Input

Changed

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

Unspoken Revolutions is a term coined to describe significant changes that occur without much public or official discourse. A single, quietly swelling metric reveals more about Beijing's monetary playbook than a thousand summit communiqués: by end-2024, offshore banks were sitting on roughly RMB 1.09 trillion worth of renminbi deposits in Hong Kong alone. This all-time high eclipses the previous record set two years earlier. In strategic terms, what looks like petty cash beside the multi-trillion-dollar market is an anchor—one grain of ballast at a time—dragging global liquidity toward China. The step-by-step logic is brutally simple: get counterparties to accumulate yuan for trade settlement today, let habit and payment infrastructure lock them in tomorrow, and only then worry about challenging the dollar's throne. The following analysis unpacks how that incrementalism works, why it is still far from a coronation, and what the numbers in Figures 1 and 2 say about the next decade.

Liquidity Before Legitimacy

Beijing's strategists have drawn the key lesson from the post-war rise of the U.S. dollar: a reserve currency is first a working capital currency. Hence, the People's Bank of China (PBoC) has rewired trade invoicing, not by edict but by nudging. Pipeline oil contracts with Russia settle in yuan; Chilean copper exporters accept RMB letters of credit at a discount. Every such deal ends with cash parked in offshore clearing banks. The Hong Kong Monetary Authority reports that yuan deposits grew 14% year-on-year even as cross-border capital outflows accelerated, illustrating a stickiness that mere portfolio flows lack.

That stickiness is deliberate. China's leadership fears the capital account whiplash that wrecked Japan's 1980s financial opening, so it uses trade channels—where flows are anchored by real shipments—to internationalize the currency without exposing its bond market to hot money. The result is a thin but dense layer of RMB funding inside commodity and manufacturing supply chains: modest in size yet strategically invaluable because it embeds the yuan at the operational core of corporate treasuries from São Paulo to Surabaya.

From Swap Lines to Synthetic Reserves

When a partner's dollar stockpile runs short, Beijing offers a bilateral swap line rather than moral lectures about fiscal prudence. Those lines total roughly RMB 4 trillion across 29 central banks, up from just over RMB 2 trillion in 2017. The genius of the program is asymmetry: because activation and roll-over decisions sit with central banks, the PBoC can drip-feed liquidity precisely where politics dictates while avoiding the risk of hedge-fund speculation that would accompany full convertibility. Approximately one-third of drawings remain outstanding for longer than twelve months—evidence that at least some recipients are content to treat the yuan as a reserve asset rather than a mere stop-gap financing tool. Over time, those swap balances turn into what might be called "synthetic reserves," further increasing the gravitational pull of the currency without an outright float.

Payment Rails and the Shadow of Sanctions

Pipelines need valves, which the Cross-Border Interbank Payment System (CIPS) provides. Launched in 2015 as a sleepy back-office utility, CIPS exploded in relevance the week Russian banks were ejected from SWIFT in 2022. By 2023, it was processing over RMB 123 trillion a year, averaging RMB 483 billion daily traffic. As of March 2025, 170 direct and 1,497 indirect participants in 119 jurisdictions are wired into its Shanghai servers. These numbers are tiny besides SWIFT's, yet they matter because every new connection immunizes a bank against unilateral U.S. sanctions. The geopolitical insurance premium converts directly into persistent demand for yuan clearing balances—a safe if subordinated, harbor amid weaponized finance.

Digital Yuan and Programmable Influence

The electronic counterpart to CIPS is China's central bank digital currency (e-CNY). Embedded in the BIS-sponsored m-Bridge pilot, the e-CNY processed over USD 22 billion in test cross-border payments last year. Early trials cut settlement costs by almost 98% relative to correspondent banking—a differential big enough to matter on the razor-thin margins of commodity trade. While privacy concerns deter some democracies, emerging-market treasurers welcome a rail that clears outside Washington's legal shadow. Programmability adds an extra lever: a yuan that can be time-stamped or geofenced is a currency conditioned on political compliance.

Quantifying Momentum

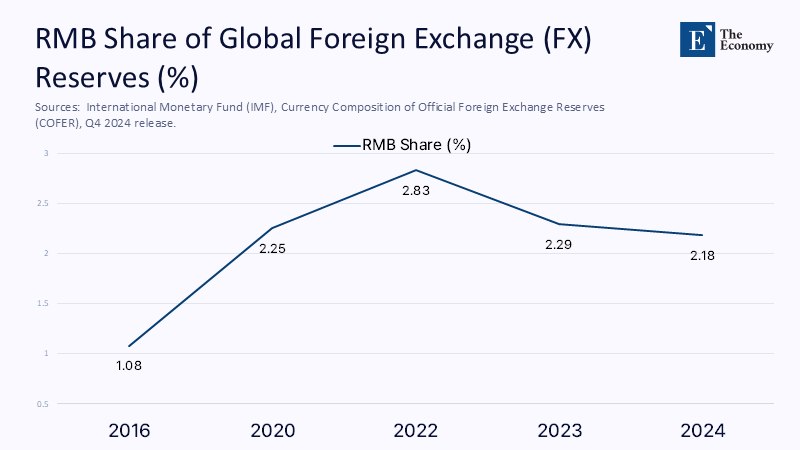

Momentum shows up in reserves data first, payments data second, and they chart the methodical advance implied by China's low-key strategy. Figure 1 plots the yuan's share of global foreign exchange reserves, drawn from the IMF's COFER survey.

