Steady, Not Supreme: How a Credible Euro Safe‑Asset Could Rewire Global Education Finance

Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

When the IMF released its latest COFER tables on Jul 9, 2025, the headline seemed small: the dollar’s share of global reserves dipped to 57.7%, and the euro’s inched up to 20.1%, a gap still wide enough to park an aircraft carrier. Yet in an allocated reserve pool of roughly €11.5 trillion, a four‑percentage‑point migration equates to about €460 billion of incremental buying power for euro‑denominated paper. This shift in reserves could significantly impact education finance, with a mere two-basis-point saving on outstanding higher-education debt freeing low-eight-figure sums each year—capital that can fund full-ride STEM grants or retrofit energy-hungry laboratories. The potential benefits of the euro’s safe-asset status are substantial, and it is up to universities, school districts, and policymakers to capitalize on this opportunity or allow it to dissipate.

Reliability, Not Rivalry

Media framing still depicts the euro-dollar relationship as a gladiatorial contest for reserve‑currency primacy, yet the policy conversation has moved on. Central bankers gathered in Sintra this July openly conceded that any serious dethronement of the dollar remains a “long way off,” and most reserve managers are comfortable with the status quo. That admission does not doom the euro; instead, it clarifies its achievable niche. The Swiss franc commands barely 1% of global reserves but enjoys a safe-haven cachet, a term used to describe the perception of an asset as a safe investment during times of market stress because it offers legal clarity, abundant collateral relative to domestic output, and impeccable fiscal discipline. The euro can capture a similar, though larger, share if it continues to supply deep, fungible, and transparent securities. Critically, those are the same properties that bursars prize when locking in multi-year tuition forecasts. Growth plays a lesser role: the European Commission’s Spring 2025 Forecast pegs euro‑area output at a modest 0.9%, yet that has not deterred reserve inflows. Predictability, not velocity, underpins safe‑asset status, and predictability is what classrooms require when committing to multiyear hiring or scholarship plans.

