Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

For every kilogram of finished consumer goods unloaded at the quays of Long Beach or Rotterdam, a Chinese producer can still shave roughly twenty euro-cents off the price a Western rival must charge—an edge that magnifies into almost €2.6 billion of price leverage each day across the trans-Pacific and Eurasian lanes. Even after five discrete tariff rounds on both sides of the Atlantic, that gap has hardly narrowed because the forces behind it-the world’s most lavish industrial-subsidy regime, a quietly weakening renminbi, and a logistical chess game of trans-shipment—continue to operate beneath the headline numbers. Washington and Brussels must shift from reactive tariff walls to proactive capability building to effectively address this. This foresight and planning are essential in a situation that demands dynamic policy measures.

Cartography of Cheapness: How Thin Margins Drag Heavy Assets West-to-East

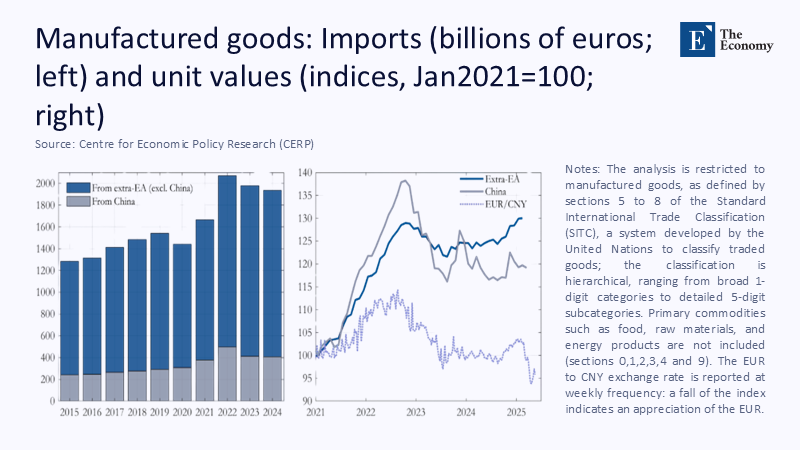

According to Eurostat customs data, merchandise from mainland China reached a staggering €403 billion in 2024. This figure represents a doubling of its share of extra-EU imports since 2010, surpassing the combined inflows from the United States and Türkiye. Unit-value data further sharpens the picture: Chinese microwave ovens landed in Antwerp last year at roughly €70 apiece, compared with German equivalents clearing at €92—a 24% wedge that negates the bloc’s manufacturing-wage advantage in less than four months of depreciation expense on capital equipment. The United States presents a mirror image. According to the Office of the U.S. Trade Representative, Chinese goods imports climbed to $438.9 billion in 2024, widening the bilateral deficit to $295.4 billion despite duties on steel, solar panels, and battery-electric vehicles. What may seem like a short-term consumer benefit is, in macro terms, a gradual erosion of the mid-skill production ecosystem. The magnitude of this phenomenon is starkly visible in the euro-area trade ledger.

Figure 1 captures two dynamics defining the competitive imbalance: volumes of manufactured imports (left axis) and an index of unit values (right axis), normalized to January 2021 = 100. Chinese suppliers gain share even as their price index undercuts the rest of the world, underscoring how scale and subsidy reinforce each other.

The Physics of Oversupply: Subsidies, Scale, and Shadow Exchange Rates

Beijing’s fiscal playbook, outlined in the 14th Five-Year Plan, commits resources equivalent to almost 5% of annual national income to direct and indirect industrial support—more than triple the scale of America’s Inflation Reduction Act when measured against relative GDP. Analysts at the Peterson Institute reckon that roughly 40% of those disbursements materialize as concessional credit, accelerated depreciation, or VAT rebates for export-oriented firms, embedding a four-to-seven-cent discount into every euro of ex-factory cost. When the renminbi slipped 10% against the euro between February 2024 and May 2025, the net wedge expanded toward 14% at the dock. Gigafactory volumes amplify the distortion: a single Chinese photovoltaic module line running at 25 GW a year spreads capital amortization so thin that Western producers must post double-digit margins to match the Chinese break-even price.

