Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

When Washington proposed a 145% “Liberation Day” tariff, the trade policy landscape shifted from discussing marginal mark-ups to a critical stress test for the modern economy's machinery. A duty of such magnitude transforms every border crossing from a routine cost-minimization exercise into a life-or-death decision: do we maintain the artery open at a ruinous premium or cauterize it and hope for domestic substitutes before the patient crashes? By interpreting the tariff as a deliberate shock to supply chains and price stability rather than just another bargaining chip, we can understand why seemingly robust cushions like diversified sourcing and timely monetary easing become fragile when faced with such a threat. This analysis, which builds on the macro foundations laid by Auray, Devereux, and Eyquem and incorporates the Harvard Business Review’s perspective on U.S. infrastructure bottlenecks, underscores the potential for a triple-digit duty to push the boundaries from manageable friction to systemic rupture.

Supply Chains — The Hidden Amplifier of a Tariff Shock

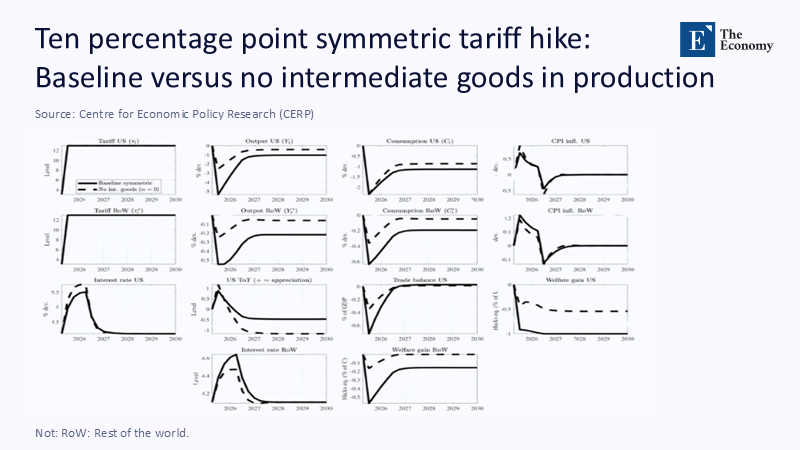

Auray, Devereux, and Eyquem’s dynamic model for CEPR was calibrated around a modest ten-percentage-point tariff hike. Yet, even that jolt sliced almost 3% off U.S. output on impact and hoisted consumer-price inflation by a third of a percentage point. Crucially, the output loss nearly halved when the authors stripped imported intermediates from the production function—essentially, imagining factories that rely only on labor. The result, reproduced in Figure 1 below, exposes global supply chains as both the transmission belt and the shock absorber of tariff pain.

In the solid-line baseline, the hit to U.S. consumption, the collapse in the trade balance, and the short but sharp spike in interest rates all trace back to a single mechanical fact: twenty-first-century factories import sub-components almost by reflex. Remove those foreign inputs (the dashed series), and the model’s welfare cliff recedes, but that “fix” only works on paper. Real boardrooms report far tighter margins for substitution. QIMA’s post-announcement survey finds four out of five U.S. buyers expecting a “major impact” on sourcing flexibility this year. At the same time, Willy Shih’s April Harvard Business Review essay reminds executives that qualifying a new circuit-board plant typically lasts six to nine months, and pharmaceutical fill-and-finish slots are booked two years out. The theoretical “global spare tire” is already bolted onto someone else’s axle. The clean counter-factual curve omits the gritty reality that certifying, tooling, and staffing substitute facilities demand both capital and calendar time the tariff clock does not grant.

Yet the same illustration also warns policy optimists: the production links that lifted growth over three decades now magnify pain at the speed of an overnight Federal Register notice. Cutting the chain is not simply a question of price; it is a question of whether the machine keeps turning. Add the wrinkle of retaliation—Canada, Mexico, China, and the EU have each published draft schedules targeting politically sensitive U.S. exports—and even the dashed relief line would bend lower once foreign demand recoils.

Monetary Policy — A Smoother Runway or a Longer Crash?

