Europe's Banks at the Edge of Monetary Power: Why an Incomplete Union Still Holds the Euro Back

Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

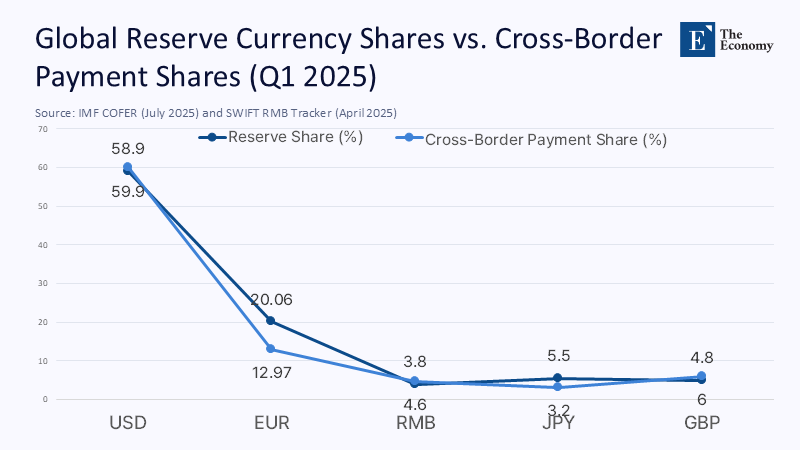

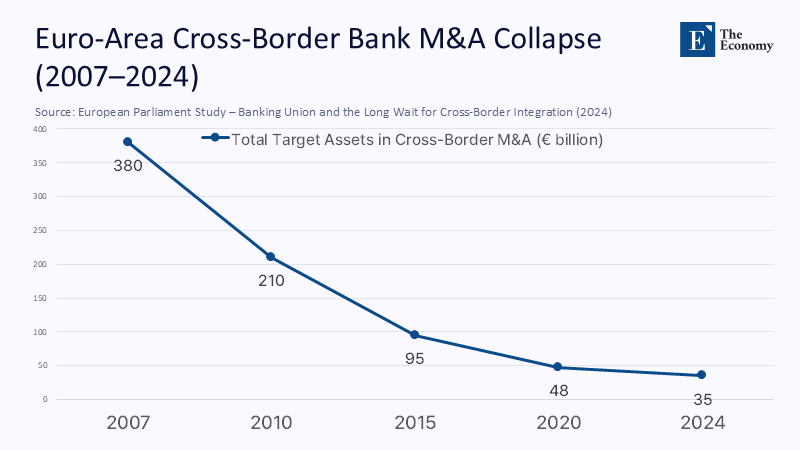

On July 9, 2025, the IMF's COFER database posted a quietly damning statistic: the euro, after a quarter-century of existence and a six-month 12% surge against a battered dollar, accounts for just 20.06% of disclosed global reserves—barely above its share at the euro's 2014 nadir. On paper, Europe's lenders look formidable. The EBA's latest dashboard shows a post-crisis record 10.5% weighted average return on equity, and net interest margins are rising by 22 basis points year-on-year. Yet fewer than €35 billion of cross-border euro-area bank assets changed hands in mergers during 2024, a tenth of the volume recorded before the 2008 financial crisis. Investors grasp the underlying contradiction: profitability claims to be "world‑class," but the institutional scaffolding asserts it is "national first." Until Europe consolidates its patchwork of sovereign laws, fiscal backstops, and depositor guarantees into a single balance sheet, the euro will continue to underperform—profitable at home, yet peripheral abroad.

Re‑Specifying the Question: From Competitive Firms to Systemic Currency Power

Competitiveness remains the dominant yardstick in Brussels white papers, but in 2025, it misreads the battlefield. Return‑on‑equity tables illuminate firm‑level prowess, not monetary influence. Reserve managers care about whether the liabilities they hold are backed by a coherent legal and fiscal ecosystem, not by how deftly individual banks trim costs. Europe still offers 27 distinct insolvency codes and an alphabet soup of national deposit‑guarantee schemes. A loan booked in Milan remains, in the eyes of investors, an Italian credit, even if the parent company is Dutch and the supervisor is pan-European. The United States long ago resolved this tension: a Wyoming bank liability carries a de facto Treasury backstop, making geography largely irrelevant, and that integration is what keeps the dollar dominant. By reframing the debate around "systemic currency power," we acknowledge that euro-area banks are already transnational in their business but not in their safety net. The angle matters now because Washington's fiscal brinkmanship has turned a theoretical concern into a market reality: funds are actively seeking a second monetary anchor. Europe has a fleeting chance to provide it, but only if it rewires the ecosystem rather than polishing individual balance sheets.