Liquidity by the Numbers

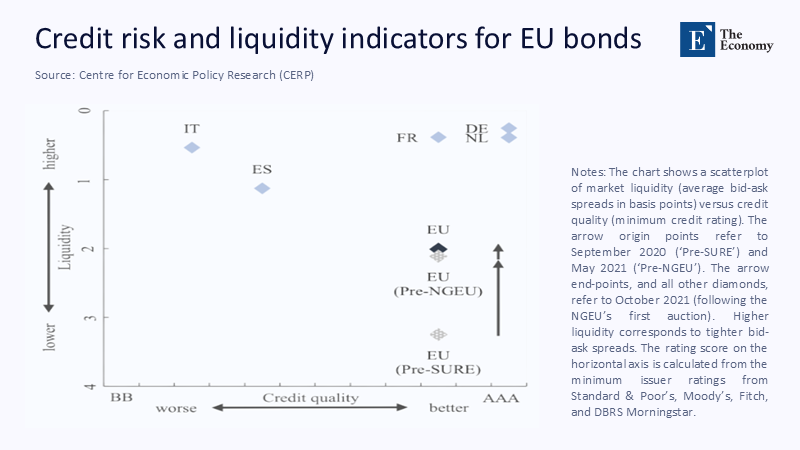

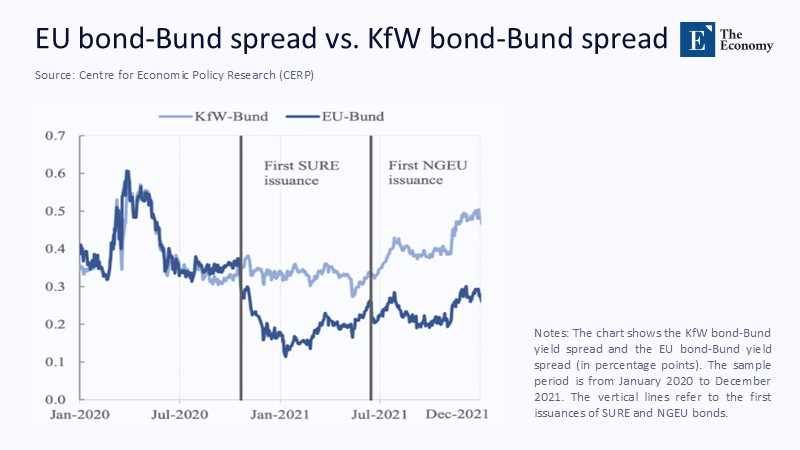

Depth on the screen tells the real story. Between January 2023 and June 2025, the Commission tapped markets for nearly €600 billion under its NextGenerationEU umbrella, including a €9 billion dual-tranche on July 9, 2025, that attracted orders fifteen times the offer.

Every syndicated deal this calendar year cleared with double‑digit bid‑to‑cover ratios. At the sovereign level, the momentum is similar: January’s national debt sales drew demand a record eleven times the supply despite the ECB ending its net purchases. Liquidity metrics mirror that appetite. Traders now report bid‑ask spreads at the five‑year point slipping toward two basis points, territory once reserved for US Treasuries. The tightening is beginning to show up in reserve flows: IMF data indicate that euro holdings grew 2.6% quarter-on-quarter to roughly $2.3 trillion, even as the total reserve pool expanded more slowly, signaling a genuine portfolio reweighting rather than mechanical growth. Analysts discuss Europe enjoying a slice of the “exorbitant privilege” long monopolized by Washington, a term no longer confined to op-ed pages but now embedded in syndicate chatter as investors view EU paper as the closest proxy to Treasuries outside the United States.

Speed Limits and Safety Rails

The potential is not destiny. Three structural constraints bound the euro’s runway. First comes feeble real growth: a projected 0.9% in 2025 limits tax receipts and, by extension, the credibility of large future mutual‑borrowing programs. Second, fiscal governance is uneven. Italy’s debt-to-GDP ratio still hovers around 145%, Germany is debating whether to suspend its constitutional debt brake, and France faces bruising budget votes. Italian‑Bund spreads have narrowed below 100 basis points—down from above 200 two years ago—yet the repricing is as much about investors seeking yield as it is about political serenity. Third, the withdrawal of ECB reinvestments means that €660 billion of net government issuance will hit markets this year, raising fears of crowd-out if the Commission and sovereign calendars clash. These constraints guarantee that the euro will remain a complement, not a substitute, for the dollar. But they do not negate its candidacy as a secondary safe asset; investors accepted negative‑yielding Bunds for half a decade, proving that credibility can trump carry.

From Bond Desk to Classroom

Liquidity’s benefits are tangible once the transmission chain reaches campus. Erasmus+ funded 1.3 million mobility opportunities in 2023 on a €4.5 billion budget, yet program administrators still hedge about 15% of those outlays into dollars to pay non-euro partners, incurring an estimated €28 million in swap costs. If deeper EU-bond markets trimmed those spreads by 40%—the midpoint of the Commission's sensitivity analyses—that saving alone could finance 15,000 additional grants. Capital budgets tell a similar story. A medium-sized research university issuing a €750 million sustainability bond today prices around mid-swaps + 68 basis points. An EU convenience yield of even 25 basis points would lop more than €35 million of interest over a 25‑year tenor—funds that could retrofit laboratories or digitize lecture theatres without resorting to tuition increases. Volatility damping is a quieter dividend. By collateralizing working capital lines with EU bonds instead of dollars, treasurers at two Dutch universities report cutting their foreign‑exchange value‑at‑risk by one‑third in the first half of 2025.

Student affordability also gains indirectly. Eurostat tallied 1.76 million non-EU tertiary students in the EU last year, a 4% rise despite a 6% appreciation in the trade-weighted euro, indicating that stable fee structures and scholarship pools outweigh modest currency fluctuations.

