Input

Changed

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

Donald Trump's April 2025 "reciprocal‐tariff" decree impacted the yen on Nikkei share prices, effectively removing the United States from the Pacific's rule-writing cockpit. Japan has filled this void, now holding the reins of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). As a result, Japan is shaping the commercial code that every exporter, from Manchester to Manila, will soon have to adhere to, regardless of Washington's stance.

The Weight of a Leaderless Bloc

Before the UK's flag was even dry on the membership certificate last December, the CPTPP's twelve economies already mustered close to 15% of world output—about US $12 trillion—making the bloc larger than RCEP measured in value-added per capita and only a whisker behind USMCA in aggregate GDP. With Washington absent, that scale is transformational: global automakers, ag-tech firms, and cloud service providers now draft compliance manuals keyed to Japanese-drafted rules of origin instead of NAFTA templates. In effect, the center of gravity in Pacific trade has migrated eastward across the dateline to Tokyo.

Tokyo's Arithmetic: Two Percent That Matters

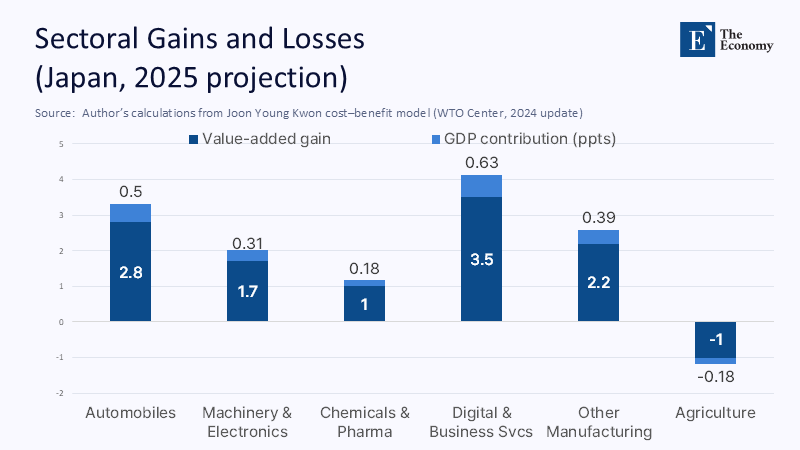

Japan's Ministry of Economy reminds skeptics that the CPTPP is not a diplomatic vanity project. WTO-style modeling shows a net GDP gain of roughly 2%—about US $86 billion by 2025. The real star of this growth is the automobile sector, which is projected to grab more than a quarter of the pie thanks to a 24% jump in outbound units. This potential for growth in a key sector is a reason for optimism.

The macro context magnifies that dividend: the IMF pegs Japan's 2025 growth at just 0.6% without the agreement. Strip out the CPTPP boost, and the economy will flirt with contraction.

The Agrarian Bill Comes Due

However, the same econometric models that excite Keidanren also highlight potential political challenges. The agricultural sector, particularly wheat, barley, and rice, faces significant tariff cuts, potentially leading to a 30–40% margin decrease. Government reports indicate that core farmers have dwindled to 1.36 million in 2020, with 70% over 65. This trend is expected to continue, with the number projected to drop below 1.2 million by 2030 without new entrants. Rural prefectures, whose voters hold significant Diet representation, demand a ¥1.2 trillion compensation package. Tokyo is aware that such transfers may delay an inevitable resource shift. Still, they also buy political time for land and labor to transition into export-oriented, CPTPP-enabled value chains.

