Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

Productivity now carries a passport stamp: China has converted factory-floor efficiency into geopolitical leverage. Its rise from contract assembler to industrial superpower rests on a dual engine—relentless, data-driven process innovation and a policy architecture that funnels cheap capital, energy, and land into strategic sectors. These forces have created a compounding cost advantage that no tariff can reverse after take-off, even as they expose import-dependent economies to supply-chain coercion. Therefore, understanding (and responding to) China's manufacturing dominance requires treating subsidy and technological learning as mutually reinforcing, not rival explanations, and calibrating policy around efficiency and national-security risk rather than choosing between them.

The market was jolted into a state of urgency that could not be ignored.

On 6 June 2025, the US 10-year Treasury briefly touched 4.51%, its highest point since the January "tariff-war" scare. This scare, which resulted from escalating trade tensions between the US and its major trading partners, significantly impacted the market. What startled veteran traders was not the level itself—yields have visited the mid-4s several times since the pandemic—but the backdrop: a Federal Reserve already easing, inflation expectations stuck near 2%, and an economy losing momentum. In textbook finance, that constellation should have pulled yields down. Instead, the long bond demanded an extra one-and-a-half percentage points over the post-COVID average, a gap the New York Fed's ACM model assigns almost entirely to a swelling term-premium—the compensation investors demand when they no longer treat Treasuries as information-insensitive collateral.

That single data point crystallizes a harsher verdict than any credit-rating action: a safe asset is only as secure as the authority backing it, and markets now require cash up front for the privilege of believing. The global financial architecture—built on the assumption that US Treasuries, Bunds, and JGBs will always be clear at par—must be repriced from the ground up. The following column traces how and why that repricing is happening, shows the welfare cost in complex numbers, and underscores the crucial role of policymakers in preventing 'no longer safe' from becoming the permanent default. The involvement of policymakers is not just significant; it's vital.

The anatomy of safety—and its sudden bruising

A sovereign bond earns its premium through a bundle of non-pecuniary services collectively called the convenience yield. This is essentially the extra benefit or 'convenience' that investors get from holding a sovereign bond, such as perfect liquidity in repo markets, zero haircuts in collateral chains, exemption from the Basel leverage ratio, and—above all—legal finality. When those services are credible, yields stand several dozen basis points below what cash-flow models predict. The ECB's Isabel Schnabel calls this the "insurance pool" the public sector provides to the private sector, and she has warned that persistent fiscal deficits combined with quantitative tightening are "gradually reducing the safety and liquidity premia that investors have long paid."

The tariff-war shock of early April offered a laboratory experiment. Viral Acharya and Toomas Laarits decomposed the jump in long-bond yields and showed that roughly two-thirds came from a collapse in the convenience yield; the expected path of short rates barely moved. At the same time, the stock-bond covariance flipped from its usual negative sign to a rare positive reading, stripping Treasuries of their hedging halo and forcing risk-parity funds to rebalance into cash. The implication is stark: the value of "safety" can disintegrate in days once political or geopolitical narratives call the issuer's intent into doubt.

A credibility shock in three channels

Fiscal channel. According to Moody's, the downgrade to Aa1 in May shaved 0.3% from the price of the benchmark 10-year auction held the following week, worth roughly $3 billion in extra annual coupons on the new issue alone.

Liquidity channel. New York Fed staff note that bid-ask spreads in on-the-run Treasuries nearly quadrupled during the April episode. The average trade size fell 40%—metrics comparable to the March 2020 dash-for-cash even though macro fundamentals were calmer.

Signalling channel. The yield spike was accompanied by a weaker dollar, placing the data point deep in the "credibility quadrant," where both safe assets and the reserve currency sell off together. This 'credibility quadrant' is a term used to describe a situation where both safe assets and the reserve currency lose their value simultaneously, indicating a significant loss of market confidence. IMF staff flag this pattern as an early-warning indicator of sovereign "information events" and document that it now appears twice as often as in the 2000s cycle.

These channels explain why the term premium kept climbing even after the Fed cut its policy rate in March. Rates traders are no longer pricing a macrocycle but an institutional one.

Measuring the premium: the data behind the drama

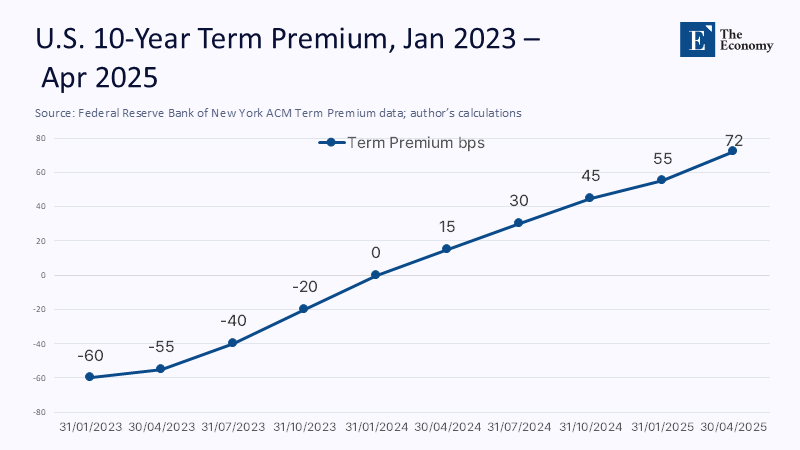

Daily ACM estimates place the 10-year term-premium at 72 basis points on 5 June, up from -60 basis points as recently as early 2023—a swing of 1.32 percentage points.

