Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

The volleys of tariffs exchanged by Washington and Beijing were aimed at each other. Yet, the most conspicuous craters now lie thousands of miles away—fertile depressions in São Paulo, Sriperumbudur, Bac Ninh, and Lagos where fresh factory clusters, logistics corridors, and data-center farms are springing to life. This resilience of these regions, rather than coaxing production back to either belligerent, the trade war is carving a polycentric industrial landscape whose political economy will dominate the next decade's development debates. To grasp that redrawn map, we must follow the export registers, green-field announcements, payroll ledgers, and bandwidth upgrades that are recalibrating where the world's goods—and increasingly its services—originate.

Shifting Dynamics: From a US-China Trade War to a Multi-Hub Commerce System

A mere ten years ago, supply-chain risk managers still spoke in binary code—"China versus the rest." Today, their dashboard reads "China + N," and N is expanding. The Centre for Economic Policy Research (CEPR) has supplied the most granular confirmation to date: exploiting Brazil's mandatory payroll registry, its researchers isolated micro-regions most exposed to Beijing's retaliatory farm-good tariffs. They found a statistically significant rise—about 2.4 percentage points—in formal manufacturing employment and a commensurate lift in wage bills between 2017 and 2021 relative to matched controls. These local-labor-market gains are not merely statistical curiosities; they represent a structural break from the winner-take-all narrative still favored on cable news, underscoring that tariff warfare functions less as a tug-of-war rope than as a centrifuge spinning factories toward new destinations.

Oxford Economics strengthens the picture with computable-general-equilibrium simulations showing that every one-percentage-point rise in Chinese export prices relative to ASEAN substitutes diverts close to US $6 billion in annual American import demand into Southeast Asia within three years, a shift significant enough to re-rank countries on the US top-ten supplier list. In other words, when Beijing and Washington reached for punitive tools, Bangkok and Bengaluru added headcount; the geometry of shock absorption became triangular, not bilateral.

Brazil's Growing Influence: A Bid for Industrial Depth—Exports First, Payrolls Next

Long caricatured as a passive soybean beneficiary, Brazil is moving briskly up the complexity chain. Customs data show that exports of automotive parts, intermediate electronics, and processed metals to the United States rose 3.7% year-on-year in the first quadrimester of 2025, cannibalizing share previously held by Chinese suppliers now hobbled by duties that exceed 100% on select components. Simultaneously, Stellantis has earmarked 30 billion reais (roughly US $6 billion) for its hybrid-flex platform, and BYD has begun pouring concrete at a three-plant battery campus on Ford's former Camaçari site, moves unthinkable before tariff arithmetic tilted cost curves.

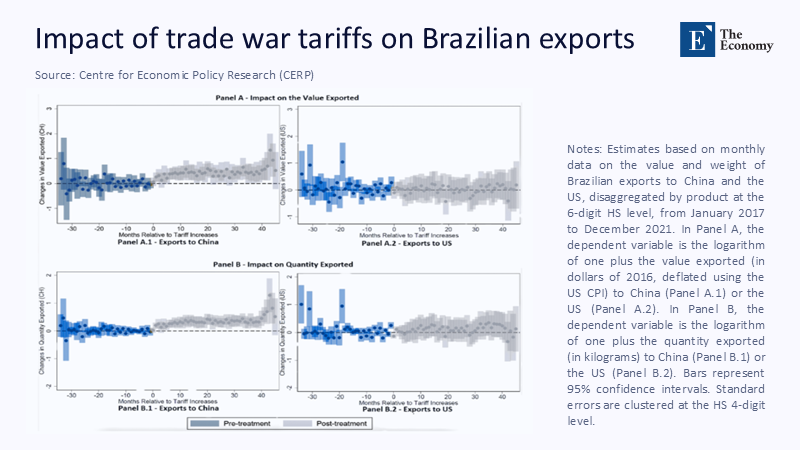

Figure 1 reinforces the two core claims above. Panel A shows that, in the months immediately following tariff hikes, the value of Brazil's exports to China plummeted while shipments to the United States climbed—a mirror image that captures the instant diversion effect. Panel B repeats the pattern in physical tonnage, demonstrating that volume, not merely price, is rerouting. The plots corroborate the narrative that Brazil's commodity engine is being rewired toward higher-margin US demand even as Chinese orders shrink.

