Input

Changed

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

When a single jurisdiction can cut photovoltaic module costs by nearly a third in a calendar year or double its robot density in four, the compounding of factory-floor learning becomes inseparable from geopolitical leverage. The world’s unease over Chinese “overcapacity” is thus less about gluts of batteries or steel than about the strategic aftershocks of rapid, state-aligned efficiency gains. Beijing’s plant managers and policymakers have fused two engines—algorithmic process optimization and heavy industrial subsidy—into a flywheel that spins ever faster even when tariffs rise. Any policy response that ignores one side of that duality will miss the entire physics of the problem. This underscores the need for strategic interdependence, where nations work together to ensure global stability and prosperity.

The Invisible Compound Interest of Manufacturing Learning

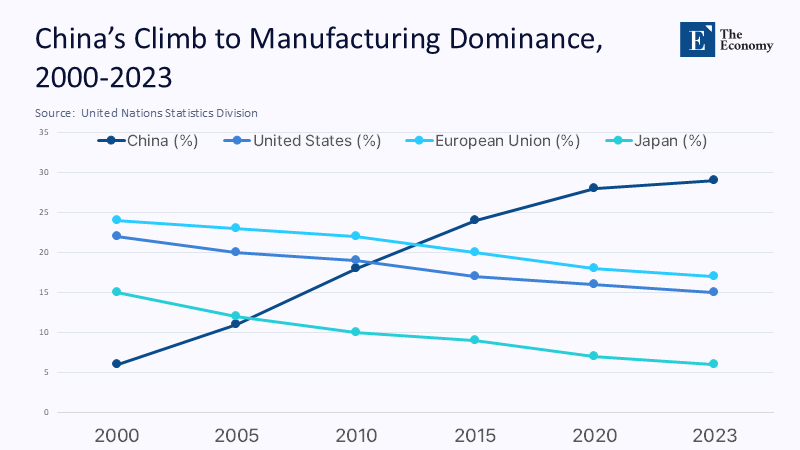

China now generates roughly 29% of global manufacturing value-added, more than the next four economies combined, according to United Nations data for 2023. That share stood below 6% at the turn of the millennium. Classic growth theory would attribute the leap mostly to factor accumulation, yet a closer look suggests exponential learning effects. Each doubling of output in China’s solar-PV sector between 2010 and 2023 delivered an average 28% decline in module cost—a textbook expression of Wright’s Law, which states that costs will fall by a consistent percentage for every cumulative doubling of units produced. This phenomenon is on a scale unmatched elsewhere. Cost curves are, therefore, compounding assets: every extra shipment lowers the marginal price of the next, setting off a self-reinforcing cycle that no import duty can neutralize once critical mass has been reached.

Subsidy Architecture: Capital as Catalyst, Not Crutch

None of these cost compressions occurred in a policy vacuum. Beijing channels concessional credit through state banks, discounts industrial power tariffs, and—in strategic sectors such as EV batteries—front-loads depreciation allowances so aggressively that plants can recoup capital costs in half the time of their North-Atlantic peers. IMF gravity-model estimates suggest subsidies lift Chinese export volumes by about two percentage points relative to a no-subsidy baseline, magnifying spillovers along each supply-chain link. Yet the same study finds that artificial incentives become far more potent when layered atop productivity trends. In this view, the subsidy is less a prosthetic and more a high-octane accelerant thrown onto an already burning learning curve.

