pain, public frustration over soaring food prices became politically salient. Opinion polls indicated that nearly 70% of respondents identified food affordability as a top concern during the 2024 local elections. Voter turnout spiked in rural regions hardest hit by the apple shortage, and incumbents perceived as indifferent to agricultural distress were decisively ousted. The episode illustrates how climatic stressors can amplify socio-political tensions, transforming a horticultural challenge into a catalyst for governmental change.

Japan’s Rice Shortage: Cultural Identity Meets Economic Strain

In Japan, rice is more than a staple food; it is a cultural linchpin woven into festivals, ceremonies, and daily life. Climate-induced heatwaves and shifting precipitation patterns severely disrupted rice cultivation in 2022, resulting in an almost 30% reduction in yields—a historic nadir reported by Japan’s Ministry of Agriculture, Forestry, and Fisheries. Consequently, rice prices soared by approximately 45%, shaking consumer spending habits and traditional dining patterns.

Shifts in Dietary Behavior and Tourism Impact

Faced with higher rice expenses, families transitioned to affordable substitutes such as noodles and imported grains. Bento vendors and convenience stores, long reliant on domestic rice for bentos and onigiri, reported a 20% drop in volume sales. International tourism, which markets Japan’s culinary heritage as a core attraction, suffered collateral damage: higher meal prices and altered menu offerings led to a 15% decline in food-tourism revenue, contributing to a broader 5% annual drop in tourist spending in 2022.

National Pride and Cross-Border Dynamics

Japan imported significant amounts of rice from South Korea for the first time in over a century. Though this alleviated immediate shortages, it provoked public outcry—a potent reminder of historical and cultural sensitivities. Nationalist pundits criticized governmental preparedness, and social media platforms brimmed with debates over domestic food security strategy. This rice episode epitomizes how climate change can strain national pride, magnifying the socio-economic repercussions of agricultural deficits.

China’s Pest Proliferation: Agricultural Instability as a Precursor to Wider Risks

China’s vast agricultural sector is particularly vulnerable to climate oscillations. Warmer temperatures and erratic rainfall foster ideal breeding conditions for crop pests and diseases. Research from the Global Landscapes Forum indicates a 70% rise in pest-related crop damage between 2020 and 2023, a significant increase that imperils key staples such as wheat, maize, and rice.

Food Security and Urban-Rural Inequities

In affected provinces, harvest losses exceeded 20%, driving domestic grain prices upward by 15%. Higher food costs disproportionately burdened rural and lower-income urban populations, exacerbating income disparities. In some regions, farmers reported debt increases of 30% as they invested in pest-control measures, further entrenching cycles of rural financial vulnerability.

Socio-Political and Global Supply Chain Implications

Historically, spikes in food prices have been linked to social unrest. The Chinese government’s swift deployment of emergency subsidies and pest-eradication teams helped prevent widespread protests. However, this episode highlighted underlying social tensions and the fragility of rural livelihoods. Given China’s pivotal role in global agricultural trade, domestic shortages had international repercussions: worldwide wheat and maize futures experienced 8–10% volatility spikes, posing a threat to food security in import-dependent regions. This underscores the urgent need for international cooperation in addressing the global challenge of climate change.

Modeling the Domino Effect: Integrating Climate Risk into Economic Forecasts

Economic models must evolve to incorporate both direct and indirect climate impacts, translating these case studies into actionable insights. The Centre for Economic Policy Research (CEPR) has been at the forefront of developing frameworks that quantify how localized agricultural disruptions can ripple through broader economic systems. This integration of climate risk into economic forecasts is not just a suggestion, but a necessity in the face of climate change.

Yield Projections and Price Volatility

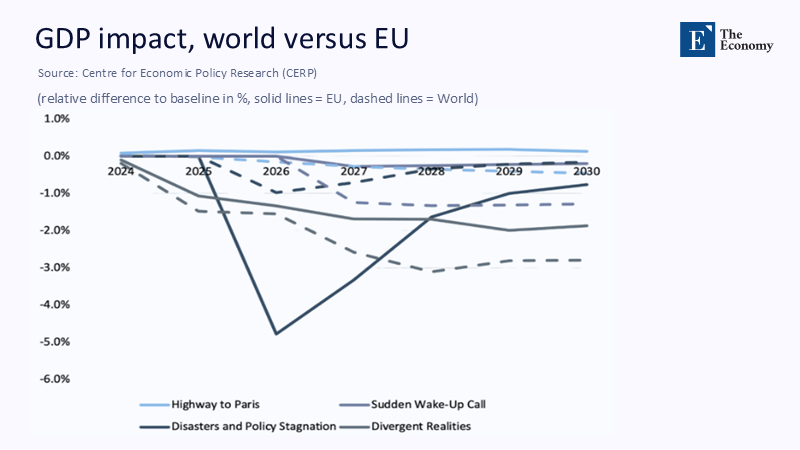

CEPR’s scenario analysis suggests that, under a “Business as Usual” climate trajectory, East Asian agricultural yields could decline by 20–30% annually by 2030. This scenario assumes no significant changes in climate policy or global environmental conditions. Such sustained yield reductions would precipitate prolonged price volatility: food staples could see price swings of ±20% year-on-year, introducing significant uncertainty into household consumption and commercial planning. Under a "Disasters and Policy Stagnation" scenario characterized by minimal climate policy intervention and a continuation of current trends, East Asia's aggregate GDP could contract up to 4% relative to baseline projections by 2027.