Yet, the transition is not frictionless. The World Bank still estimates domestic logistics add 41% more to a delivered unit's cost in Brazil than in Mexico, a drag large enough to wipe out much of the tariff-driven advantage. And Brasília's flirtation with a "reciprocal" 10% tariff on US auto parts—meant to placate local lobbyists—threatens to erase the preference margins luring foreign direct investment (FDI). Brazil's industrial climb, therefore, hinges on whether policymakers can convert temporary tariff arbitrage into permanent productivity gains: cabotage reform, highway concessions, and skill-pipeline overhauls.

India's conveyor belts write a new script—scale meets iterative learning.

If Brazil exemplifies diversification through commodity upgrading, India epitomizes diversification through relentless scale and iterative capacity-building. In March 2025, Apple air-lifted US $2 billion in iPhones out of Tamil Nadu in a month to beat a threatened 46% handset tariff—logistics theatre that doubled as a confidence vote in India's production ecosystem. Behind that spectacle, UNCTAD's latest Global Investment Trends Monitor records US $9.8 billion in green-field electronics pledges for India in 2024 alone, quadrupling the 2017 baseline. PMI surveys corroborate: the manufacturing employment sub-index hit its survey-era high in April 2025, propelled by the sharpest leap in export orders since 2014, with respondents explicitly citing "orders rerouted from China."

Critics rightly note India's import duties on semiconductor inputs keep local fabs 6–11% above Chinese cost levels. At the same time, an average 13% tariff gap with the United States could nullify savings if Washington widens its net. Yet such commentary underrates the architectural logic of India's Production-Linked Incentive (PLI) scheme, which disburses subsidies only when firms hit specific value-addition and volume thresholds—essentially engineering a forced learning curve. This strategic planning is impressive. As Foxconn, Tata, and Pegatron move beyond assembly into component machining and PCB design, India inches toward genuine ecosystem depth. Demography provides the runway—one million Indians turn working age each month—while dedicated freight corridors and renewable-power auctions attack infrastructure bottlenecks in tandem.

ASEAN's elastic supply-web—small nodes, big optionality

The Association of Southeast Asian Nations (ASEAN) does not enjoy India's brute scale but offers an unmatched modularity prized by supply-chain architects. Samsung's handset ecosystem graphically illustrates the logic: chips fabricated in Penang are shipped to Thai plastic-housing lines, then whisked north to Bac Ninh for final assembly before moving through Singapore's Tuas Mega Port into US retail channels. Oxford Economics' full-blown trade-war scenario shows half the projected GDP hit to ASEAN clawed back within 36 months through trade diversion alone. Sunk-cost inertia greases the mechanism. Already responsible for 60% of its global smartphone output in Vietnam, Samsung committed another US $2.7 billion upgrade even after the White House signaled potential 46% duties—confident the tariff would be softened or out-priced by efficiency gains.

Indonesia's nickel blockade adds a strategic layer. The 2014 ban on raw ore exports forced Chinese stainless-steel and battery-chemistry producers into joint ventures on Sulawesi; by 2024, the archipelago commanded 61% of refined nickel output. Financial Times reporting from Morowali renders a tableau where Chinese metallurgists, Western EV sourcing teams, and Indonesian labor activists now share the same cafeteria—embedding capacity so deeply that tariff risk becomes a sunk-cost anchor rather than an uprooting force.