Europe’s Tariff Labyrinth: The Hidden Cost of Re-Routing

Brussels moved first with complex law. On 12 June 2024, the Commission imposed provisional countervailing duties of up to 38.1% on Chinese battery-electric vehicles. The ink was barely dry when freight forwarders began advertising “triangle” itineraries: drive rolling chassis to Tanger-Med, secure a North African certificate of origin, then load a feeder bound for Rotterdam. By the fourth quarter, customs declarations listing Morocco, Algeria, or Türkiye as origin covered goods worth €64 billion that Eurostat once chalked up to mainland China—nearly two-fifths of the product categories targeted initially. Those evasive routes are not free. Marine insurance premiums climbed 12%; median container dwell time at North African trans-shipment hubs lengthened almost two days; importers paid about €22 more to move a €500 washing machine into the single market.

Inflation’s Hidden Addendum: When Trade Policy Meets the Price Index

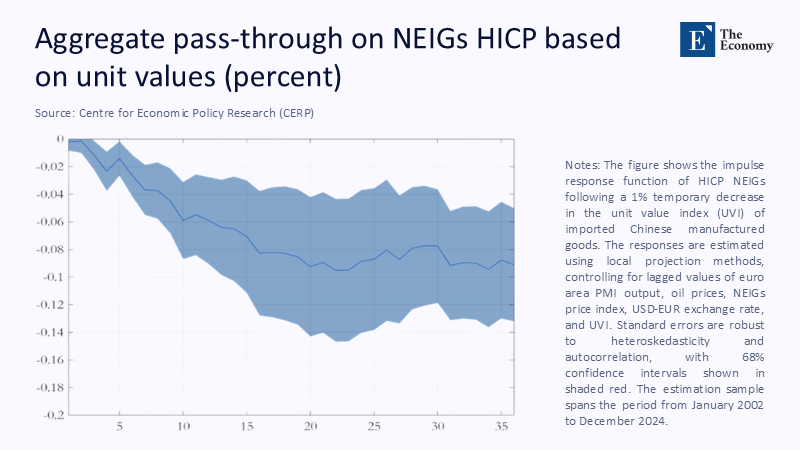

Central bankers often comfort themselves with the notion that goods tariffs exert minimal pressure on headline inflation because exporters absorb most of the hit. The euro-area data complicates that narrative. A CEPR panel regression finds that every ten-percentage-point rise in effective tariffs lifts the Harmonised Index of Consumer Prices (HICP) by roughly 0.2 percentage points within twelve months, even after controlling for exchange-rate shifts. The culprit is the efficiency loss in re-routing: extra container moves, additional paperwork, and duplicated quality checks add frictional costs that trickle into retail shelves. The aggregate pattern is mapped in Figure 2, which traces the impulse response of consumer prices to a one-percent change in Chinese export unit values.

Figure 2 shows that the initial disinflationary impulse from cheaper Chinese supply is significant but not permanent; the shaded band depicts the 90% confidence interval. As re-routing inefficiencies mount, roughly two-thirds of the early price relief dissipates by the third year, challenging the European Central Bank’s disinflation strategy.

America’s Spectacle of Selective Protectionism

Across the Atlantic, tariff strategy has been narrower but louder. President Biden’s May 2024 proclamation quadrupled duties on Chinese EVs to 100% and raised photovoltaic cell tariffs to 50%; former President Trump’s 2025 campaign proposal goes further, threatening a 125% blanket duty. Yet Chinese models accounted for less than 2% of U.S. passenger-vehicle sales before either measure. With over half of Chinese shipments, smartphones, computers, toys, and furniture flow almost unimpeded. The result is a political optic of toughness that leaves 96% of the trade relationship on pre-existing duty schedules.

