Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

When inflation expectations drift far from reality, central banks no longer manage the economy—they chase its mirage. In 2025, while the Federal Reserve holds policy steady and actual inflation cools below 3%, American households still brace for prices to rise more than twice that fast. This isn't just a perception gap—it's a policy failure with a price tag. When people don't understand what central banks signal, monetary policy loses its sharpest tool: expectation anchoring. This article argues that the credibility of central banks now hinges not on interest rate precision but on communicative clarity. Until households internalize the Fed's logic, rate hikes will overshoot, markets will misprice risk, and the economy will bear the unnecessary cost of misunderstood intent.

The Quiet Crisis Behind a Loud Economy: Urgent Need for Clarity in Monetary Policy Communication

When households expect prices to jump by 6% or 7% while the official inflation rate languishes closer to 2%, the problem is no longer cyclical noise—it is an information failure. In May 2025, the University of Michigan survey put one-year household inflation expectations at 7.3%, almost five full percentage points above realized CPI. That chasm has opened despite the Federal Reserve's best efforts at "forward guidance." It reveals a flaw more dangerous than any quarter-point policy error: if the public misreads the central bank's story, even perfect rate setting will leak welfare through the cracks of misunderstanding.

Understanding the Expectation Gap

Professional investors process every comma of an FOMC statement within seconds, but retail borrowers and wage-setters rarely tune in. The January 2025 CEPR study "Fed Communication for All – But Understood by Few" documents that only market professionals statistically adjust their projections after a policy meeting; household expectations barely move. The detachment shows up in complex numbers. Michigan's five-year expected inflation rate increased to 4.6% this spring, double the Fed's target. A wedge that size does not stay on paper: it changes wage bargains, prompts firms to front-load price increases, and lifts the term premium embedded in Treasury yields. Communication failure, in short, translates directly into a higher cost of capital and lower real household purchasing power.

The Unseen Price Tag of Misalignment

Policy researchers at the Laubach Conference this year offered a stark arithmetic. Each percentage-point gap between expected and realized inflation imposes roughly 0.1% of GDP in consumption-equivalent welfare losses through inventory mistakes, distorted contracts, and misallocated capital. With the current wedge hovering near five points, the annual bill approaches 0.5% of GDP, around $150 billion, more than the federal Head Start budget. Much of that loss is dead weight: it does not buy jobs, innovation, or infrastructure; it simply reflects households and firms acting on the wrong script.

When Fed Text Speaks Louder Than Press Conferences

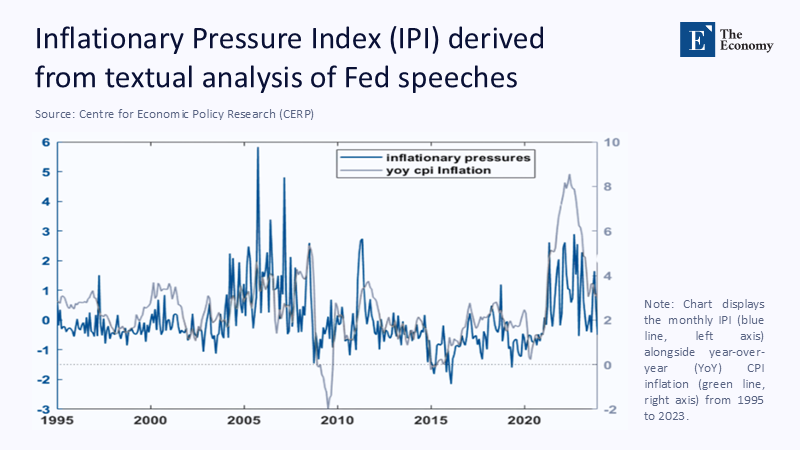

Figure 1 situates the communication problem in the Fed's own words. The blue line plots an Inflationary Pressure Index (IPI) extracted from every public Fed speech since 1995; the grey line is the actual year-over-year CPI. Apart from the post-dot-com disinflation and the 2009 financial crisis, Fed rhetoric has shadowed price reality with striking synchronicity, peaking in 2005, dipping during the Great Recession, and spiking again in 2021-22.

Yet that alignment exists only inside the corpus of speeches; it never fully transfers to public perception. The figure, therefore, exposes an irony: the Fed's semantic antennae are finely tuned, but the broadcast signal is scrambled somewhere between the Eccles Building and Main Street.