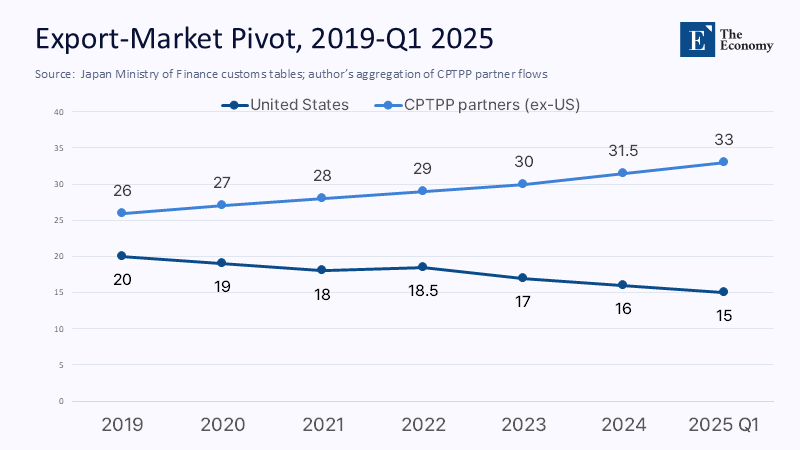

Tariff Shock and the "Third-Path" Doctrine

Trump 2.0's 24% blanket tariff on Japanese goods, formalized on 3 April, shaved an estimated 0.6 percentage points off Japan's 2025 growth outlook. However, this shock did not deter corporate Japan, which was jolted into an overdue diversification sprint. Ito En's scramble to re-tool US supply lines is only the most photogenic example. The broader strategy—labeled a "third path" by East Asia Forum analysts—aims to anchor future export growth inside a rules-based bloc neither corralled into Beijing's state-capitalist orbit nor hostage to White House mercantilism. Early customs tallies show the pivot is underway: Japanese exports to Vietnam jumped 12.4% year-on-year in the first quarter, softening the tariff blow.

Contesting the Helm: China, Australia and a Watching Europe

Beijing's 2021 application still languishes in pre-screening limbo as members weigh its subsidy regime, data-localization laws, and SOE dominance. Canberra, chairing the CPTPP Commission in 2025 under the banner "Delivering Sustainable Trade and Resilient Growth," has floated phased accession benchmarks on carbon and labor that China currently fails. Brussels, meanwhile, is tiptoeing toward observer status rather than full membership, attracted by Japanese-drafted digital chapters and wary of reopening fissures that sank Mercosur ratification. A limited EU–CPTPP mutual-recognition deal on conformity assessments—now mooted in Commission briefing rooms—would vault the bloc's combined GDP above RCEP's and, by extension, further consolidate Tokyo's convening heft.

Digital Rule-Making in a US Vacuum

When the United States first exited the original TPP, it also vacated the field of e-commerce norms. In July 2024, Tokyo and Brussels signed a protocol outlawing forced data localization and safeguarding algorithmic transparency—the first cross-border data regime among G7 economies. Japan's negotiators have since embedded similar language into the CPTPP's working-party checklist for future applicants, ensuring that any new member, from Taiwan to maybe even China, must swallow the same digital medicine. The calculus is economic as much as ideological: OECD research shows data flows now underpin a larger slice of Japanese value-added than finished-vehicle exports.

Supply-chain hedging and the Security Dividend

Standard rules of origin inside the CPTPP reduce friction costs for intermediate goods, nudging high-precision production stages into bloc territory. Semiconductor equipment shipments to Vietnam alone rose nearly 10% in the latest monthly customs snapshot, offsetting lost US sales. Richard Baldwin's "Grievance Doctrine" warns that so long as Washington's narrative of betrayal persists, tariff spasms will recur; every percentage point of exports rerouted to CPTPP partners acts as an insurance premium against the next White House tweetstorm.

Fiscal Headroom and the Myth of 250%

Critics like to wave Japan's headline 250% debt-to-GDP ratio as proof that Tokyo cannot underwrite bloc leadership. However, IMF staff point out that decoupling export performance from the US cycle stabilizes revenue streams and, therefore, the debt trajectory even without eye-watering primary surpluses. In practice, a sliver of that incremental revenue is already being funneled into a new ¥250 billion grant window supporting hydrogen-supply-chain R&D across CPTPP universities—a quiet signal that Japan defines leadership as financing public goods, not merely chairing meetings.

Pedagogy, People and a Pacific Learning Economy

Education ministries across the bloc have weaponized mutual-recognition annexes to fast-track professional credentials, turning the CPTPP into a de-facto Erasmus of the Pacific. Japan's 2026 science budget allocates more money to cross-CPTPP university consortia than to any bilateral program. The result is a live laboratory for post-carbon industrial policy—hydrogen pilot corridors from Perth to Aichi, AI-ethics sandboxes in Toronto and Sapporo—all scaffolded by trade rules Tokyo helped codify.

