Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

The revelation came in the first quarter of 2023 when the benchmark ten-year U.S. Treasury delivered a negative 3.5% real return while the broad European equity benchmark, the Stoxx 600, yielded a real gain. That data point flipped a hundred years of portfolio wisdom on its head. It exposed a new law of motion for capital: nominal safety morphs into a liability in an inflationary supply recession.

A Tale of Two Crises — and Two Very Different Safe Assets

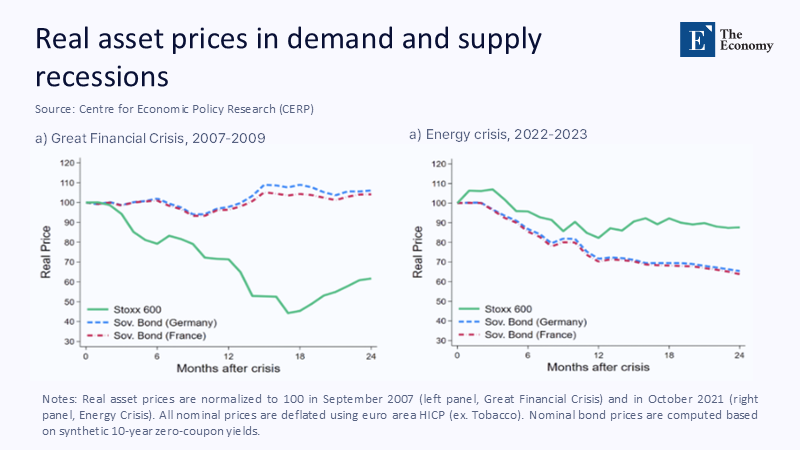

The popular narrative treats every downturn as a demand shock that rewards holders of government paper. Yet the numbers refuse to comply when the dominant disturbance is a bottleneck in supply. Figure 1 contrasts asset-price dynamics after the 2008–09 Great Financial Crisis with the 2022–23 energy crunch. In 2008, real prices of German and French sovereign bonds rose more than 10% within eighteen months while equities bled. 2022 the script flipped: the Stoxx 600 fell early but re-stabilised, whereas real sovereign-bond prices slid relentlessly, shedding roughly one-third of their value in less than a year. The pattern validates the thesis advanced by Faraglia, Lettau, and co-authors: convenience yields, which normally immunize bondholders against recessions, evaporate when the shock arrives through cost-push inflation rather than collapsing demand.

The arithmetic is unforgiving. Real Yield ≃ Nominal Yield – CPI inflation. From October 2021 through December 2023, headline euro-area HICP printed 6.8% on average, while the German ten-year Bund struggled to stay above 2.5%. A holder of Bunds, therefore, forfeited 4.3% of purchasing power every year. Equity, by contrast, builds inflation into the numerator of its valuation by transmitting higher prices into revenue (assuming margins are not completely erased). Investors, especially those with real liabilities such as pensions, chose the lesser of two evils and trimmed sovereign duration by an estimated €370 billion across European mutual funds, according to ECB settlement data.

How a Negative Convenience Yield Grows Out of a Positive Inflation Risk Premium

Traditional models include a positive "convenience yield" because a sovereign bond serves as pristine collateral: it can be rehypothecated, used to meet regulatory liquidity ratios, or pledged in repo without a haircut. However, the convenience yield has a limit set implicitly by the inflation risk premium (IRP). As long as IRP is near zero, investors accept a modest negative carry in exchange for liquidity. But when IRP spikes — indicating fear that future cash flows will be devalued — the convenience yield must offset not only time value but also the new inflation risk.