Monetary policy can soften the landing if supply chains cannot adjust on cue. The Federal Reserve’s staff simulations, shared by Governor Christopher Waller in St Louis, suggest a 25% average tariff could shove PCE inflation toward 5% under full cost pass-through, or four if firms absorb part of the squeeze. Minutes from the May FOMC meeting show officials caught between the Scylla of stagflation—prices up, output down—and the Charybdis of a disinflationary slump if households freeze spending. So far, the Committee has chosen to hold the policy rate at 4.25 – 4.50%, implicitly betting that patience beats tightening into a supply-side shock.

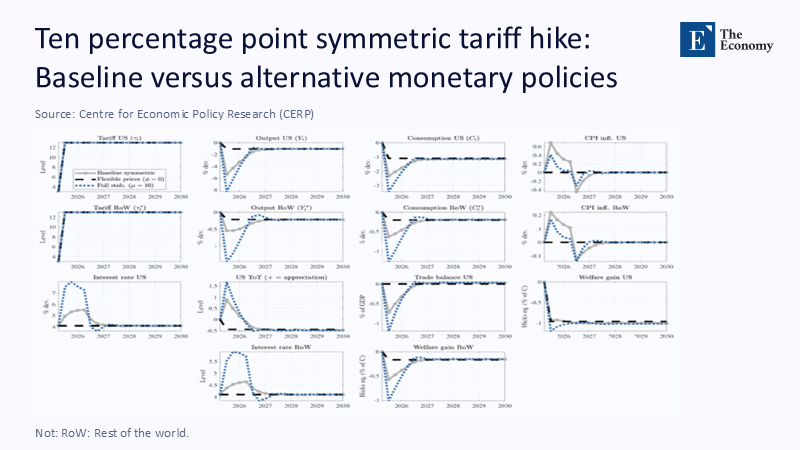

The CEPR team stress-tested that instinct by re-running the ten-point hike under alternative monetary rules. Figure 2 illustrates three regimes: the grey baseline, a dashed path with fully flexible prices (σ = 0), and a red path in which the central bank pursues “full stabilization” (μ = 10) by vigorously suppressing price swings.

Under aggressive stabilization, the Fed drives policy rates above 7% within months, crushing demand quickly enough to cap the CPI spike near zero. Yet, the reward is paltry: output and consumption remain almost as low as in the baseline, and welfare, measured by Hicks-equivalent variation, barely budges. With perfectly flexible prices, inflation never lifts off, but the real economy contracts even harder because nominal wages cannot stick above equilibrium. The message is stark: monetary finesse can redistribute pain across sectors and calendar quarters, but it cannot conjure missing circuit boards, gearboxes, or API vials back into American warehouses. At best, the Fed can buy corporate treasurers a little time to reroute orders; it cannot rewind the tariff clock.

When Macro Theory Meets Dock-Side Reality

While economists draw tidy impulse-response graphs, stevedores count containers. The Port of Los Angeles reports that sailings scheduled ten weeks ahead are down 35%, with lanes from China off as much as 60%. On the Atlantic, Savannah’s vessel planners warn that boxes are backing up on railheads because chassis utilization hit 95% in late April—well above the 80% level the system can sustain without cascading delays. Retailers front-loaded goods so heavily in the first quarter that March imports set a record $346.8 billion and drove the trade deficit to $140.5 billion, but the apparent resilience of Q1 GDP is a mirage; shelves are full, warehouses are stuffed, and replenishment at punitive prices is already stalling. Once inventories clear, the collapse in purchase orders will align with the supply shock, intensifying layoffs in transport, warehousing, and retail just as labor-force participation finally normalizes post-pandemic.

The ground truth at America’s ports also exposes a structural weakness that macro models smooth away: U.S. logistics infrastructure entered 2025 with pandemic-era scar tissue still visible. The national chassis pool is tight, rail hubs in Chicago and Dallas still run on twentieth-century signaling, and the trucking sector is short roughly 60,000 drivers. In this context, HBR’s warning that tariff responses are a “zero-or-one game” for mid-sized manufacturers rings painfully true. A single missing imported sub-component means the assembly line stops, not merely that margins are thin. Infrastructure capacity sets the threshold between bend and break in every practical sense.