The Algorithmic Factory: Robots, Sensors and the New Taylorism

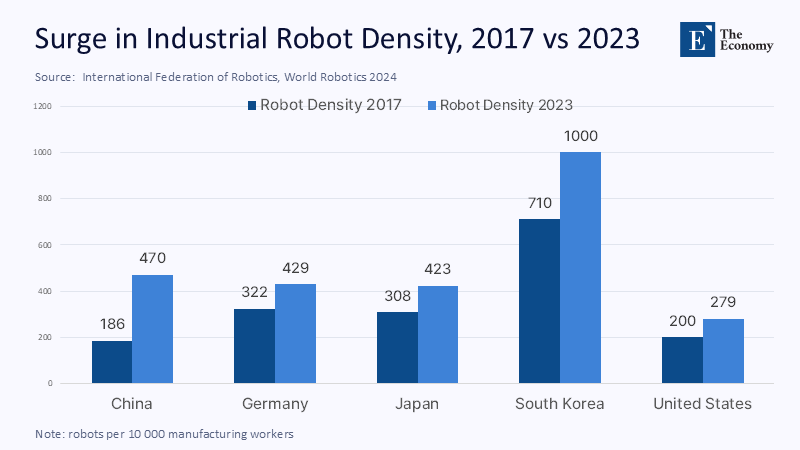

The productivity half of the equation is increasingly visible. The International Federation of Robotics reports that in 2023, Chinese factories operated with 470 industrial robots per 10,000 workers, up from 186 in 2017; Germany, long the benchmark, now ranks fourth at 429. Crucially, robot density is only the hardware headline. Behind the gantries hums an invisible decision stack: IoT sensors stream vibration and temperature data into in-house Manufacturing Execution System (MES) software; cloud-trained machine-vision models flag defects in milliseconds; predictive-maintenance algorithms schedule downtime between shift changes. By 2024, Foxconn’s “dark factories” in Shenzhen reported first-pass yields above 99.7%, a statistic that shrinks the unit-labor cost penalty of reshoring to the West—because the labor share itself is evaporating in China.

Solar PV: Wright’s Law at Gigawatt Scale

Photovoltaics offers the clearest laboratory for scale, subsidy, and software synergy. In 2010, a standard multi-silicon module sold for around US $1.60 /W. By late 2024, Chinese plants were quoting bulk prices below US $0.11 /W, with half the delta attributable to direct progress along the learning curve and roughly one-sixth to state-enabled access to zero-interest “green” loans and discounted electricity. The third stems from vertical integration: upstream polysilicon, wafering, cell sintering, and shipping are executed, scheduled, and often financed inside a single national ecosystem. Overcapacity accusations miss this point: selling at razor-thin margins is tolerable when each extra gigawatt drives the next step down the cost curve, cementing global share even as nominal profitability hovers near zero.

EV Batteries and the Mirage of Parity

Policymakers sometimes counter that China’s edge will evaporate once Western gigafactories enjoy their economies of scale. However, the International Energy Agency found that average battery-pack prices fell by nearly 30% in China in 2024, compared with a global decline of 20%. The gap widened despite higher lithium and nickel volatility. Chinese cell makers shortened design-to-production cycles from 18 months to just seven by leveraging real-time material simulation and AI-driven electrode coating diagnostics. Tariffs imposed by Brussels in October 2024—provisional duties up to 45%—did not erase that cost delta; they merely reallocated it between exporters and European consumers, who now pay more for the same kilowatt-hour and still import the anode slurry from Guangdong.

Overcapacity or Predator Narrative? A Data Reality Check

Steel furnaces, glass kilns, and aluminum smelters illustrate the potential risks of overreliance on China. Chinese plants often run at utilization rates below 80%, dumping surplus abroad while clutching domestic market share. Yet OECD monitoring shows that since 2019, most of the new blast-furnace capacity commissioned globally has been electric-arc rather than coal-fired—and 62% of that low-carbon build-out happened inside China. Once renewable electricity is integrated, the carbon-adjusted cost gap narrows to less than US $40 per tonne—within the zone where logistics costs trump factory-gate prices. Put differently, overcapacity is real, but it is intertwined with the climate transition: the same investment wave that threatens overseas mills is also retiring China’s dirtiest legacy assets.

Vulnerability Exposed: South Korea’s Urea Shock

If efficiency were the sole policy variable, Seoul’s diesel additive fiasco would read as a footnote. Instead, it is a case study of how single-supplier optimization becomes a national security hazard. In November 2021, a minor tweak to China’s fertilizer export quota cut South Korea’s urea imports by 67% in three weeks, forcing gas stations to ration diesel and threatening a logistics freeze. Domestic plants could have produced urea at a 12% cost premium; decades of penny-pinching had erased that margin. The episode gave Seoul a crash course in the real efficiency price: supply shock insurance becomes priceless when dependency crosses 90%.