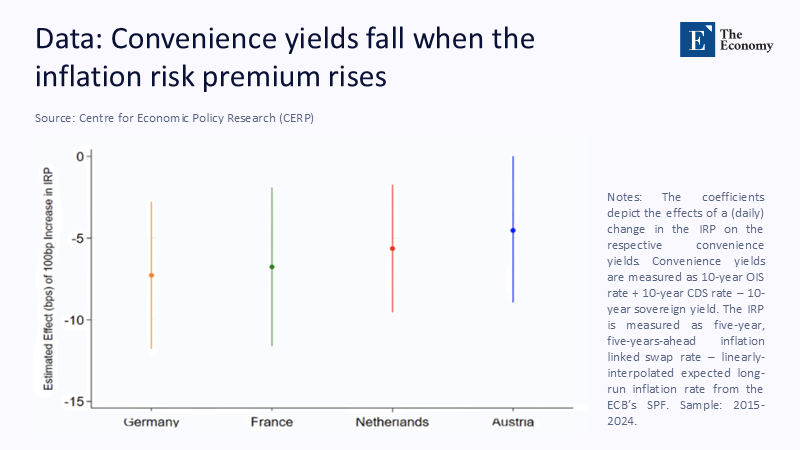

Figure 2 converts that logic into data. A one-hundred-basis-point jump in the euro-area five-year-five-year inflation-swap premium slices seven to nine basis points off the convenience yield of German, French, Dutch, and Austrian ten-year paper. The bar is steeper where fiscal space is thinner (France) and shallower where debt dynamics appear safer (Germany), underscoring that convenience is partly a fiscal-credibility story. The relationship survives after controlling for credit-default-swap spreads, reaffirming that the culprit is inflation risk rather than solvency anxiety.

The mechanism echoes recent internal ECB research showing that the swap-bund spread — a high-frequency proxy for convenience value that measures the difference between the interest rate on a government bond and the interest rate on a swap contract — flipped from +20 basis points in 2019 to –-5 basis points at the height of energy shortages, meaning dealers demanded extra yield to hold Bunds even after accounting for credit safety.

Natural-Rate Illusions and the Real Yield That Investors Can Observe

Economists may argue over the exact level of the natural interest rate (r*), but markets only need a rule of thumb. When the yearly coupon on a bond is half the rate of grocery-store inflation, no complex analysis is required: the saver is in for a sure loss. Holston-Laubach-Williams estimates the U.S. post-pandemic r* at roughly 0.2%. This means a Treasury that pays 3% amid 7% CPI is close to five standard deviations below equilibrium. Because central bank forward guidance ostensibly tracks r*, each negative print in real yields worsens the public perception that policy is "behind the curve," accelerating the exit from fixed-income safe assets.

Quantitatively, the share of foreign-official holdings in outstanding Treasuries slipped from 34% in 2019 to 27% in 2024, according to U.S. TIC data, while reserve-manager allocations to gold rose from 13% to 16% of global reserves. That pivot represents US$550 billion that previously subsidized U.S. deficits via convenience premiums.

A Capital Migration Toward Productive Risk

The lost money had to find a new home. One channel is the surge in euro-denominated commodity ETFs, whose assets under management tripled between September 2021 and April 2024, riding both nominal-price gains and net inflows. At the same time, listed European corporates exploited negative fundamental discount factors by issuing €210 billion in secondary equity over the same period. Citigroup's proprietary flow-of-funds database confirms that more than half of those proceeds replaced term-loan bank debt, revealing a strategic shift in corporate capital structure prompted by the perceived cheapness of equity relative to fixed-rate borrowing.

The textbook substitution effect also appears across household portfolios. In Germany, life insurance providers — historically the single largest domestic buyers of Bunds — cut sovereign exposure from 46% of total assets in 2020 to 32% in early 2024, reallocating primarily into investment-grade credit and diversified dividend funds that promise partial inflation pass-through. The delta in demand shows up in auction metrics: the Bundesbank's latest thirty-year reopening tailed by eleven basis points and cleared with a bid-to-cover ratio of 0.92, the weakest since 2009.

Fiscal Arithmetic Meets Monetary Tightening: A Feedback Loop Few Treasuries Can Afford

Higher coupons feed directly into the government's cash-flow strain. OECD simulations suggest that a one-percentage-point permanent rise in nominal-bond yields increases the average advanced-economy debt-service ratio by 3% of GDP after five years. Absent faster growth, and productivity statistics remain limp, debt sustainability pushes fiscal authorities toward either consolidation or financial repression. The former collides with post-pandemic political realities; the latter contaminates bank balance sheets and constrains credit to the private sector. Investors understand the game and demand an additional term premium, compounding the vicious circle that economists label fiscal dominance.

Cumulating the feedback reveals a striking statistic: in 2024, the weighted average maturity of euro-area sovereign debt was shortened by fourteen months, a deliberate policy choice to postpone the affordability crisis into the next electoral cycle. Yet shorter tenors thin out the markets where convenience is greatest (the five—to fourteen-year sector), eroding the last remnants of demand by institutions requiring benchmark-curve depth for hedging.