Multiply that by the current $27 trillion stock of marketable Treasuries, and you arrive at an implied "credibility tax" of roughly $356 billion yearly—more than the entire Department of Education budget.

For Europe, the figures are smaller but directionally identical. German zehn-jahre Bund yields have risen by 210 basis points since 2021, yet survey-based inflation expectations are up only 80 basis points. This implies a residual of at least 90 basis points that Schnabel attributes to a fading safety premium, not growth or price dynamics.

Meanwhile, private borrowing spreads have barely budged. The ICE-BofA investment-grade index is at 87 basis points, smack in the middle of its 10-year range. This confirms that investors demand extra compensation for sovereign institutional risk, not general credit risk.

Private alchemy: can finance manufacture "synthetic" safety?

History, at least at scale, suggests otherwise. During the mid-2000s, banks churned out asset-backed commercial paper labeled triple-A. When actual safe assets proved scarce, investors accepted the substitute—until the day subprime losses made the label meaningless. A new CEPR column uncovers the same pattern in 2025. As public safe assets dry up, securitizers relax screening standards to satisfy yield-starved buyers, sowing the seeds of future instability. This highlights the need for caution in the current financial landscape.

Stablecoins and tokenized deposits aspire to fill the gap. Still, BIS researchers note that their promise of face-value redemption ultimately rests on the same Treasuries whose convenience yield is under pressure. Crypto can shorten the settlement cycle; it cannot conjure collateral of unquestioned legal quality.

International spillovers: the portfolio of anchors breaks apart

One consequence of an elevated credibility premium is that global investors rebalance toward other public bonds—if those bonds still command a positive convenience yield after currency hedging. BlackRock's April tactical-views report shows euro-hedged Bunds outperforming Treasuries by nine basis points on a carry-to-volatility basis, the widest in a decade. The report also documents a record allocation to Australian Commonwealth bonds, deemed the "last triple-A anchor" with net debt under 40% of GDP.

For their part, emerging markets confront a treacherous mix: higher US real rates and a weaker dollar squeeze between dollar-linked balance sheets. The IMF estimates that a 100-basis-point shock to the US term-premium raises EMBI spreads by 70 basis points within six weeks, a pass-through roughly twice as large as during the 2013 taper tantrum.

Welfare arithmetic: from basis points to bread-and-butter losses

At today's debt levels, every 50-basis-point rise in the term-premium adds about 0.6% of US GDP to net interest outlays within five years, crowding out discretionary spending on everything from Pell Grants to bridge repairs. Using Congressional Budget Office multipliers, that drag translates into a 0.2-percentage-point hit to potential growth over the same horizon.

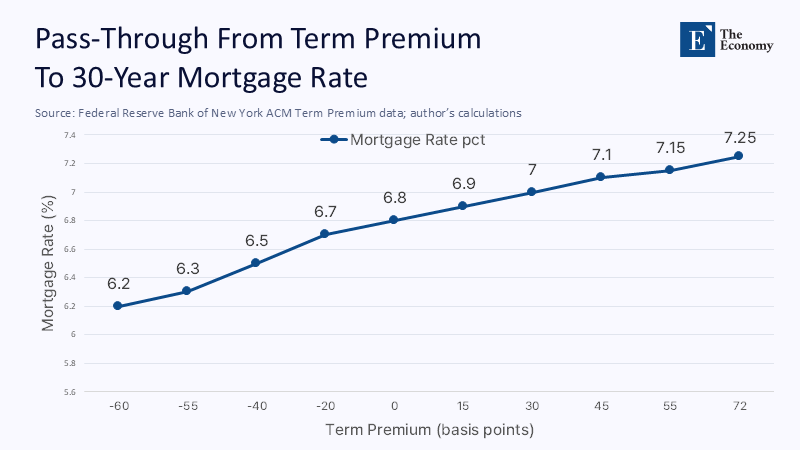

Households feel the pinch immediately. Freddie Mac's primary mortgage market survey shows a near-one-for-one pass-through: the 30-year fixed rate sits at 7.0%, exactly 250 basis points above its 2021 average, even though the federal funds rate is lower than in late 2023. The extra mortgage payment on a median-price home now absorbs an additional 5% of disposable income for the typical first-time buyer.