Hawks, Doves, and a Public That Only Sees Birds

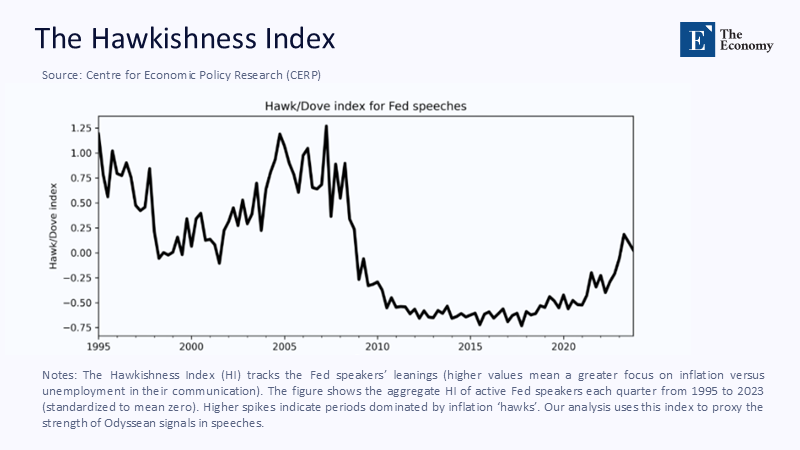

A second lens clarifies the residue of confusion. Figure 2 presents a Hawkishness Index (HI) that scores each Fed communication on a hawk-to-dove spectrum. The late 1990s were hawkish, reflecting pre-dot-com overheating; the 2010s dipped into dovish territory amid secular stagnation; and the last three years have seen a renewed hawkish ascent as policymakers fought the post-pandemic price surge. This index is crucial as it measures the Fed's stance on inflation and interest rates, directly influencing the public's perception of the economy and financial decisions.

For market economists, these swings map cleanly onto Taylor-rule prescriptions. For households, they read as an erratic chorus: Are rates going up, down, or sideways? The CEPR column "Monetary Policy in the News" shows why. Analyzing three decades of press coverage, it finds that newspaper tone explains up to a quarter of the variation in household expectations when inflation is volatile—an effect an order of magnitude larger than the direct impact of the FOMC statement itself. Where the Fed speaks in sequences of probabilities, headline writers compress nuance into click-worthy absolutes, often inverting the intended signal.

The Media as Relay—and Risk Amplifier

The indirect route through journalists and influencers might be harmless if the filter were transparent, but evidence suggests otherwise. During the March 2025 policy meeting, the FOMC maintained its 4.25 to 4.5% target range and issued a boilerplate note that "risks to achieving the Committee's goals have moved toward better balance." Within hours, cable news chyrons blared "Fed Signals Imminent Cuts," while several online outlets declared "High Rates Here to Stay." Each headline captured a sliver of truth, yet they produced a fog dense enough to obscure the Fed's actual reaction function in aggregate. Sensing narrative risk, Bond markets priced ten-year yields 25 basis points higher the following week despite unchanged fundamentals, a move Cleveland Fed staffers attributed to a rising term premium.

Institutional Cross-Winds Complicate the Message

Politics has given the miscommunication problem fresh urgency. A Supreme Court ruling two days ago carved the Federal Reserve out of the president's new powers to dismiss agency heads, formally cementing its independence. Paradoxically, the decision narrows the set of democratic checks on the central bank precisely when high grocery bills are testing public trust. Independence without intelligibility can look like technocracy bordering on aloofness, fuelling the conspiracy theories that already populate social media. Unless the Fed finds a way to converse in everyday metaphors, judicial insulation may heighten, not dampen, the political backlash that ultimately undermines policy credibility.

Communication Architecture: From Revelation to Engagement

Classical central bank transparency relied on revelation: release forecasts, publish minutes, and trust rational agents to incorporate the information. That model assumes a public that reads PDFs and updates Bayesian priors. Behavioral evidence says otherwise. Gasoline prices—vivid and ubiquitous—exert more influence on expectations than the entire CPI basket. At the same time, TikTok influencers summarise FOMC meetings in thirty seconds to millions of viewers. The St. Louis Fed's "In Plain English" portal, which translates complex monetary policy jargon into everyday language, is a worthy step. Still, its web traffic is eclipsed by a single viral clip of a finance vlogger dramatically shredding supermarket receipts. In 2025, engagement beats access; a message unheard might as well be unspoken. This portal is a significant step towards making monetary policy more accessible to the public, but it also highlights the need for more engaging and relatable communication strategies.

