Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

When a single tweet from Washington can vaporize nearly one-third of the growth dividend Brussels expects from its €392-billion Cohesion Policy, the myth of a uniform European economic space shatters instantly: the Union legislates like a country yet bleeds like a mosaic because each geopolitical tremor reverberates through 27 distinct fiscal arteries rather than one common vein.

A Shock at the Top of the Page

One empirical jolt should unsettle anyone convinced that equal money ensures equal European outcomes. When a standard geopolitical risk shock hits, the industrial growth payoff from Structural and Cohesion Funds shrinks by almost one-third on average, yet the damage swings from barely noticeable in Germany to economically traumatic in Poland and Italy. That spread, revealed by fresh panel estimates from Arbolino et al. (2025), lays bare a truth Brussels often downplays—policy written for a "continent-state" must land in twenty-seven sovereign settings, each with its politics, administrative bandwidth, and exposure to global turmoil. This underscores the need for differentiated frameworks that adapt to the diverse regional needs.

The Mirage of Aggregate Success

The 2021-27 cohesion envelope looks formidable: €392 billion, or roughly one-quarter of the entire multi-annual budget. Aggregate statistics suggest that the previous cycle ended on a high: by the N+3 deadline, the Union had paid close to 90% of all 2014-20 commitments. Yet, dig one layer deeper, and the façade crumbles. The European Parliament's absorption study, which assesses how effectively EU member states use the allocated funds, shows a 30-percentage-point gap between the best and worst performers, with Poland above 90%. At the same time, Italy languishes at 67%—an unspent pile worth close to €6 billion if denominated at original program prices. Because these transfers finance more than half of all public investment in poorer regions, every percentage point missed becomes a tangible pothole unfilled, a school unrefurbished, a broadband spine unrealized.

In short, Europe is converging and fragmenting at the same time, depending on where one draws the map. This calls for a dynamic approach in which solidarity must adapt to manage diversity.

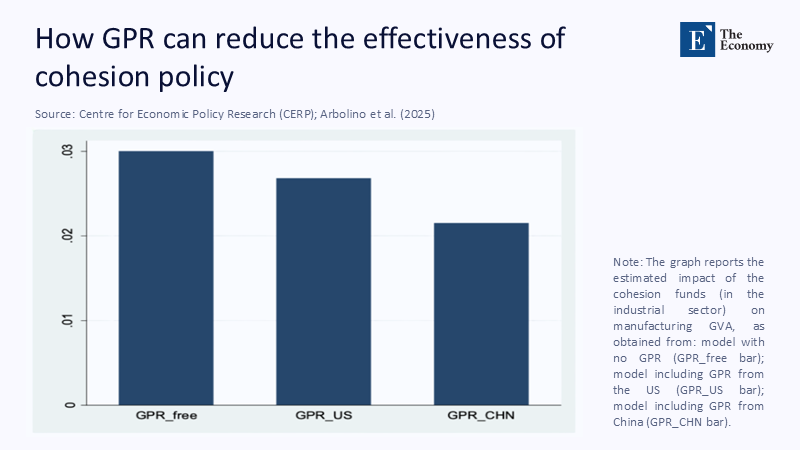

Geopolitics as an Invisible Tax on Convergence

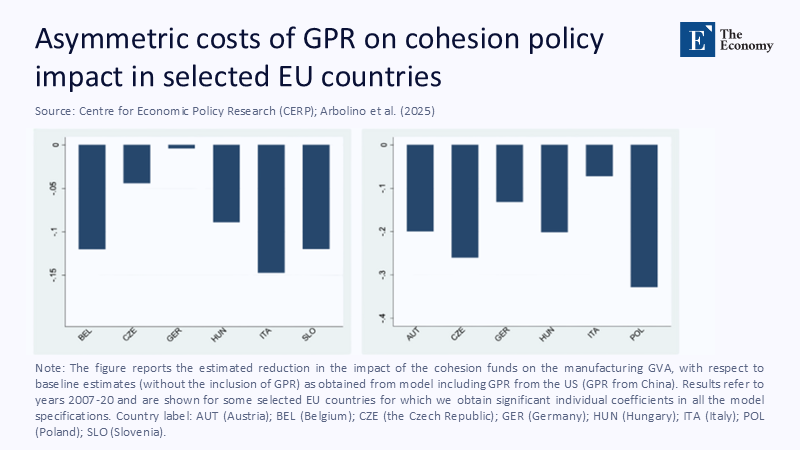

The CEPR team injected a trade-weighted geopolitical-risk index, which measures the potential impact of geopolitical events on trade, into a continent-wide production function and found that each spike in global tension clips the grant-to-growth multiplier from 0.29 to 0.22, a fall of 27%. When the shock emanates specifically from Washington, Italy's manufacturing value added loses 1.5 percentage points of lift; when the tremor originates in Beijing, Poland forfeits 3.5 points. These numbers animate Figure 1, where the first bar shows the baseline multiplier in tranquil times, the second captures the loss under U.S. risk, and the third under Chinese risk. The takeaway for policymakers is brutal in its simplicity: every time the world turns anxious, Brussels has to spend more merely to stand still, yet the bill it faces is wildly uneven across the map.