Engineering a New Social Contract for Safe Assets

Against that backdrop, the temptation to restore demand via regulatory command will be great. Europe's 2024 Insurance Capital Directive already grants capital relief for domestic sovereign holdings; the United States is debating similar tweaks for bank liquidity rules. These measures buy time but at the cost of deeper entanglement between sovereigns and financial intermediaries, the doom loop that made the euro crisis so dangerous. A sustainable fix cannot rely on compulsion but on product design and fiscal credence.

One promising route lies in inflation-linked debt. The U.K. Debt Management Office issues roughly one-quarter of gross funding through index-linked gilts; bid-to-cover ratios have held above 2.0 even at the height of CPI spikes. However, excessive linkers cannibalize nominal benchmarks crucial for swap pricing, and indexation shifts inflation risk from saver to taxpayer only if the latter can absorb it. A more balanced instrument is the floating-rate note (FRN) tied to overnight secured benchmarks. FRNs preserve the asset-side liquidity of sovereigns while relieving investors of duration and inflation risk. France raised nearly €60 billion through BTF-linked FRNs in 2024 at spreads close to zero over the compounded €STR, a modest but telling proof of life for the convenience-premium concept.

Further out, GDP-linked securities can align coupons with taxable capacity. Greece's post-restructuring GDP warrants trade around 77 cents on the dollar versus an issue price of 44, illustrating investor appetite for convex macro hedges once governance is credible. Novel as they seem, such instruments echo eighteenth-century consol logic: variable payouts in exchange for durable capital. Standardization is challenging; without a harmonized contract architecture, secondary liquidity — the lifeblood of convenience — will remain thin.

Transparency as the Twenty-First-Century Convenience Yield

In a world where nominal stability cannot be guaranteed, the scarce asset becomes information. Investors will pay for real-time fiscal telemetry that reduces uncertainty about inflation paths. Chile's Sovereign Asset-Liability Management system, which releases machine-readable expenditure and revenue data every fortnight, enjoys one of the lowest term premia among emerging markets despite comparable debt metrics to its Latin American peers. The implication for advanced sovereigns is clear: upgrade the data pipeline or forfeit part of the privilege that once came automatically with reserve-currency status.

Digital bond platforms can amplify that effect. A fully distributed-ledger issuance of Italian BTPs in late 2024 shaved three basis points off the auction yield relative to conventional paper, primarily because auto-reconciliation reduced settlement fails — a hidden tax on repo users who prize "hard collateral." Technology, therefore, offers a pathway to reconstructing convenience not by subsidizing the coupon but by shrinking the frictions that make alternative assets more attractive.

Earned Convenience or Political Coercion

Pandemic-era supply shocks have exposed a dangerous complacency in sovereign debt management. Negative real coupons, once a curious artifact of post-crisis QE, became the normal price of liquidity precisely when investors learned that liquidity does not offset an inevitable loss of purchasing power. The evidence—from the blunt contrast in Figure 1 to the granular regressions embedded in Figure 2—demonstrates that the convenience yield is neither immutable nor free. It must be earned through credible fiscal frameworks, adaptive bond design, and transparent data.

Should governments choose instead to compel demand through regulation or stealth caps, the bond market will mutate into a captive venue that no longer prices risk, replicating the dysfunctions of the 1970s. The alternative is harder but ultimately cheaper: Concede that the "risk-free rate" is a promise that must be backed by real value, not nostalgia. Only by aligning payouts, policy, and probability can sovereigns restore the privilege of borrowing cheaply when the next shock — supply-side or otherwise — inevitably arrives.

The original article was authored by Matthias Gnewuch, an Economist at European Stability Mechanism, along with two co-authors. The English version of the article, titled "Sovereign bonds, convenience yields, and the resurgence of supply shocks," was published by CEPR on VoxEU.

References

Bianchi, F., Lettau, M., & Jordà, Ò. "Sovereign Bonds, Convenience Yields and the Resurgence of Supply Shocks," CEPR VoxEU, 2025

European Central Bank. "No Longer Convenient? Safe-Asset Abundance and r*," Speech, February 2025.

European Central Bank. Economic Bulletin, Issue 4 / 2024, Chart 17.

OECD. "Benefits and Costs of Asset Purchases," Keynote, May 2024.

Reuters. "View: ECB Delivers Another Rate Cut," June 2025.

STOXX Ltd. “STOXX Europe 600 Factsheet,” 2025