Input

Changed

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

Every thirty days, the U.S. Treasury now expends more to service yesterday's borrowing than the Federal Highway Administration plans to spend on new roads for the entire fiscal year ahead—an inversion that crystallizes the urgent need for action in American public finance. Net-interest outlays hit $82 billion in the December 2024 Monthly Treasury Statement, while the highway budget request for FY 2025 is just $62.8 billion. The inversion is not an anecdote; it is a flashing dashboard warning that the cost of debt itself has become the pivotal policy variable.

Debt Fatigue Has Curdled into Market Anxiety

The world's savers have long tolerated the U.S.'s red ink, considering U.S. Treasuries the deepest pool of 'risk-free' collateral. However, this perception was shattered when the gross federal debt surpassed $36 trillion this spring, equating to roughly $ 274,000 for every U.S. household. The market's response was clear at the March 30-year bond auction, where investors demanded ten basis points, the most significant tail since 2011. This signal is unambiguous: pricing now includes a 'governance premium,' a surcharge for the lingering threat of congressional brinkmanship even after the debt ceiling is raised. The bond market, not the rating agencies, delivered the real-time downgrade.

Rating Agencies Are Only Confirming What Traders Already Priced In

Fitch's 2023 demotion of the United States to AA+ was dismissed as symbolism until Moody's followed suit in May 2025, citing the glide path toward 134% debt-to-GDP by 2035 and a deteriorating interest-to-revenue ratio. Downgrades lag the market, yet they matter because large insurers and pension funds with AAA mandates must rebalance away from Treasuries. The result is a shorter average maturity profile and higher rollover risk precisely when the debt stock is most vulnerable to interest-rate resets.

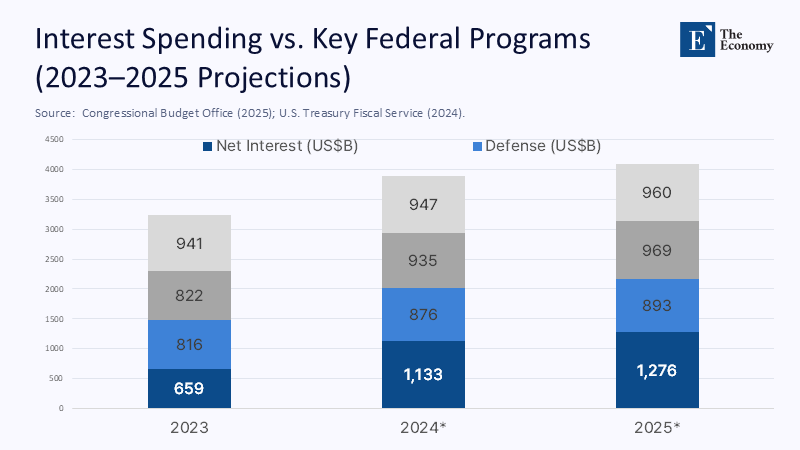

Interest Is Overtaking the Classroom—and the Pentagon

According to the Congressional Budget Office, net interest is set to surpass defense outlays in 2025 and outstrip all non-defense discretionary spending by 2027. Taxpayers will soon pay more for yesterday's deficits than today's classrooms. The fiscal year 2024 ended with a staggering $1.133 trillion in interest payments, larger than the entire Medicare or Pentagon budget and a 29% year-on-year increase. At the current rate, the Treasury is spending $2.7 billion daily on interest, a sum that could double NIH research grants or fund every Pell Grant twice over.