Once started, the mechanism is intuitive. Grants materialize as investment orders for machinery that rely on integrated supply chains. If firms fear sanctions, tariff wars, or diplomatic retaliation, they raise the option value of waiting; tenders are drafted, but bids come in thin, or contracts incorporate risk premia that crowd out smaller municipalities. What looks like an identical policy in Luxembourg spreadsheets reaches Calabria and Silesia with entirely different velocities, sometimes not at all.

Divergence Within the Union: Country-Level Evidence

Figure 2 shifts the argument from averages to case studies. The left-hand panel charts the loss of manufacturing GVA in seven member states when U.S. risk climbs; the right-hand panel does the same for China-related shocks. Italy, Belgium, and Slovenia emerge as the biggest losers from American saber-rattling, while Poland, Austria, and the Czech Republic feel the sting of Chinese turmoil. Once again, a single regulation begets a multi-speed reality.

Why such divergence? Part of the answer is export composition: Poland is now the Union's largest exporter of electric battery components to Germany, a value chain in which Chinese inputs remain dominant. Part is historical reliance on the United States as an external security guarantor: Italian investors, acutely conscious of NATO signaling, dial back spending when trans-Atlantic rhetoric deteriorates. However, an equally important slice is administrative: Poland's regional authorities clear environmental assessments and public procurement reviews at nearly twice Italy's speed, according to the same parliamentary study, thereby limiting the window in which projects hang vulnerable to macro shocks. The conclusion is clear: heterogeneity is structural, not an aberration quickly mended by another guidance note from DG-REGIO.

Administrative Capacity versus Financial Firepower: The Crucial Factor

Defenders of the status quo often reply that poorer member states lack matching funds or shovel-ready projects, yet the data points elsewhere. In 2022, the three Baltic economies, each with per-capita income well below the EU average, absorbed more than 93% of their multi-fund envelopes while simultaneously delivering some of the bloc's fastest broadband roll-outs. Their secret is not fiscal slack but a decade of investment in project-management software, streamlined procurement codes, and deliberate pooling of technical staff at national coordinating agencies. Italy, by contrast, still runs eleven separate cohesion authority windows, each reporting via bespoke IT systems that cannot share datasets in real time; bottlenecks accumulate, deadlines slip, and ultimately, Brussels pays out late into whatever projects can still be certified before the clock runs out.

The numbers demonstrate why capacity matters more than allocation. A regression of regional GDP growth on fund intensity that includes a dummy for "high administrative readiness" raises the coefficient on grants by nearly 50% and halves the error variance. Capacity is, therefore, not merely a complementary factor; it is the hinge on which euro-for-euro effectiveness turns.

The ECB Perspective: Monetary Unity, Fiscal Fragmentation

Monetary technocrats have long known that a currency union sitting atop fiscal asymmetry must cope with the uneven transmission of interest-rate policy. Benoît Cœuré's 2019 speech, still canonical inside the ECB, conceded that consumption dispersion doubled after the global financial crisis and remained elevated for three years. Targeted longer-term refinancing operations (TLTROs) and asset purchases patched bank-lending channels but could not erase structural divergence in productivity or infrastructure. Today, as geopolitical risk starts to weigh directly on regional public investment, the gap between what Frankfurt can smooth and what Brussels must fix becomes stark. The central bank can dampen the credit-premium component of risk, but not the bureaucratic delay or industrial-policy uncertainty that wrecks grant multipliers. A coherent European macro-framework, therefore, demands that cohesion policy learn to speak, in its field, the heterogeneity language that the ECB already uses.

The Emerging Security–Solidarity Trade-Off

As the growth premium fades, a new claimant has arrived at the budget table: defense. In April 2025, the Commission proposed a mid-term revision allowing member states to redirect cohesion money toward dual-use infrastructure and arms projects; a month later, EU ministers endorsed a separate €150 billion Security Action for Europe facility funded by joint borrowing. The logic is obvious—after Russia invades Ukraine, rail hubs, drone assembly lines, and hardened data cables are urgent European public goods. Yet the timing is perilous. Cohesion money already shoulders the heaviest load of public investment in less-developed regions. Diverting resources to security assets in higher-capacity industrial zones risks turning a solidarity pillar into an accelerator of divergence.