Africa's quiet digital uptick—software eats the tariff shock

Africa's windfall materializes not on conveyor belts but in clouds and cables. MTN South Africa's November memorandum with Huawei and China Telecom marries 5G roll-out with paired cloud-availability zones sized specifically for AI inference workloads, offering compute cycles that American hyperscalers cannot legally supply because of export-control ceilings. Downstream spill-overs travel fast: Transsion-backed PalmPay vaulted to 35 million users by pre-installing a Chinese-style super-app on smartphones retailing below US $120, enabling Lagos street vendors to accept QR payments without prior banking access. GlobeNewswire projects that Africa's data-center construction spend will climb from US $1.26 billion in 2023 to over US $3 billion by 2030, with Chinese engineering-procurement-construction (EPC) contractors' front-running bids.

The upside is an entrepreneurial renaissance—Nairobi ed-techs streaming vocational training at one-seventh the pre-2020 bandwidth cost; Johannesburg fintech leveraging edge nodes to shrink latency below 30 milliseconds. The downside is vendor lock-in. Sovereign ID schemes tied to proprietary Chinese cloud APIs raise surveillance and data-localization risks that African parliaments have only begun to debate. The pivot from dependency to sovereignty will hinge on whether regulators can enact competition-neutral spectrum auctions, mandate multi-vendor core-network architectures, and legislate data-protection standards before first-mover advantages harden into path dependency.

Crunching the numbers—formal labor, capital flows, and their lagged pay-offs

UNCTAD aggregates the country stories: "China-plus-one" manufacturing announcements leaped 28% in 2024, totaling US $64 billion for Brazil, India, and the three largest ASEAN economies—even as global pledges fell 7%. Applying the International Labour Organization's rule of thumb—one direct factory job per US $50,000 in fixed investment—suggests up to 1.3 million new positions outside China and the United States since 2018, a headcount rival to Detroit's auto-sector payroll at its mid-twentieth-century zenith.

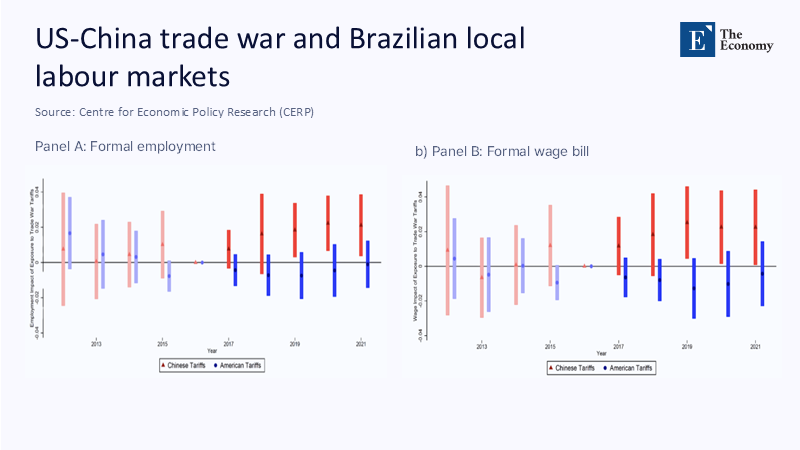

Figure 3, Panels A and B, extends the CEPR payroll narrative. The red bars chart the employment and wage-bill impact of Chinese tariffs on Brazilian municipalities by year; the blue bars do the same for American tariffs. Notice the polarity reversal: after 2017, exposure to Chinese tariffs consistently raises local employment and wages, while exposure to US tariffs depresses them—visual evidence that reciprocal levies did not simply wash out but instead redistributed labor demand within Brazil, benefitting soy-dominated interior regions while pinching coastal electronics clusters.

Trade statistics triangulate the investment data. Brazilian non-commodity exports to the United States climbed 14% from 2021 to 2024; Indian electronics exports surged 68%; Vietnam jumped 72% before tariff threats slowed momentum. Africa's installed data center capacity is set to grow 140% between 2024 and 2030, a trajectory expected to cut wholesale bandwidth by a third. Put bluntly, the spreadsheet pages now confirm what local hiring managers and logistics brokers have sensed for years: the tariff war is less a wall than a funnel, guiding flows into new corridors.