Policy Experiments with Narrative Engineering

Some central banks are already prototyping new tools. The Bank of Canada now attaches YouTube explainers to every rate decision in three languages. The Reserve Bank of New Zealand live-streams pressers on Instagram, complete with audience Q&A. Early metrics show viewers retain twice as much policy content from a two-minute video as a 500-word summary. The Fed could pilot similar "storyboards" that visualize its reaction function: if core PCE stays above 3% and unemployment below 4%, rates drift one baby step higher; if either threshold breaks, the path pauses. By pre-plotting conditional trajectories, the Fed would trade a sliver of discretion for a giant leap in public comprehension. This use of 'storyboards' could significantly enhance the public's understanding of the Fed's reaction function and the factors that influence its policy decisions, thereby fostering more informed public expectations and reducing the risk of miscommunication.

Designing for Cognitive Friction, Not Just Transparency

Transparency is necessary but insufficient. People recall vivid anecdotes over statistics, so the Fed must package data inside narratives that stick. Consider embedding personal finance calculators in every statement, allowing users to estimate how a 25-basis-point change affects their mortgage payment. Or partner with state curricula so that high-school economics classes dissect a live FOMC release each semester, turning rote textbooks into real-time case studies. Such strategies create cognitive friction—they force audiences to manipulate the numbers themselves, locking the content into long-term memory far better than passive reading.

A Three-Point Blueprint for Closing the Gap

1. Precision Over Poetry. Retire Delphic modifiers like "moderate" or "robust." Instead, pair each adjective with a numeric band ("moderate growth = 1.5–2.5% annualized GDP"). Investors already do this translation; households deserve the legend on the map.

2. Participation Over Broadcast. Co-author content with teachers, community groups, and, yes, social media creators who already command the audience the Fed lacks. The goal is not to surrender the narrative but to disseminate it through trusted messengers.

3. Pre-Commitment Over Hints. Publish fan-chart paths that show explicit baby-step, big-step, or pause scenarios tied to core variables. Critics warn this reduces flexibility; the welfare cost of surprise now dwarfs the option value of silence.

Align the Story—or Keep Paying the Premium

Economists love equations, but the economy ultimately runs on stories people believe about tomorrow's prices. Figures 1 and 2 show that the Fed's rhetoric contains a wealth of quantitative foresight; the tragedy is that those signals rarely reach the wider public unwarped. Every basis-point mis-expectation echoes through labor contracts, shelf prices, and bond yields, imposing real costs that dwarf the marginal gains from finer model calibration. The Supreme Court may have insulated the Fed from politics, but it cannot shield policy from the silent tax of misunderstanding. That task falls to communication, not in volume, but in clarity. Until households can finish the Fed's sentences, the central bank will keep paying and making us pay for a conversation we never truly heard.

The original article was authored by Eleonora Granziera, a Research Economist at Norges Bank Investment Management, along with three co-authors. The English version of the article, titled "Fed communication for all – but understood by few," was published by CEPR on VoxEU.

References

Blinder, A S, M Ehrmann, M Fratzscher, J De Haan and D Jansen (2008), “Central Bank Communication and Monetary Policy: A Survey of Theory and Evidence”, Journal of Economic Literature 46(4): 910–945.

Coibion, O, Y Gorodnichenko and B K Kamdar (2023), "Fed Communication for All – But Understood by Few", VoxEU (CEPR), 14 September.

Andrei, D, C Ferrari and D Wessel (2024), "Monetary Policy News: FOMC's Media Coverage and Inflation Expectations", VoxEU (CEPR), 8 March.

University of Michigan (2025), "Survey of Consumers – Preliminary Results, May 2025", Ann Arbor: Surveys of Consumers.

Federal Reserve Board (2025), "Federal Open Market Committee Statement, 19–20 March 2025", Washington, DC.

Laubach Research Conference (2025), "Inflation Dynamics and Expectations: Proceedings of the May 2025 Conference", Board of Governors of the Federal Reserve System.

Mester, L J (2025), "Remarks at the Economic Club of New York", Federal Reserve Bank of Cleveland, 6 May.

Federal Reserve Bank of St. Louis (2024), "In Plain English: The Fed Explained", St. Louis Fed Educational Resources.

Supreme Court of the United States (2025), "Opinion in State of Texas v. Federal Reserve Board", 599 U.S. ____.

Bank of Canada (2024), "Monetary Policy Report", October 2024, Ottawa.

Reserve Bank of New Zealand (2024), "Live Press Conference: November 2024 Monetary Policy Statement", Wellington.