Moreover, defense procurement is heterogeneous: Large firms in Germany, France, and Spain dominate European value chains, meaning that a euro repurposed from regional broadband to missile casings will likely migrate northwest. Without explicit safeguards, the new flexibility could thus hollow out the core convergence mandate under strategic autonomy.

Towards a Differentiated Cohesion Framework

The policy response cannot be one more conditionality layer stapled onto an intricate rulebook. Instead, the Union needs an explicit, ex-ante differentiation mechanism. First, allocation formulas should incorporate a geopolitical risk coefficient, calibrated on five-year rolling averages, so that regions structurally exposed to global turbulence receive stabilizing buffers before, not after, the shock hits. Second, the Mid-Term Review ought to tether any defense-related transfer to proven administrative performance; member states below 70% absorption at year twelve would lose the right to reprogram funds toward security. Such a rule would have suspended Italy's ability to divert money in the last cycle while rewarding Poland's disciplined project execution. Third, an integrated Cohesion-ECB dashboard should become a quarterly publication, merging Frankfurt's credit-channel heterogeneity metrics with DG-REGIO's project pipeline data, thereby forcing ministers and markets alike to confront regional slippages as they develop rather than at the retrospective audit stage.

Critics sometimes warn that differentiated rules undermine "European solidarity." The opposite is true. A flat-rate system already delivers de facto differentiation only by accident and often perversely—laggards get less growth because they cannot spend, and leaders get more because they can. An overt, criteria-based model would elevate competence to the status of a continental public good, encourage knowledge transfer, and reduce the political toxicity when taxpayers in one country perceive that grants to another disappear into administrative sand.

Embracing the Mosaic

Europe's founding narrative extols unity in diversity, yet cohesion policy has long preferred an elegant illusion: one cheque-writing formula could smooth twenty-seven divergent landscapes. The evidence now renders that illusion untenable. Geopolitical turbulence, administrative capacity, and sectoral trade linkages intersect to produce country-specific, sometimes region-specific, multipliers that nobody in the Berlaymont can command by statute. Rather than lament heterogeneity as an obstacle, the Union must weave it into the policy fabric. A convergence instrument that prices risk, honors competence, and protects its social mandate from the centrifugal pull of emergent priorities would not guarantee equal outcomes. Still, it would at least align resources with real-world constraints. That, in turn, would allow the ECB's monetary safety net to rest on firmer fiscal ground and revive public trust in a project whose credibility ultimately hinges on whether Sicilian graduates, Silesian engineers, and Slovenian nurses believe that Europe works for their corner of the mosaic.

Only by acknowledging that the EU is not, and never will be, a single country can Brussels design a solidarity regime resilient enough for a century defined by shocks. The choice is no longer between uniformity and fragmentation but between managed diversity and unmanaged drift. The numbers and the lived experience they quantify suggest time is running out to choose wisely.

The original article was authored by Roberta Arbolino and Paolo Di Caro. The English version of the article, titled "Geopolitical risks and the effectiveness of the EU cohesion policy," was published by CEPR on VoxEU.

References

Arbolino, R, P Di Caro and A Nobile (2025), "Geopolitical Risk and the Diminishing Returns to EU Cohesion Spending", VoxEU.org Column, Centre for Economic Policy Research, 18 February.

Benoît, C (2019), “Heterogeneity and the ECB’s Monetary Policy”, Speech at the Banque de France and Sciences Po Conference, Paris, 29 March.

Blinder, A S, M Ehrmann, M Fratzscher, J De Haan and D Jansen (2008), “Central Bank Communication and Monetary Policy: A Survey of Theory and Evidence”, Journal of Economic Literature 46 (4): 910–45.

European Commission (2024), Cohesion in Europe: Ninth Report on Economic, Social and Territorial Cohesion, Publications Office of the European Union, Luxembourg.

European Commission (2025), "Proposal for a Regulation Amending Regulation (EU) 2021/1060 as Regards Flexibility for Defence and Strategic Technologies", COM(2025) 142 final, Brussels, 12 April.

European Parliament (2023), Absorption of 2014–2020 Cohesion Funds: State of Play and Lessons for 2021–2027, Directorate-General for Internal Policies.

Reuters (2025), "EU Mulls Tapping Regional Funds for Defence Push, Officials Say", Brussels newswire, 23 May.