Commerce as Security: Mapping the Chokepoints

Urea is merely the canary. The same concentration metrics apply to gallium and germanium (China controls 95% of the refined supply), magnet-grade rare earth (92%), and graphite anodes (97%). Any of these nodes can be throttled with administrative permits rather than gunboats. The policy map for Washington, Brussels, and Tokyo now resembles power-grid planning, which includes building redundancy, buffer storage, and emergency switching capacity. Strategic stockpiles, multi-region sourcing clauses in public tenders, and joint strategic-reserve financing are emerging as the twenty-first-century equivalents of Cold War oil buffers.

Risk-Adjusted Efficiency: A New Industrial Frontier

Matching subsidies yen-for-yen is fiscally untenable and probably futile. The smarter frontier is risk-adjusted efficiency: let comparative advantage allocate routine products, but pay public money to ensure chokepoints. Funding anodization plants in Sweden—where hydropower is cheap—makes more sense than underwriting another EV assembly line in Michigan. Likewise, Europe’s Net-Zero Industry Act could prioritize midstream lithium refining, where payback periods fall below seven years once political-risk premia are priced in. Governments should also require that any nation supply no more than half the value of critical components in taxpayer-funded projects. Such diversity thresholds tame coercive leverage without closing the door on cost-efficient imports.

Climate Arithmetic: The Paradox of Cheap Green Tech

There is an uncomfortable symmetry here. The planet needs China’s cost curves to reach net zero on schedule, yet unchecked reliance on those curves amplifies geo-economic fragility. Policymakers, therefore, confront a trilemma of price, pace, and security. Curtailing Chinese supply raises near-term costs and slows the diffusion of green hardware; failing to diversify invites hostage-taking at moments of highest political tension. The optimal path, statistically speaking, is partial decoupling: keep Chinese competition in the market to discipline prices but expand second and third hubs so that any deliberate shock distributes pain rather than focusing on it.

Codifying Conditional Interdependence

The debate over Chinese overcapacity often degenerates into caricature: either Beijing is an unbeatable techno-authoritarian juggernaut or an industrial bubble floating on subsidies. The data show it is highly efficient and heavily subsidized—an uncomfortable duality transforming traditional trade remedies into blunt instruments. A more surgical architecture would:

- quantify embedded subsidies and discount dumping margins accordingly;

- benchmark process productivity so that tariffs do not penalize genuine efficiency;

- fund redundancy where chokepoint risk is systemic rather than merely commercial.

In short, free trade alone cannot solve the contradiction between efficiency and resilience, nor can autarky. The only viable settlement is conditional interdependence: wide-open markets for goods where supply chains are plural and strategic guardrails where they are not. For every tonne of cheap steel or kilowatt-hour of budget lithium that Chinese factories ship abroad, the importing economies must ask: Does this transaction deepen a learning curve that benefits the planet, or does it entrench a dependency that can be weaponized tomorrow? The answer will vary by sector, and so must the policy. What cannot vary is the principle that productivity, when it compounds inside a single geopolitical silo, will always carry strategic weight far greater than the sum of its cents.

The original article was authored by Dr Weihuan Zhou, an Associate Professor and Co-Director of the China International Business, along with two co-authors. The English version, titled "Overcoming the geopolitics of overcapacity through cooperation," was published by East Asia Forum.

References

Asia Society Korea, “From ‘Clean Diesel’ to ‘No Diesel’: South Korea’s Urea Crisis Explained,” November 2021.

European Commission, “Provisional Countervailing Duties on Battery Electric Vehicles from China,” July 2024.

International Energy Agency, Global EV Outlook 2025: Webinar Slides, May 2025.

International Federation of Robotics, Global Robot Density in Factories Doubled in Seven Years, December 2024.

International Federation of Robotics, World Robotics 2024 Report, September 2024.

International Monetary Fund, Trade Implications of China’s Subsidies, Working Paper 24/180, August 2024.

Oxford Institute for Energy Studies, “Hydrogen in China: Learning from Solar PV,” February 2025.

Statista, “China Is the World’s Manufacturing Superpower,” April 2025.

United Nations Statistics Division, “Global Manufacturing Value Added by Country, 2023.”