Policy Levers that Matter

Securing the euro’s safe‑asset niche does not require Treaty revision, but it does demand deliberate architecture. The first lever is a standing education‑repo line at the European Central Bank that accepts EU bonds from accredited endowments at haircuts mirroring those of Treasuries. Such a facility would halve the liquidity premiums universities now pay on short-term commercial paper without appreciably expanding the ECB balance sheet. The second lever is a statutory Knowledge Infrastructure Window, capturing 10% of annual EU-bond proceeds—roughly €16 billion this year—for green campuses, VR-driven teacher-training suites, and cross-border research data hubs. Because those bonds carry supranational credit risk, they unlock leverage multiples that national budgets cannot match. The third lever is radical transparency. CEPR event studies show that each tap accompanied by granular use-of-proceeds disclosure trims spreads by about 0.16 basis points; tracking every euro to its Sustainable Development Goal 4 outcome would extend that “purpose premium” and cement investor trust. Together, these three moves package legal certainty, collateral depth, and social impact into a single asset that reserve managers can buy without apology and universities can finance without penalty.

Answering the Skeptics

Objections cluster around three themes. The first is supply saturation, yet January’s auctions prove that investors hoovered a record volume of German, French, and Belgian paper even as Commission syndications crowded the calendar—spreads tightened rather than widened. The second is sluggish growth, but the Swiss franc experience shows that macroeconomic velocity is less decisive than the rule of law and fiscal rectitude; the franc’s reserve share quadrupled to 0.8% without stellar GDP figures. The third is student affordability, a worry that a stronger euro will deter international enrolment. Eurostat data point in the other direction: non-EU student numbers rose even as the euro appreciated because visa policy, housing supply, and program quality dominate marginal currency movements. None of these challenges contradict the central thesis that a rock‑solid, liquid euro asset can insulate European education finance while coexisting with an enduring dollar hegemony.

Anchoring Ambition in a Multipolar Currency World

Reserve reallocations seldom make commencement‑day speeches, yet they determine how many scholarships a university can offer, how quickly a school district can weatherproof its classrooms, and whether a doctoral lab must shelve its next‑generation spectrometer for lack of predictable funding. A euro that steadily holds one‑fifth of global reserves will not dethrone the dollar. Still, it can buffer European learning systems against Washington-centric shocks, lower borrowing costs, and attract ESG capital that is eager for transparent impact. The window will not stay open indefinitely. Political drift, auction mis‑coordination, or opaque reporting could stall momentum and relegate the euro once more to a thinly traded sideline. Yet, if Europe embeds its bond market in the legal clarity and purpose-built architecture outlined above, it can claim a durable, safe-asset franchise. That steadiness, not supremacy, is the currency of confidence the continent’s students and researchers deserve.

The original article was authored by Olli Rehn, the Governor at the Bank of Finland. The English version of the article, titled "Europe must not waste its currency moment," was published by CEPR on VoxEU.

References

European Commission. (2025, Jul 9). “Commission issues €9 billion in its seventh syndicated transaction of 2025.” Retrieved from ec.europa.eu.

European Commission. (2025, May). Spring 2025 Economic Forecast: Moderate growth amid global uncertainty.

European Commission. (2024, Nov 22). “Record 2025 bond sales risk higher euro‑zone borrowing costs.” Reuters.

European Commission. (2024, Dec 5). “Erasmus+ annual report: 1.3 million learning opportunities in 2023.”

Eurostat. (2024). Learning mobility statistics.

International Monetary Fund. (2025, Jul 9). “Dollar cedes ground to euro, Swiss franc shines in global reserves.” Reuters.

International Monetary Fund. (2025). Currency Composition of Official Foreign Exchange Reserves (COFER) – Q1 2025 data brief.

Reuters. (2025, Jan 31). “Higher yields drive record demand for euro‑zone government debt sales.”

Reuters. (2025, Jun 18). “From outcast to star: euro‑periphery rally gains pace.”

Reuters. (2025, Jul 1). “Challenge to dollar supremacy a long way off, central bankers say.”

Reuters. (2025, Apr 15). “Europe enjoying some ‘exorbitant privilege.’”

Comment