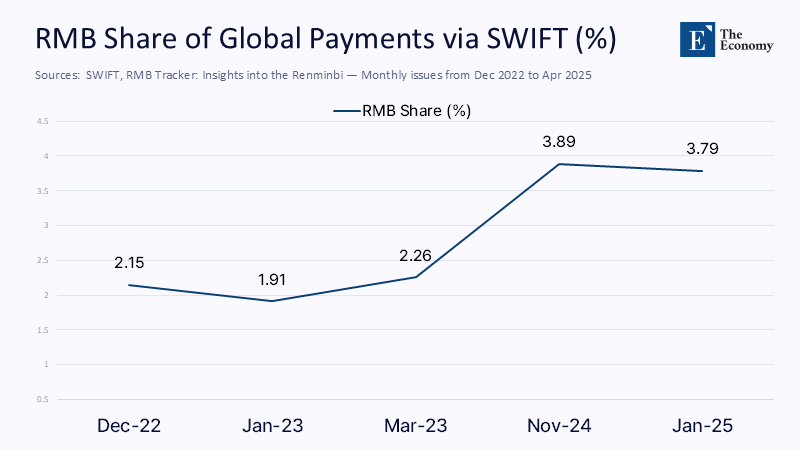

Figure 2 turns to SWIFT's RMB Tracker to show the currency's share of global payment traffic.

Taken together, the graphs spell incremental but unmistakable progress: the yuan now accounts for roughly one dollar in every fifty held by central banks and one transaction in every thirty cleared across borders. Though seemingly small, these figures are significant enough to leave the dollar unthreatened yet large enough to guarantee that any future sanctions regime sweeps up unintended victims.

Capital Controls and Controlled Capital

Conventional wisdom says the renminbi cannot graduate into an actual reserve currency without fully opening China's capital account. Beijing demurs, and for now, the numbers vindicate its caution. Foreign holdings of Chinese sovereign and policy-bank bonds stand at RMB 3.3 trillion—just 11 % of outstanding supply but an all-time high nonetheless. Investors accept quota-limited market entry because ten-year Chinese paper yields about 170 basis points more than its U.S. counterpart. Those yields are a carrot; the quota is a stick, ensuring speculative outflows cannot morph into a 1997-style crisis. The approach is visible nationalism: openness on Chinese terms, precisely calibrated to avoid handing Wall Street a macro-prudential tripwire.

The Political Economy of Patience

Each incremental gain in deposit balances, swap utilization, and payment traffic testifies to a strategy that prizes optionality over speed. By avoiding a frontal challenge to the dollar—no oil-for-yuan diktats, no overnight free float—Beijing denies Washington the apparent provocation that would unify allies. Instead, the PBoC is building what might be called "distributed interdependence": a web so granular that no single counter-move can sever it. If the dollar retains sixty cents of every reserve dollar by 2035, China will still win if five of the remaining forty cents are unambiguously yuan. In that landscape, sanctions deterrence and trade financing both tilt subtly eastward.

No Coronation, but Crowded Thrones

Projecting forward on current trajectories, the IMF data imply the yuan could claim 6 – 7 % of global reserves by 2035; SWIFT data suggest an 8 % payment share is plausible if annual growth merely halves from recent rates. Neither figure dethrones the dollar, yet both would cement China's veto over exclusion. The future of monetary power thus looks less like a single throne and more like a crowded dais: the dollar in the center but flanked by the euro, yen, and an increasingly self-confident renminbi.

Currencies, like ecosystems, change by accumulation. Beijing's low-key strategy has traded velocity for resilience, converting each incremental deposit into a micro-bond of dependency. The forest line of global finance is moving—not in a blaze of headlines, but in the steady, photosynthetic quiet of small balances that refuse to drain away. Whether that slow-rooted growth yields a canopy wide enough to dethrone the dollar is uncertain; what is certain is that every additional renminbi outside China's borders makes the forest harder to uproot.

The original article was authored by Monique Taylor, a University Lecturer in World Politics at the University of Helsinki. The English version, titled "Rethinking China's renminbi strategy in a fragmenting global economy," was published by East Asia Forum.

References

Bank for International Settlements (BIS) Innovation Hub. (2024, October). Project m-Bridge: Connecting Economies through Digital Currencies — Pilot Results and Next Steps. Basel: BIS.

China Central Depository & Clearing Co. (CCDC). (2025, January). Monthly Bond Market Statistics. Beijing: CCDC.

East Asia Forum. (2025, 26 May). Wong, L. "Rethinking China's Renminbi Strategy in a Fragmenting Global Economy."

Hong Kong Monetary Authority (HKMA). (2025, April). Monthly Statistical Bulletin: Renminbi Banking Business. Hong Kong: HKMA.

International Monetary Fund (IMF). (2025, March). Currency Composition of Official Foreign Exchange Reserves (COFER), Q4 2024 release. Washington DC: IMF.

Modern Diplomacy. (2025, 27 May). "The Rise of the Renminbi: China's Strategic Move to Dethrone the U.S. Dollar in Global Trade."

People's Bank of China (PBoC). (2024). Payment System Development Report 2023 (CIPS statistics). Beijing: PBoC.

People's Bank of China (PBoC). (2025, 15 May). "PBoC Renews Bilateral Local-Currency Swap Agreement with the Central Bank of Brazil" (press release).

Reuters. (2025, 16 May). "China's Yuan Swap Lines Top RMB 4.3 Trillion — Analysis."

Shanghai Clearing House. (2025, 3 January). "Bond Connect Repo Expansion Notice."

SWIFT. (2025, May). RMB Tracker: Insights into the Renminbi — monthly issues used: December 2022, January 2023, March 2023, November 2024, January 2025, April 2025.