Domestic Politics: Buying Time, Not Votes

Rural over-representation in the upper house means the hefty agricultural adjustment bill will pass. Still, mathematics trumps nostalgia: by the ministry's count, only 150,000 farmers under 50 remain in the country. Even the loudest farm lobbies concede that tariff shields can no longer resurrect a dying workforce. The government's gamble is that temporary payouts cushion short-term pain. At the same time, capital and talent redeployed into higher-yield activities unlocked by CPTPP access—robotics in Hokkaido greenhouses, precision fermentation in Yamagata dairy sheds, and agri-tech service exports to fellow members such as Peru and Malaysia.

American Opportunity Cost: Paying but Not Playing

In 2016, the Peterson Institute calculated that US ratification of the original TPP would have lifted American real incomes by US $131 billion annually by 2030. Updating that estimate for today's CPTPP membership and trade elasticities implies a forgone windfall of roughly US $83 billion annually. Ironically, US multinationals are now eating those compliance costs anyway: They must meet CPTPP content thresholds to sell into a market the size of the EU and India combined—but they enjoy zero agenda-setting influence because their government stayed home.

A Debt-Burdened Superpower Hands Tokyo the Pen

Washington's fiscal spasm has morphed into an externality subsidy for Japan. By weaponizing tariffs, the US validated the demand for an alternative rule set and multiplied Tokyo's diplomatic returns on the CPTPP salvage operation. Australia's 2025 chairmanship, with its ESG-heavy vocabulary, gives Japan further leverage to braid climate and labor clauses into the pact, future-proofing its exports against EU carbon-border adjustments and burnishing credentials with potential European entrants.

From Substitute to Standard-Setter

What began in 2017 as a defensive move to keep the TPP alive until a friendlier US president appeared has evolved—after two election cycles and a tariff war—into a fully-fledged Japanese grand strategy. The CPTPP is no longer a substitute for US leadership; it is an operating system that firms, regulators, and even reluctant superpowers must interact with on Japanese terms. Whether Washington eventually re-enters or Beijing clears the accession hurdles, the code is already written—and it is written in Japanese.

The original article was authored by Satoru Kohda and Ayaka Hiraki. The English version, titled "Charting Japan’s ‘third path’ under Trump 2.0," was published by East Asia Forum.

References

Department of Foreign Affairs and Trade (Australia), CPTPP Chair Theme 2025.

Department of Foreign Affairs and Trade (Australia), CPTPP Joint Ministerial Statement, 16 May 2025.

East Asia Forum, "Charting Japan's 'Third Path' under Trump 2.0," 13 June 2025.

EU Council, "Protocol to Facilitate Free Flow of Data—EU–Japan EPA," 29 April 2024.

European Commission, "EU–Japan Deal on Data Flows Enters into Force," 1 July 2024.

Government of the United Kingdom, "£2 Billion Boost to Growth as UK Joins Major Trade Group," 15 December 2024.

IMF Executive Board, "2025 Article IV Consultation with Japan," Press Release 25/084, 1 April 2025.

IMF, "Japan at a Glance," 2 April 2025 database update.

MAFF, "Core Persons Mainly Engaged in Farming—Trend and Outlook," 2020 data pack.

Ministry of Agriculture, Forestry and Fisheries, "Shift in Japan's Agricultural Structure," FY 2021 White Paper.

OECD, "Cross-Border Data Flows," Topic Note, 2024 update.

Peterson Institute for International Economics, "The Economic Effects of the Trans-Pacific Partnership: New Estimates," Working Paper 16-2.

Reuters, "Britain Joins Trans-Pacific Pact in Biggest Post-Brexit Trade Deal," 15 December 2024.

Reuters, "IMF Cuts Japan's Growth Forecast as Trump Tariffs Bite," 22 April 2025.

Reuters, "Japan 'Disappointed' in Trump Tariffs, Will Support Businesses," 3 April 2025.

Reuters, "Trump Throws Curveball at Japan Tea Giant's U.S. Expansion Swing," 13 June 2025.

Reuters, "What's in Trump's Sweeping New Reciprocal Tariff Regime," 3 April 2025.

Vietnam–Japan Trade Monitor, "Vietnam–Japan Import-Export Increased by Over 9 % in Q1 2025," 20 May 2025.

VoxEU/CEPR, Richard Baldwin, "Dealing with Trump: Dos and Don'ts," 11 June 2025.

WTO Center, "Cost-Benefit Analysis of Japan's Decision to Join CPTPP," October 2018.