GDP and Financial Market Exposure

Model outputs also reveal stark GDP impacts. Under a “Disasters and Policy Stagnation” scenario—characterized by minimal climate policy intervention—East Asia’s aggregate GDP could contract up to 4% relative to baseline projections by 2027.

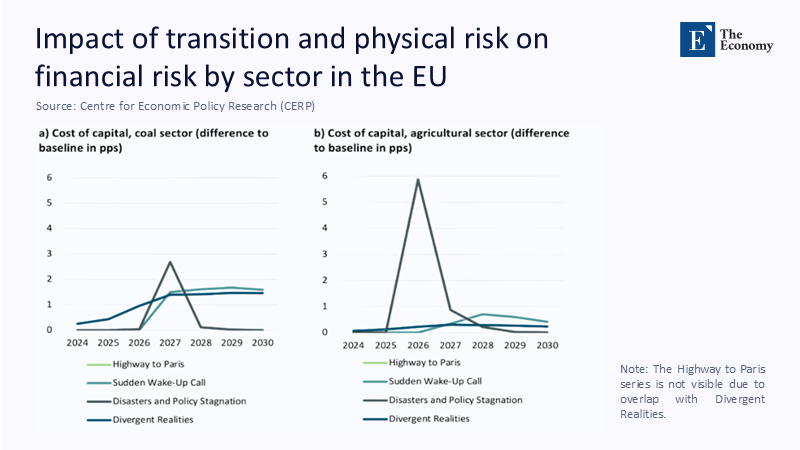

Sectoral Risk Profiling

Further, CEPR’s sectoral analysis delineates cost of capital fluctuations across industries. In extreme climate scenarios, the coal sector’s cost of capital could spike by over 2.5 percentage points, reflecting heightened transition and policy risks. Similarly, the agricultural industry might experience capital-cost increases of up to 6 percentage points during peak disaster periods.

Toward Resilient Economies: Policy and Financial Sector Strategies

The East Asian experiences and CEPR modeling collectively underscore the urgency for integrated, proactive policy, finance, and technology strategies.

Agricultural Adaptation and Diversification

Governments must invest in climate-resilient crop varieties and advanced irrigation systems. South Korea could mitigate future apple yield shocks through controlled-environment agriculture (CEA) technologies, while Japan might expand its investments in drought- and heat-resistant rice strains. China, facing pest surges, should prioritize integrated pest management (IPM) systems and bolster research in biocontrol solutions.

Stabilizing Supply Chains and Social Safety Nets

Policymakers should establish strategic grain reserves and price stabilization funds to absorb price shocks. Subsidies targeted at vulnerable populations can alleviate immediate burdens, but long-term resilience requires diversified income sources, promoting rural non-farm employment, and supporting agritech entrepreneurship.

Embedding Climate Risk in Financial Decision-Making

Financial regulators and institutions must incorporate climate risk analytics into credit ratings, investment approvals, and stress tests. Mandatory climate-risk disclosure for publicly traded companies, aligned with Task Force on Climate-related Financial Disclosures (TCFD) guidelines, would enhance market transparency. Further, central banks should explore climate scenario-based stress testing for major banking institutions.

International Cooperation and Knowledge Sharing

Given the transboundary nature of climate impacts, regional cooperation is vital. East Asian nations could form a unified Climate-Economic Resilience Alliance, facilitating data sharing, coordinated policy responses, and joint research initiatives. Such collaboration would amplify individual efforts and promote collective economic security.

From Awareness to Action

The East Asian case studies demonstrate unequivocally that climate change’s economic effects extend beyond environmental degradation. Minor climatic shifts can cascade through agriculture, commerce, politics, and global markets, producing far-reaching impacts. Recognizing and quantifying these indirect risks through rigorous modeling, as CEPR exemplifies, is fundamental to informed policymaking.

Proactive measures—ranging from agricultural innovation and supply chain stabilization to robust financial regulation and international cooperation—are no longer optional but existential imperatives. The butterfly effect in East Asia serves as a clarion call: economic resilience in climate change demands comprehensive, forward-looking strategies. By transcending siloed approaches and embracing interdisciplinary solutions, policymakers and business leaders can mitigate hidden vulnerabilities, turning potential economic tsunamis into manageable ripples of adaptation and growth.

The original article was authored by Tina Emambakhsh, a Financial Stability Expert at the European Central Bank, along with three co-authors. The English version of the article, titled "What the financial sector needs to know about climate-related risks in the next five years: Navigating the new NGFS short-term scenarios for Europe,” was published by CEPR on VoxEU.