Policy prescription—diversify, don't decouple

For US strategists, every factory that exits China looks like a scalp, yet CEPR's finely grained evidence shows jobs rarely boomerang; they ricochet. Blanket tariffs that ensnare allies as readily as rivals undercut any coherent resilience agenda: Brazil's anxiety over a seemingly mild 10% duty on auto parts demonstrates how quickly goodwill erodes when policy lacks nuance. If resilience rather than repatriation is the objective, then a coordinated diversification strategy—rules-based tariff exemptions for friendly suppliers paired with on-shore training tax credits-beats unilateral escalation.

For recipient nations, the window of opportunity is perilously narrow. Brazil must slash logistics costs that currently swallow its wage advantage; India must convert tariff arbitrage into genuine productivity via power-sector reform and mass skilling; ASEAN must forge harmonized standards lest regulatory spaghetti strangles its supply web; Africa must enact vendor-neutral data-governance regimes before digital dependencies. Fail, and the present bonanza becomes a commodity trap; succeed, and the Global South could lock in a portfolio of complementary specializations—lithium cathodes from Minas Gerais, precision gearboxes from Pune, SiP chip-packaging from Penang, edge-cloud instances from Johannesburg—that collectively render the world economy more shock-proof.

Western multinationals must, likewise, update their spreadsheets. Dual-sourced supply chains may run 17% above mono-source baselines, but that premium buys political optionality and reputational durability. The rational move is not "restore at any cost" but "multi-shore with contractual escape hatches": throughput clauses that flex with tariff schedules, mirrored credit lines to hedge currency shocks, and workforce roadmaps that treat vocational institutes as strategic assets, not philanthropic afterthoughts.

Pedagogical implications—teaching the tariff paradox

In 2018, the op-ed question was whether punitive tariffs could coax Midwestern factories home. Seven years later, the more salient query is how a rewired manufacturing atlas will reshape labor standards, trade governance, and classroom syllabi. Trade-theory modules must add network resilience to comparative advantage; development-economics seminars should retire linear "stages of growth" in favor of leap-frog trajectories powered by digital infrastructure; and public-policy workshops will spend less time on tariff incidence and more on the unintended consequences of weaponized interdependence.

Herein lies the core paradox: protectionism, conceived as a nationalist moat, has accelerated the diffusion of productive capacity to countries once considered footnotes in great-power rivalry. The task for scholars, policymakers, and investors is to harness that diffusion's upside—diversification, resilience, and inclusive growth—while tempering its inequities and dependencies. If we meet that challenge, the trade-war era's ultimate legacy will be neither decoupling nor de-globalization but a more varied, contested, and potentially more resilient global production fabric. That is the real exam question for the next generation of students poised to manage it.

The original article was authored by Tiago Cavalcanti, an Adjunct Full Professor in Economics, EESP-FGV at the Sao Paulo School of Economics, along with two co-authors. The English version of the article, titled "The US-China trade war created jobs (elsewhere)," was published by CEPR on VoxEU.

References

CEPR. "The US-China Trade War Created Jobs (Elsewhere)." VoxEU column, June 2025.

Financial Times. "How Indonesia Cornered the Nickel Market." June 2025.

GlobeNewswire. Africa Data Center Construction Market: Outlook & Forecast 2025-2030. February 2025.

International Labour Organization. "One Job per US$50,000 Investment" guideline, Economic-Development Finance Slides, 2018.

Oxford Economics. Asia-Pacific: US-China Trade Tensions May Benefit ASEAN. October 2024.

Reuters. Apple iPhone air-lift from India, April 15 2025; Brazil formal-jobs release, April 30 2025; Brazil tariff-negotiation report, April 1 2025; BYD and Stellantis investment announcements in Brazil, 2024-25; Huawei-MTN 5G and cloud MoU, November 26 2024; Samsung-Vietnam tariff-exposure analysis, April 12 2025.

UNCTAD. Global Investment Trends Monitor, No. 48, January 2025.