Quantifying the Welfare Cliff at Triple-Digit Tariffs

A back-of-the-envelope Armington calculation, calibrated with an elasticity of -4, shows how steep the cliff edge becomes at 145%—driving the landed price from 1.0 to 2.45 trillion import volumes by roughly three-quarters. Foreign intermediaries comprise about 15% of U.S. gross output, so the direct drag on GDP reaches 11% before any multiplier effects. Layer on retaliation and input-output feedback loops of the type embedded in Kansas City Fed’s DSGE models, and peak-to-trough contractions on the order of 14 – 17% move from tail-risk to base-case. Meanwhile, headline inflation of nearly 5% would collide with falling real wages—an echo of the late-1970s stagflation that ended only with brutal disinflation and double-digit unemployment.

Designing an Exit Ramp Before the Clock Hits Zero

The policy must pivot from mitigation to controlled exit if robust supply networks and a dovish Fed cannot plug a tariff crater. Three principles stand out. First, invest in flexibility rather than brute capacity. Shuttle-train links between terminals and inland depots, modular trans-loading facilities that can toggle between rail and truck, and paperless customs routines that cut reroute lead times from weeks to days will do more to absorb shocks than another billion dollars of berth dredging. Second, invert the tariff schedule. A declining block levy that auto-ratchets downward as domestic capacity verifiably scales preserves bargaining leverage while unclogging investment pipelines. Third, codify a joint Fed-Treasury protocol. When tariffs breach a trigger, the central bank commits to “look through” the first-round price jump. Meanwhile, the Treasury cushions low-income households with targeted rebates, limiting demand destruction without conceding the negotiation field.

Why the Dikes Cannot Hold at 145%

The fundamental insight survives every modeling twist and boardroom anecdote: once tariffs cross into triple-digit terrain, the dikes cannot hold. Figure 1 shows that deleting foreign inputs on paper halves the shock, yet real-world plants cannot sever those ties overnight. Figure 2 demonstrates that even heroic monetary stabilization barely nudges welfare once supply chains seize. Live container counts confirm the arteries of commerce are already constricting, and the Fed’s scenario work concedes that rate policy can only dull—never neutralize—the inflation pulse. Strong supply networks and nimble monetary policy are necessary; they are insufficient. Without parallel investment in adaptive logistics and a tariff architecture that recognizes the finite capacity of any economy to absorb shocks, a 145% wall is not merely high—it is porous precisely where twenty-first-century commerce leaks value fastest. Policymakers have a narrow ninety-day pause to pivot from bravado to design. If they miss it, the binary future—trade or no trade—could bury a half-century of incremental integration beneath the rubble of the supply chains that once promised resilience.

The original article was authored by Stephane Auray, a Full Professor at the National School of Statistics and Information Analysis, along with two co-authors. The English version of the article, titled "Tariffs and retaliation: A macroeconomic analysis," was published by CEPR on VoxEU.

References

Auray, Stéphane, Michael B. Devereux, and Aurélien Eyquem. Tariffs and Retaliation: A Macroeconomic Analysis. VoxEU (Centre for Economic Policy Research), 2 May 2025.

Auray, Stéphane, Michael B. Devereux, and Aurélien Eyquem. Tariffs and Retaliation: A Brief Macroeconomic Analysis. NBER Working Paper No. 33739, May 2025.

A.P. Møller–Mærsk. Q1 2025 Investor Presentation. Copenhagen: A.P. Møller–Mærsk A/S, April 2025.

Brown, Chris. “Tariff Update May 5: Repair Costs Poised to Spike Under New Parts Tariffs.” Automotive Fleet, 5 May 2025.

Darmiento, Laurence. “Traffic at the Port of Los Angeles Set to Plunge amid Tariffs.” Los Angeles Times, 24 April 2025.

Federal Open Market Committee. Minutes of the Federal Open Market Committee, March 19–20 2025. Washington, DC: Board of Governors of the Federal Reserve System, 2025.

QIMA. Q1 2025 Barometer – Global Supply Chains Prepare for Uncertainty as New Trade Wars Loom. Hong Kong: QIMA, 21 January 2025.

Shih, Willy C., and Veronica Chua. “The Tariff Wars Just Upended Your Supply Chain—Here’s How to Adapt.” Harvard Business Review, 9 April 2025.

Waller, Christopher J. “The Economic Outlook.” Speech delivered at the Federal Reserve Bank of St. Louis, 14 April 2025.

Mutikani, Lucia. “Rush to Beat Tariffs Boosts U.S. Trade Deficit to Record High in March.” Reuters, 6 May 2025.