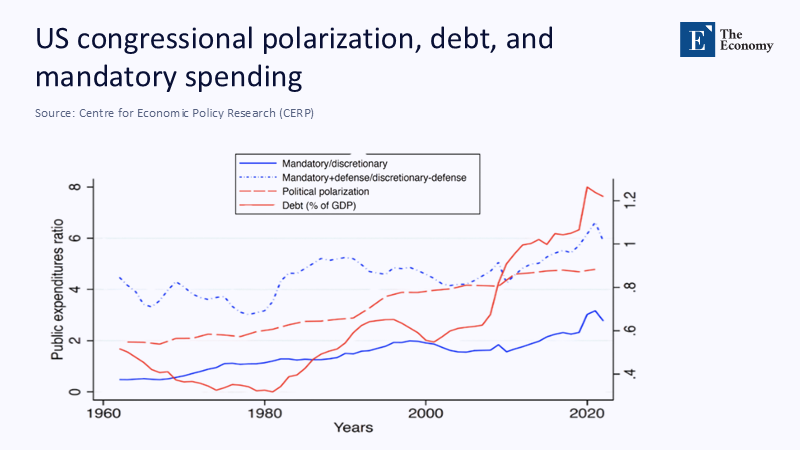

Gridlock, Entitlements, and the Debt Spiral

Figure 1 complements the macro numbers by showing the structural forces underneath: as the share of mandatory spending and political polarisation (right axis) rise, so too does federal debt. The blue solid line (mandatory-to-discretionary ratio) began to steepen in the late 1970s, precisely when the dashed red polarisation index bottoms out and accelerates. The correlation underscores how legislative gridlock combines with entitlement autopilot to generate a mechanically expanding deficit. When consensus is scarce, the easiest vote is no, leaving mandatory formulas to dictate the cash burn. That inertia powerfully vindicates the given angle that "politicians cannot keep spending more than they earn, like everybody else."

The Ceiling's Fifty-Percent Rule: A Machine for Deficits

Why does the statutory limit repeatedly fail as a brake? Because under a simple majority rule, the political cost of overspending is lower than that of restraint. Congress has lifted or suspended the ceiling seventy-eight times since 1960—on average, once every ten months—as real per-capita spending doubled. The concentrated benefit programs (farm subsidies, pandemic add-ons) pass easily, while tax increases with diffuse costs stall. Budget inertia thus works against sustainability: once a benefit is entrenched, any senator can defend it by invoking constituent pain, but ending it demands fresh majorities in both chambers. This highlights the urgent need for a more effective fiscal policy.

Lessons from the Alps and the Rhine

Switzerland's 2003 "debt brake" requires structural balance over the cycle and enjoys double-majority constitutional protection. Despite two global recessions, gross debt has fallen from 53% to under 40% of GDP. Germany's Schuldenbremse, adopted in 2009 with a two-thirds vote, caps structural federal deficits at 0.35% of GDP and forces Länder to balance by 2020. Both regimes are formula-based and enjoy broad public salience, turning the default from drift to discipline. Crucially, tax cuts and spending hikes face identical hurdles, eliminating Washington's asymmetric bias for giveaways.

Foreign Creditors Are Voting with Their Portfolios

Treasury International Capital data show Japan trimming net Treasury holdings in five of the last eight months and China cutting back to $765 billion, its lowest position since 2009. Foreign official investors now hold just under half of marketable Treasuries, down from 59% a decade ago. The retreat is incremental yet relentless: official holders are the least price-sensitive, so losing them pushes the Treasury toward leveraged funds and domestic money-market vehicles that demand floating-rate or very short-dated paper. The "exorbitant privilege" is eroding via portfolio arithmetic, not dramatic renunciation.

Why a Sixty-Percent Rule Is Necessary but Not Sufficient

The CEPR proposal to require 60% of Congress to approve any ceiling hike rightly flips the burden of proof, but without a binding fiscal anchor, it risks weaponizing brinkmanship. The 2011 and 2023 showdowns added 15-to-20 basis points to funding costs, wiping out whatever savings hawks expected. A supermajority threshold raises the stakes; it does not rewrite the game.

Toward a U.S. Fiscal Charter

A comprehensive fiscal plan is necessary to address the current fiscal challenges. A credible pivot would pair the higher hurdle with a statutory charter featuring three automatic anchors:

- Structural deficit cap of 1% of GDP over the cycle.

- Absolute primary-spending growth limit tied to potential output growth.

- The tax symmetry clause requires any net tax cut to be fully offset within a ten-year window.

Escape clauses—activated by declared recession or war—would sunset after three years unless renewed by the same 60-vote supermajority. The charter targets growth rates, not absolute levels, allowing nominal spending to rise while bending the long-run curve.

Spending Discipline Is Not Synonymous with Austerity

Critics equate brakes with austerity. Data refute that caricature. Indexing entitlement cost-of-living adjustments to chained CPI, harmonizing Medicare's site-neutral payments, and letting pandemic expansions expire on schedule would save $1.6 trillion over ten years, stabilizing debt below 115% of GDP without cutting nominal Social Security cheques. Discipline liberates space for high multipliers—early childhood nutrition, basic research, green-port modernization—rather than starving the state.