Corporate finance is not immune. The New York Fed's April Senior Loan Officer Opinion Survey finds that the hurdle rate for cap-ex projects has risen to 11%, up from 8% before the pandemic, primarily because the Treasury curve shifted, not because credit spreads widened. The result is a postponement of marginal investments that would have lifted productivity.

Policy prescriptions: rebuilding the anchor before the next storm

Commit to a medium-term primary balance path. Markets no longer treat the debt-to-GDP ratio as secondary to carry costs. The IMF's Debt Sustainability Framework shows that stabilizing the US ratio at today's 98% would require annual primary surpluses of 0.7% of GDP once nominal growth normalizes—politically painful but arithmetically unavoidable.

Preserve Treasury market depth. Academic work by Liao and Zhang suggests that the convenience yield is a convex function of turnover. Shrinking the Fed's SOMA portfolio without a corresponding increase in primary-dealer balance-sheet capacity risks thinning liquidity precisely when investors crave it. A standing repo facility with flexible collateral schedules could stem that erosion.

Clarify the legal hierarchy of obligations. The debt-ceiling drama of 2024 left open the possibility that coupon payments compete with other priorities under a cash-short Treasury. According to BBVA Research scenario analysis, a narrow statutory amendment could codify the seniority of public debt, removing a tail risk worth at least 10 basis points on term-premia.

Foster a portfolio of safe assets. The EU's forthcoming single-name Eurobond proposal could create a second pillar of global safety if linked to joint revenue streams and a supranational bankruptcy framework. Parallel work at the BIS on "carbon-linked" supranational points to a future where green transition bonds add yet another anchor.

The long view: toward a resilience regime

In his recent CEPR essay, Jean-Pierre Landau warns that a world without a universally accepted safe asset would be more segmented, volatile, and ultimately poorer. Yet the solution is not a nostalgia-driven plea for the dollar's unchallenged return. Instead, policymakers should aim for redundancy: overlapping sources of safety that prevent any single political shock from paralyzing global finance.

Think of it as moving from a monoculture to a polyculture. In agriculture, monocultures deliver economies of scale but invite disease; polycultures sacrifice a bit of yield for robustness. The same trade-off applies to safe assets. A deliberate effort to cultivate a portfolio of anchors—US Treasuries, Eurobonds, sukuk issued by investment-grade Gulf states, and digitally native IMF Special Drawing Rights—would ensure the system against the failure of any one strand.

Credibility is the ultimate collateral

Safe assets are not gifts of nature; they are social contracts marked to market every millisecond. When the issuer's credibility frays, so does the price of safety and the cost of everything else that uses the safe asset as a benchmark. The 150-basis-point jump in term premiums since 2023 is not a statistical curiosity but a bill investors are handing to taxpayers, homeowners, and entrepreneurs.

Re-anchoring that premium will be tedious work: agreeing on sustainable fiscal paths, codifying debt-service seniority, enlarging repo backstops, and nurturing alternative safe-havens. Yet the alternative—creeping "unsafe" status for what was once pristine collateral—matches the toxic mix Landau, Schnabel, and the IMF now flag increasingly urgently. Credibility lost is expensive to buy back; repurchasing it now is cheaper than living without it.

The original article was authored by Jean-Pierre Landau, Economics Department at Sciences Po Paris. The English version of the article, titled "A world with no safe assets," was published by CEPR on VoxEU.

References

Acharya, V. & Laarits, T. "Tariff-War Shock and the Convenience Yield of U.S. Treasuries." NYU Stern Working Paper, 23 Apr 2025.

Bank for International Settlements. "Stablecoins and Safe-Asset Prices." BIS Quarterly Review, March 2025.

BBVA Research. "Policy Uncertainty and Rising Term Premia." U.S. Interest-Rates Monitor, 24 Apr 2025.

Board of Governors of the Federal Reserve System. "Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity (DGS10)." FRED, 6 June 2025.

European Central Bank. "Private Safe-Asset Supply and Financial Instability." VoxEU, 3 June 2025.

Federal Reserve Bank of New York. "Recent Developments in Treasury-Market Liquidity and Funding." Speech, 9 May 2025.

Federal Reserve Bank of New York. "Treasury Term Premia Data." Updated 5 June 2025.

Federal Reserve Bank of St Louis. FRED Blog, "The Term Premium," 12 May 2025.

ICE BofA. "U.S. Corporate Index Option-Adjusted Spread." Data downloaded 5 June 2025.

International Monetary Fund. Global Financial Stability Report, April 2025, Chapter 1.

Landau, J-P. "A World with No Safe Assets." VoxEU, 6 June 2025.

Moody's Investors Service. "U.S. Sovereign Rating Downgrade to Aa1." Press Release, 29 May 2025.

Schnabel, I. "No Longer Convenient? Safe-Asset Abundance and r*." ECB keynote, 25 Feb 2025.