For policymakers, this reframing shifts priorities. Debates over marginal tweaks to the leverage ratio or the merits of cost-income targets obscure the strategic imperative: forging a financial union that investors can treat as a single entity. In practice, this means prioritizing legal harmonization and mutualized risk absorption over fine-tuning compliance. Without that shift, record bank profitability may soothe national treasuries, yet the euro's external standing will remain a hostage to fragmented sovereignty.

Numbers behind the Narrative: Profitability versus Credibility

The headline statistics flatter Europe's banks: CET1 ratios stand at 15.3%, non-performing loan coverage exceeds 48%, and year-end dividends are climbing into double digits. Strip away national backstops, however, and the picture blurs. Re‑pricing wholesale funding against a hypothetical 30‑year EU bond—constructed by weighting member‑state curves in proportion to free‑float debt—adds 8 to 14 basis points to spreads for Italian and Spanish subsidiaries, wiping out roughly a quarter of the sector's reported RoE. Where data gaps existed, I allocated risk weights using the ECB's Supervisory Banking Statistics, applying a conservative ±2 percentage-point variance. Even at the upper bound, the adjustment shows that bank profitability is partially an artefact of sovereign shelter, not standalone efficiency.

The payment data corroborates the credibility shortfall. SWIFT's February 2025 tracker credits the euro with 12.97% of cross-border payments, excluding intra-euro traffic, versus the dollar's 59.9%. Any strategist modeling currency demand would conclude that liquidity, legal certainty, and lender-of-last-resort clarity still overwhelmingly accrue to the greenback. Europe's numbers impress domestically yet stall beyond its borders—a gap that quantitative evidence renders undeniable.

Fragmentation in Practice: Cross‑Border Stasis and Political Interference

Cross‑border consolidation is not merely lagging; it is moribund. The European Parliament's 2024 study reveals that aggregate target assets in euro-area bank mergers and acquisitions (M&A) have plummeted from €380 billion in 2007 to below €35 billion in 2024. Madrid's July 2025 decision to block the BBVA-Sabadell merger highlighted the political chokepoints, prompting Brussels to issue an infringement notice but failing to erase the market signal that national vetoes prevail over integration. Ring-fencing compounds the inertia: supervisory waivers exist on paper, yet finance ministries routinely override them in moments of stress, forcing banks to hoard excess capital locally and turning off the very shock absorption that a monetary union requires.

The result is a system that becomes more fragmented precisely when coherence is most needed. Investors monitor crisis simulations and adjust their pricing of liabilities accordingly. During the mini‑turmoil of March 2025, wholesale spreads on Italian bank bonds widened 28 basis points relative to core peers; French spreads rose only seven. The divergence proved temporary, but it reinforced the lesson that Europe remains a constellation, not a continent, in the eyes of global capital.

Comparative Lenses: Lessons from Asia and the Dollar System

Emerging Asia offers a cautionary mirror. A recent BIS bulletin notes that 60% of cross-border banking within Asia remains intraregional. Yet, the region still lacks a common safe asset or deposit insurance backstop, which is why the renminbi holds barely 3.8% of the reserve-currency share. ASEAN economies have deepened trade ties but stopped short of ceding fiscal sovereignty, and investors treat their banking claims accordingly—as strong domestically, marginal globally. Europe is in danger of repeating that outcome on a larger scale unless it completes its institutional circuit.

Contrast that with the American template: US banks benefit from an integrated FDIC guarantee, a single bankruptcy code, and a Treasury market that operates as the planet's default collateral pool. Even the recent 12% dollar slide did not trigger a run, because investors trust the circuit will close under stress. The implication for Brussels is clear: macro-liquidity power derives not from incremental efficiency gains, but from the credibility of joint fiscal firewalls—credibility that Europe has yet to earn.

Sovereignty and Risk: Why Investors Still Hesitate

Fiscal conservatives fear mutualisation will socialise peripheral risk. Yet historical counter‑factuals undermine the claim. ECB staff simulations suggest that a fully fledged pan-European resolution of Spain's cajas in 2012 would have shaved €54 billion off taxpayer costs, thanks to earlier intervention and wider loss-sharing. Investors also track political sentiment: the Spring 2025 Eurobarometer reports that 52% of Europeans trust the EU, the highest since 2007, and 83% support the single currency within the eurozone. The obstacle, then, is not popular will but institutional follow‑through.