Revenue Realpolitik: Broaden the Base, Don't Chase Mirages

Headline rate hikes polarise voters while the base erodes via carve-outs. The Congressional Budget Office's static score for the pending "One Big Beautiful Bill" shows $3.67 trillion in lost revenue from extending the 2017 tax cuts, more than the bill's spending cuts deliver. Restoring the pre-2017 top rate, capping itemized deductions, and scrapping narrow credits would raise roughly $240 billion a year and produce minimal growth drag when coupled with full expensing for new capital. Base-broadening complements, rather than substitutes for, a fiscal brake.

Political Economy: Making Inertia Work for Prudence

Institutional design decides whether inertia entrenches discipline or deficit bias. Switzerland demonstrates that once a credible rule becomes constitutional furniture, voters penalize politicians who tamper with it. U.S. ceiling politics does the opposite: hawks must win repeatedly, while spenders need just one majority. Raising the quorum to 60% is a start, but the charter would invert incentives: breaking the rule costs political capital; obeying it is electorally neutral.

Generational Equity and the Looming Interest Cascade

The baby-boomer retirement wave amplifies the urgency. In 2027, Social Security's trust fund reserves began net redemption, forcing the Treasury to issue more debt to honor benefits. Without reform, interest alone will consume one-fifth of federal revenue by 2035, effectively taxing the wages of younger cohorts to finance the compounded shortfall of prior decades. A charter would shift the debate from inter-generational redistribution to inter-temporal balance, aligning the fiscal horizon with demographic reality.

The Federal Reserve Is Not a Fiscal Backstop

Some policymakers quietly assume the Fed can neutralize borrowing costs via balance-sheet expansion. Experience suggests otherwise. When the Fed re-launched quantitative easing in 2020, ten-year breakeven inflation rose only moderately, but real yields fell into negative territory, encouraging yet more issuance. A second wave of QE under persistent inflation risks undermining the Fed's price-stability mandate, eroding confidence in both monetary and fiscal spheres. Market participants already price a modest inflation-risk premium into long bonds, proving that central bank largesse cannot permanently offset arithmetic.

Credibility Is the Cheapest Stimulus

Every quarter-percentage-point uptick in the average Treasury coupon translates into roughly $90 billion in extra interest over a decade, dollars drained from research labs, shipbuilding yards, and climate adaptation. Restoring credibility through predictable, rules-based budgeting is the cheapest stimulus. Markets do not demand that the United States emulate Switzerland overnight; they require evidence of convergence toward arithmetic. Without it, each new ceiling episode will be fought on worse terrain, the interest bill will cannibalize discretionary priorities, and the fiscal policy toolbox will shrink.

Frugality as Strategy, Not Sacrifice

No one wishes the federal government to default, yet the bigger risk is slow-motion insolvency through interest crowd-out. Frugality is not a moral lecture but a strategic imperative for a superpower that must simultaneously finance deterrence, climate resilience, and frontier science. A 60-percent vote to raise the ceiling can be part of the toolkit, but only if paired with a comprehensive fiscal charter that locks in symmetric discipline. Otherwise, bond buyers—not elected officials—will eventually dictate the terms of American policy.

The original article was authored by Facundo Piguillem and Alessandro Riboni. The English version of the article, titled "Fiscal sustainability and budgetary inertia: When checks and balances really matter," was published by CEPR on VoxEU.

References

Congressional Budget Office. The Budget and Economic Outlook: 2025–2035. January 2025.

Federal Highway Administration. Budget Estimates Fiscal Year 2025. U.S. Department of Transportation, 2024.

Fitch Ratings. "Fitch Downgrades the United States' Long-Term Ratings to 'AA+'." 1 August 2023.

Moody's Investors Service. "Moody's Ratings Downgrades United States to Aa1." 16 May 2025.

Reuters. "U.S. Budget Deficit Tops $1.8 Trillion in Fiscal 2024, Third-Largest on Record." 18 October 2024.

The Guardian. "Trump Bill Set to Add Trillions to US Debt Pile – Can America Stop It Climbing?" 7 June 2025.

U.S. Department of the Treasury, Bureau of the Fiscal Service. Monthly Treasury Statement. December 2024.

U.S. Department of the Treasury, Fiscal Data. "Understanding the National Debt." Accessed June 2025.

U.S. Department of the Treasury, Office of International Affairs. "Major Foreign Holders of Treasury Securities." March 2025.