Scoreboard of Outcomes: Jobs, Plant Size, and Innovation Spillovers

Which architecture performs better—Europe’s wide tariff net or America’s punitive but narrow strikes? Employment arithmetic suggests neither has stemmed attrition. In Germany, the car industry payrolls slid from 830,000 in 2018 to roughly 770,000, losses clustered among Tier-2 metal formers. These mid-skill shops cannot pivot to software or design as readily as a flagship OEM, leaving regional labor markets hollowed out even when final-assembly volumes rebound. The United States boasts $110 billion in pledged clean-energy manufacturing investment since the IRA, but two-thirds originates from Korean and Japanese conglomerates hedging political risk; intellectual property stays abroad, and production engineers rotate in on three-year visas, limiting knowledge capture. Chinese firms now file triple the number of battery-chemistry patents lodged by U.S. entities and quintuple those from EU corporations. This implies that Western capital expenditure is chasing, not setting, the technological frontier.

From Static Defence to Dynamic Capability Building

Tariffs are temporary floodgates—useful only if the respite is spent raising the height of the levee. Policymakers need three levers. First, synchronize subsidy vetting with duty schedules: firms converting public grants into measurable productivity gains—energy-adjusted output per worker above the OECD median—should earn tariff rebates, making aid outcome-based rather than origin-based. Second, dismantle the gap between vocational programs and plant-floor demand by adapting Germany’s dual-apprenticeship model into stackable micro-credentials specializing in power electronics, robotic maintenance, and advanced composites. Third, blockchain-verified “digital passports” should be embedded in customs data so fraudulent certificates of origin leave an immutable audit trail that raises the cost of re-routing above its clandestine benefit.

Sketching a Transatlantic Industrial Compact

Washington and Brussels talk often but seldom legislate jointly. A credible compact would begin with reciprocal transparency: both sides would publish granular subsidy ledgers—not just budget outlays but imputed tax expenditures—in a common taxonomy, reducing China’s ability to arbitrage grievance mechanisms. Next comes a shared safeguard clause: when either partner documents export surges above a defined deviation band, the other’s customs authority would trigger an immediate provisional review rather than duplicate an entire investigation. Finally, carbon-border adjustments should be aligned so that coal-fired electricity embedded in imported goods faces a uniform surcharge. The goal is not autarky; it ensures foreign content remains competitively priced in Western supply chains.

The Container Gap as a Policy Referendum

History will remember the present tariff cycle less for its tax schedules than for what policymakers do with the window it opens. A decade hence, either the United States and Europe will have used this breathing space to re-engineer factories and up-skill workforces, or the twenty-cent discount born in the Pearl River Delta will have swelled into a canyon no tariff wall can bridge. The cranes lining Rotterdam and Long Beach are not unloading mere commodities; they unload choices deferred, investments postponed, and training budgets cut. Unless these trend lines reverse quickly, the West’s industrial core will continue to migrate inside forty-foot containers stamped with certificates from every country but their true origin. Tariffs may slow the drift, but only dynamic capability building can alter its trajectory.

The original article was authored by Francesco Corsello, an Advisor at the Bank Of Italy, along with two co-authors. The English version of the article, titled "The Great Wall of Chinese goods: The effect of tariff-induced re-rerouting on euro area consumer prices," was published by CEPR on VoxEU.

References

Corsello, F., Pica, S., & Venditti, F. (2025). The Great Wall of Chinese Goods: The effect of tariff-induced re-routing on euro-area consumer prices. VoxEU, 12 June.

Elliott, L. (2024). Biden announces 100 % tariff on Chinese-made electric vehicles. The Guardian, 14 May.

European Commission. (2024). Provisional duties of up to 38.1 % on Chinese electric vehicles. Reuters report, 12 June.

Office of the U.S. Trade Representative. (2025). China trade summary: $438.9 billion in goods imports, 2024.

PV-Magazine USA. (2024). IRA attracts $110 billion in clean-energy manufacturing investment. 22 January.

Recruitonomics. (2024). Germany’s manufacturing sector imperiled by China shock. 20 September.

Wall Street Journal. (2024). China’s industrial support equals nearly 5 % of national income. 22 August.