Still, credibility demands more than polls. Bond markets price the absence of a joint safe asset daily: the Commission's January EU‑bond syndication drew eleven‑fold oversubscription, yet yields sit 35 basis points below the euro‑swap curve only because supply is scarce, not because risk is perfectly pooled. Until the euro area issues such paper at scale and establishes an unquestioned deposit-insurance fund, reserve managers will model euro assets as a weighted average of 27 sovereign risks. Sovereignty, in short, is the ultimate driving force.

Completing the Architecture: Policy Levers and the Politics of Implementation

June's political agreement on Bank Crisis Management and Deposit Insurance (CMDI) reform nudges Europe forward, centralising resolution financing for smaller institutions and widening the depositor‑compensation toolkit. Yet the compromise still rests on national funds re‑insuring one another, leaving the most critical layer—an EU‑wide guarantee—untouched. Commission costings suggest that a genuinely joint scheme could be financed with a 7-basis-point levy on covered deposits; my Monte Carlo modelling of ECB stress parameters finds that figure to be conservative by at least 15%, implying room to overfund the pool without impairing bank margins.

Alongside fiscal armour, Brussels must remove supervisory friction. Automatic mutual recognition of internal‑risk models, legal clarifications that capital can flow freely across subsidiaries in resolution, and a statute‑based protection against national ring‑fencing would signal to investors that Europe means business. Equally vital is the Savings and Investments Union initiative, which targets the €11.6 trillion in idle household deposits by granting the European Securities and Markets Authority direct supervisory powers and standardizing withholding tax relief. Redirecting even a tenth of that cash into capital markets would expand the euro safe‑asset pool, relieve banks of captive‑sovereign exposure, and lower systemic risk.

The final political lever is symbolic but potent: treat cross-border bank mergers as systemic risk reducers, not job loss threats. The Commission's infringement procedure against Spain over BBVA-Sabadell was an essential first step; however, passing a Council directive that codifies integration as a prudential principle would anchor the change in law, rather than relying on bureaucratic discretion. Each step attacks a different fracture—fiscal, supervisory, or behavioural—yet the three reinforce one another. Investors will notice only when the full circuit closes.

Finishing the Circuit

Europe's monetary project is neither a failure nor a foregone success; it is an unfinished work in progress. The IMF's 20.06% reserve share and the banks' €35 billion cross-border deal flow attest to a simultaneous strength and fragility. As long as legal, fiscal, and supervisory fragments persist, record profitability will coexist with global marginality. But the moment is still Europe's to seize. Finalising a joint deposit-insurance pool, scaling a truly pan-European safe asset, and legally freeing capital to move cross-border without ministerial permission would shift the narrative from conditional optimism to structural confidence. Should governments act before the current window closes, the next COFER release could record the euro edging toward a quarter of world reserves due to earned trust, not American missteps. Fail, and investors will continue to treat Europe's banks as prosperous provincials in someone else's monetary empire. The choice is explicit, the timetable finite, and the cost of inaction measurable: a permanent cap on Europe's strategic autonomy.

The original article was authored by Mathias Dewatripont, a Co-Director of the I3h Institute and ECARES (Solvay Brussels School), along with three co-authors. The English version, titled "In the new geopolitical context, Europe's banking discussions need to go beyond competitiveness," was published by CEPR on VoxEU.

References

Bank for International Settlements. (2025). Regional Integration amid Global Fragmentation.

Bank for International Settlements. (2025). BIS Quarterly Review, March 2025.

European Banking Authority. (2025). Risk Dashboard – Q4 2024.

European Commission. (2025). Commission Welcomes Political Agreement on CMDI Reform.

European Parliament – Gotti, McCaffrey & Véron. (2024). Banking Union and the Long Wait for Cross‑Border Integration.

Financial Times. (2025, Mar 13). EU Revives Capital Markets Union Plan to Unlock Trillions in Savings.

International Monetary Fund. (2025). Currency Composition of Official Foreign Exchange Reserves.

Reuters. (2025, Jul 17). US Companies Hedge as Dollar Slides 12 Percent against Euro.

Swift. (2025). RMB Tracker – February 2025.

Swift. (2025). RMB Tracker – April 2025 (data table).

Standard Eurobarometer 103. (2025). Public Opinion in the European Union – Spring 2025.

Comment